Gold price developments last week

As widely expected, the gold market this week was dominated by the US presidential election. The sharp sell-off last week left market participants uncertain about the future direction of the precious metal.

Spot gold prices started the trading week at $2,739.34 an ounce and spent the first part of the week fluctuating in a narrow $20 range.

This is one of the narrowest and least volatile multi-day gold price movements in recent times, and traders are reluctant to make any moves until there is a clear trigger.

On Wednesday, key states began to swing in favor of Republican candidate Donald Trump, making Vice President Kamala Harris' bid for the US presidency all but impossible.

Spot gold reacted strongly, falling from $2,739 an ounce to $2,659 an ounce when North American markets opened on Wednesday morning.

Gold prices attempted to recover in the late morning, but then continued to weaken and hit a weekly low of around $2,648 an ounce.

Since then, gold prices have steadily risen. On Thursday, the dollar and Treasury yields fell after the election, and gold tested the $2,700/ounce resistance level twice but failed as the US Federal Reserve announced an expected 25 basis point interest rate cut.

But the drama of gold prices last week was not over yet, when a tense exchange between FED Chairman Jerome Powell and reporters in the post-FOMC press conference sent gold prices soaring to $2,707/ounce in a few minutes.

After two unsuccessful attempts to break above $2,710 an ounce, gold prices slid to $2,680 an ounce.

Experts predict gold price next week

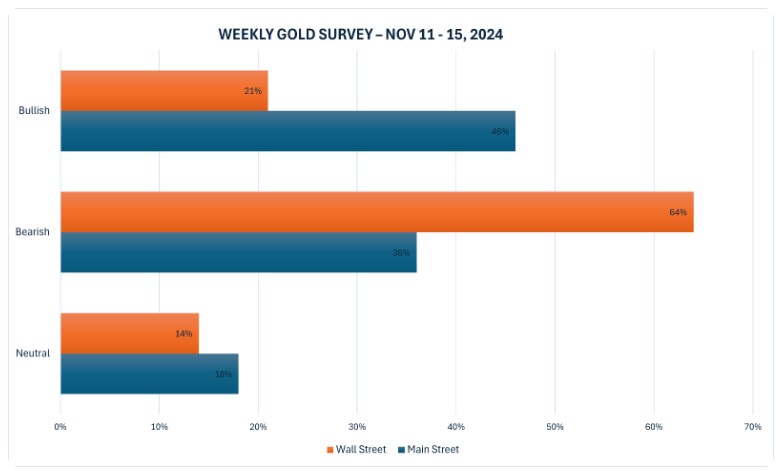

The latest weekly Kitco News gold survey shows that industry professionals are overwhelmingly bearish, while retail traders are also down for the first time in months.

Fourteen analysts took part in the Kitco News gold survey. Only three analysts see gold prices rising next week. Nine see prices falling. The remaining two see prices moving sideways.

There were 249 votes cast in Kitco’s online poll. 114 traders see gold prices rising next week. Another 91 see gold prices falling. The remaining 44 investors expect gold to trend sideways in the near term. This is the first time in months that short-term bullish expectations for gold have fallen this far.

The economic calendar for the week ahead is fairly bleak, especially compared to last week’s boom. The key economic news event to watch will be the US core CPI on Wednesday. The Federal Reserve is expected to be watching the CPI closely for signs that consumer inflation is continuing its path toward 2%.

Thursday's US PPI report, weekly jobless claims data and Friday morning's US retail sales release for October will also provide concrete data on Americans' purchasing power in the current high-cost environment.

Fed Chairman Jerome Powell will also speak on Thursday, which will be his first chance to elaborate on his press conference comments about the new administration and central bank independence.

Marc Chandler, managing director at Bannockburn Global Forex, sees a consolidation period ahead for gold but believes any pullback is a good buying opportunity.

“Gold lost steam mid-week as US interest rates and the dollar surged in the wake of the US election. The precious metal fell more than 3%. By the end of the week, it had recovered about half of its losses. The PBOC, in particular, appeared to have extended its gold purchase freeze.”

“The market looks like it needs some consolidation,” Chandler added. “A pullback to $2,600 an ounce in the spot market could be attractive to buyers.”

See more news related to gold prices HERE...