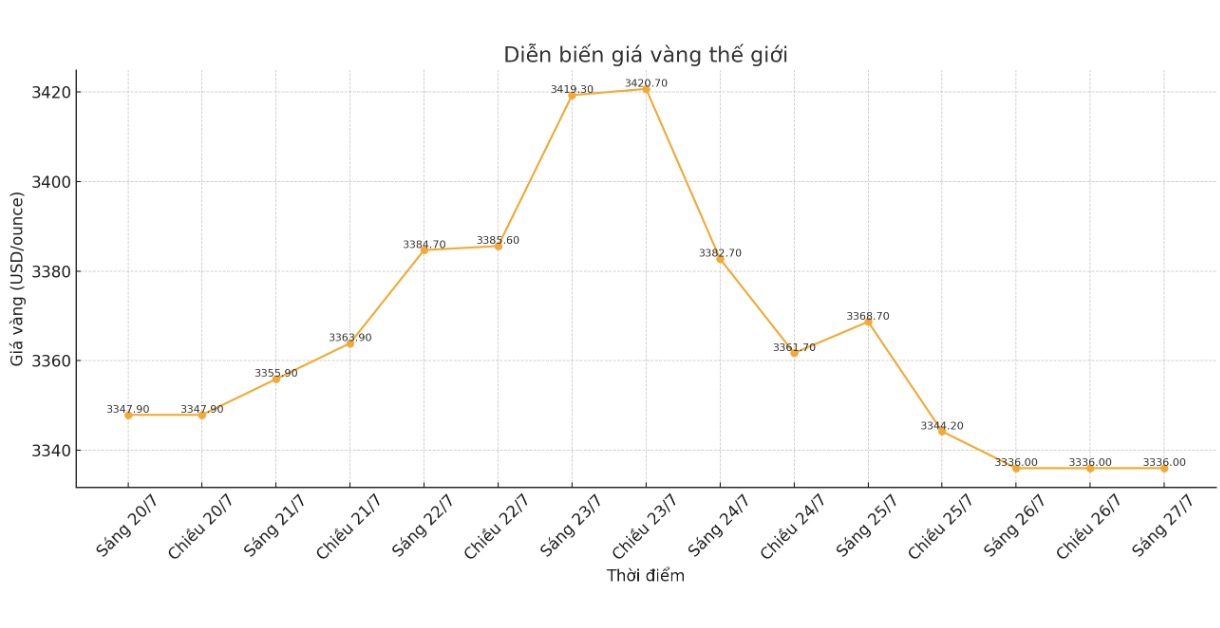

Gold price developments last week

This week, world gold prices have gone through two opposite halves, with developments almost symmetrically divided into the weekly price chart around Tuesday evening.

Spot gold opened the week at $3,347.05 an ounce and quickly rose strongly in the first sessions. Gold prices rose to $3,370 an ounce in the Asia and Europe trading sessions, then surged close to $3,390 an ounce before North American markets opened on Monday morning. By 11:00 a.m. Eastern time (EDT), spot gold had reached a short-term peak at the resistance level of $3,400/ounce.

After a second failed attempt to break above $3,400/ounce at around 7:00 p.m., gold prices retreated to the mid-$3,380/ounce range, but the European session the next day added momentum, helping gold immediately trade firmly above $3,400/ounce when the North American market opened on Tuesday, peaking at nearly $3,433/ounce.

However, this is also the time when gold prices face real resistance, with a series of efforts to overcome the threshold of failure. Gold fell into the near-term support zone around $3,383 an ounce on Wednesday morning.

After a days of spent within a narrow range of $10.10, gold began to plummet from midnight and hit $3,353/ounce at 8:45 a.m. EDT Thursday.

Gold tried another last chance to test short-term resistance around $3,380 an ounce but quickly exhausted, and in the night-time trading session, the precious metal was pushed down to $3,340 an ounce when North American markets opened on Friday.

After a quick drop to a weekly low of $3,327 an ounce, gold prices rebounded around $3,340 an ounce and held on to the low at the end of the week.

Gold price forecast for next week

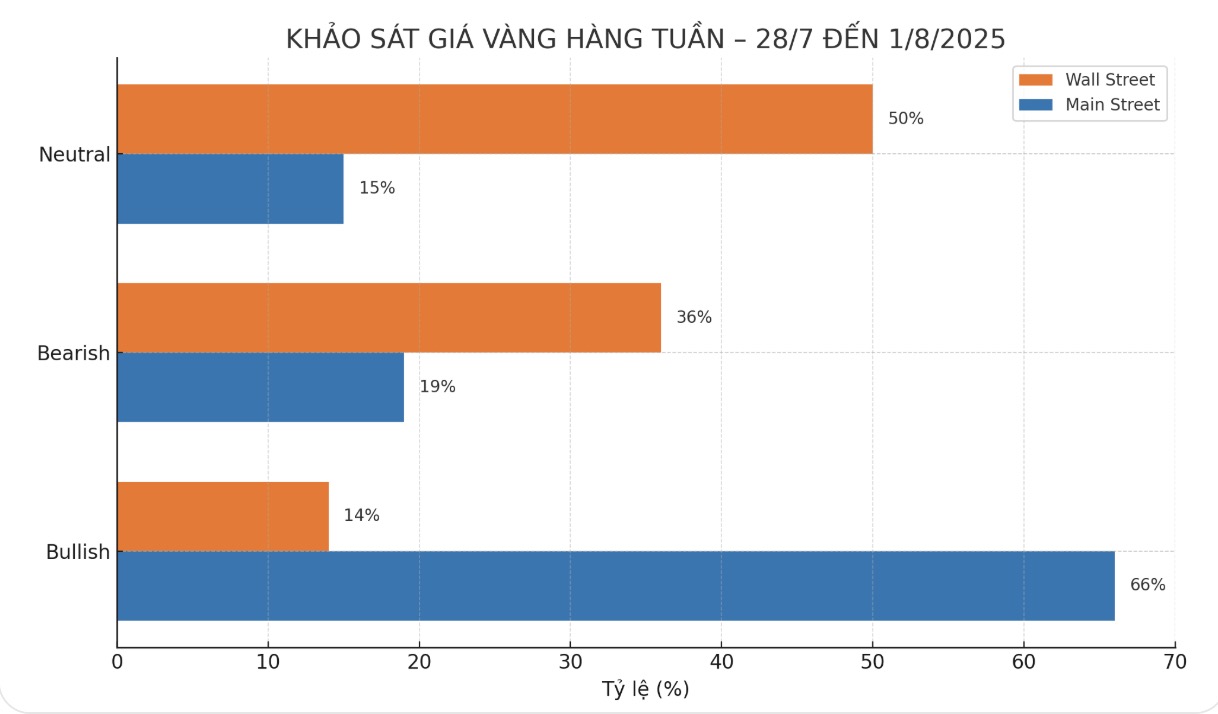

The weekly gold survey of an international financial information platform shows that industry experts are currently divided between the downside and neutral forecast. Meanwhile, individual investors are maintaining an optimistic view of gold's short-term outlook.

Wall Street analysts are quite modest after gold failed to break out successfully last week. Only 2 experts, equivalent to 14%, expect gold prices to increase next week, while 5 others (36%) predict prices will decrease. The remaining seven experts, or 50%, see gold prices moving sideways.

Meanwhile, the online survey attracted 206 votes, with investors. The majority of investors continue to maintain optimism. There are 135 individual investors, equivalent to 66%, predicting gold prices to increase next week; 40 people (19%) believe prices will decrease, while the remaining 31 people (15%) believe prices will continue to accumulate and move sideways in the short term.

Notable economic data next week

The tight economic news schedule next week, with a series of data on growth, inflation and employment, has traders always on guard, along with three important decisions on interest rates.

On Tuesday, the market will pay attention to the JOLTS employment data and the US Consumer Confidence Index for July. By Wednesday, investors will receive employment data from ADP, preliminary second quarter GDP of the US and pending home sales.

On the same day, three central banks the Bank of Canada, the US Federal Reserve (FED) and the Bank of Japan will announce their monetary policy decisions.

Thursday will see July PCE inflation data and weekly jobless claims. The trading week ended on Friday with the July non-farm payrolls and the US ISM manufacturing PMI.

See more news related to gold prices HERE...