Gold prices recorded their sharpest decline in more than two weeks on Thursday, as uncertainties surrounding the leadership position of the US Federal Reserve (Fed) weakened investor demand for precious metals.

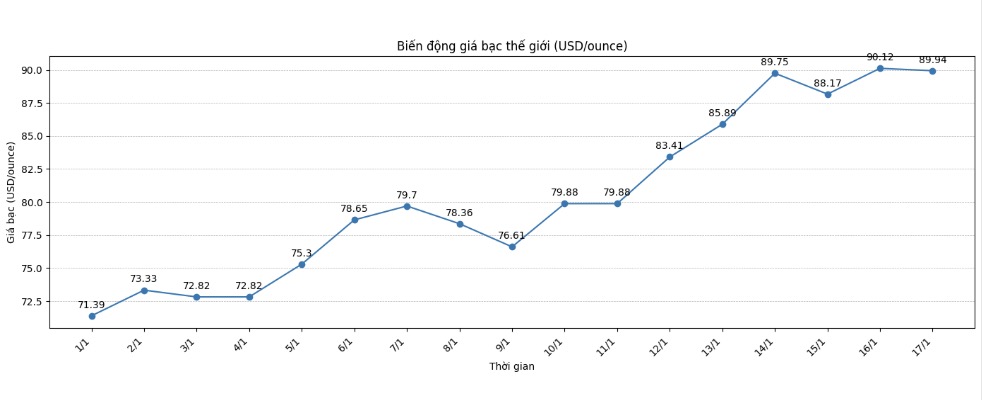

Meanwhile, silver suffered a deep drop after Chinese regulators implemented a series of measures to cool down speculation in the futures contract market.

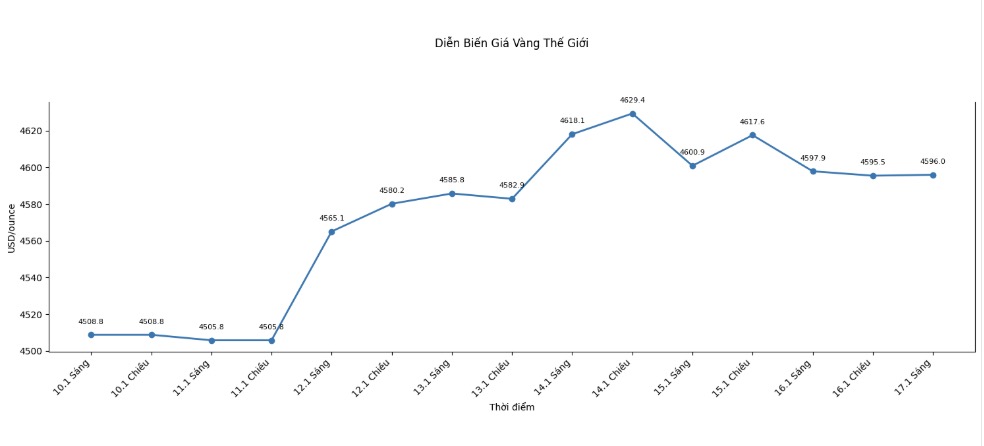

According to Kitco, gold in the last session of the week lost up to 1.7% after US President Donald Trump expressed hesitation in nominating Mr. Kevin Hassett as Fed Chairman, making the process of finding a successor to Mr. Jerome Powell more complicated.

Mr. Trump said on Friday that if Mr. Hassett leaves his current position as Director of the National Economic Council, the administration will lose one of the most effective "economic messengers".

These statements quickly spread their impact on financial markets. The USD narrowed its previous decline, while US Treasury bond yields rose, putting pressure on gold - a non-profit asset. On the exchange market, investors have lowered expectations about the Fed cutting interest rates this year, now only betting a lower probability for two reductions, each 0.25 percentage points.

Notably, silver prices also suffered heavy pressure, sometimes plummeting by 6% to around 89.95 USD/ounce, after Chinese authorities implemented a series of measures to cool down speculation in the domestic futures contract market.

The Shanghai Futures Exchange has reduced the daily position opening limit for silver contracts after a period of unusual volatility; at the same time, regulators requested exchanges to remove servers of high-frequency traders from the data center.

This tightening directly targeted the speculative wave that pushed silver prices to a record level. "Although silver is a hot topic for investors on Western social networks, the real driving force comes from speculators in China" - Mr. Ole Hansen, Head of Commodity Strategy at Saxo Bank, said. "We see this through the explosive trading volume in the industrial metal group and the high difference that traders here are willing to pay for silver compared to the London market.

Technical indicators show that before the announcement of management tightening, silver traded significantly higher than Ichimoku clouds with very strong momentum. The volume chart also reflects sluggish trading activity - the reason why Chinese authorities had to intervene.

Mixed pressure on the precious metal group shows that the investment picture is not simple. With gold, the fundamentals are still relatively favorable thanks to geopolitical instability, the trend of central banks diversifying reserves away from the USD and concerns about fiscal sustainability continue to support demand. However, the short-term catalyst, loose monetary policy, is weakening as Fed officials appear more cautious.

For silver, China's management move to handle excessive speculation has separated futures contract prices from material supply and demand factors. The difference that Chinese investors are willing to pay higher than the spot price in London is a signal that the position is unsustainable and needs to be adjusted.

Both metals still maintain important technical support zones, with the Ichimoku baseline of gold around 4,400 USD and the cloud structure of silver showing the possibility of bottom-fishing buying power. However, in the short term, expectations for the Fed to ease and China's tightening of management may continue to put pressure on prices.

Investors will closely monitor the upcoming messages from the Fed as well as all new developments in the process of finding central bank leaders, considering these as key factors dominating the precious metals market in the coming sessions.

The tug-of-war between political pressure demanding a more lenient policy and the Fed's data-dependent approach is likely to determine whether gold can resume its rally in 2025 or enter a period of accumulation.