Although gold prices have not been able to hit the record in October (over 4,360 USD/ounce), the precious metal is currently trading "nearly at a reasonable value".

In a recent interview, Nitesh Shah - Head of Commodity & Macroeconomic Research at WisdomTree - said that with so much widespread instability in the global economy, it is no surprise that the gold market - despite strong fluctuations - continues to set higher support levels after each breakthrough.

He said investors waiting for deeper corrections will continue to be disappointed, as gold prices are expected to receive solid support from the increasing weakness of the economy, a factor that could force the Federal Reserve (Fed) to cut interest rates next week and last until 2026, thereby pushing nominative and real yields down, weakening the USD.

Although it could not hold above 4,360 USD/ounce in October and was under significant profit-taking pressure, selling pressure was only limited, with the support zone remaining above 4,000 USD/ounce.

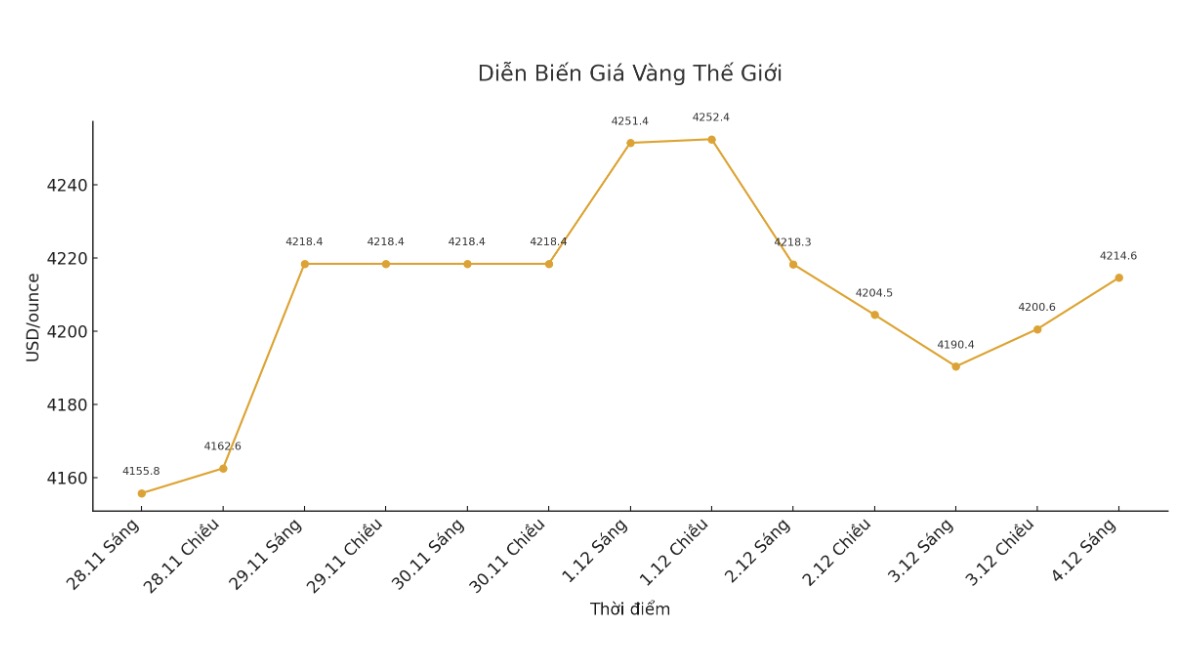

After a short sideways period, gold still maintained its position, building support around $4,200.

After the strong rally in October, we saw a healthy correction, and I think the current rate is almost reasonable. Gold is doing exactly what people expect in a world with increased government debt and reduced interest rates," he said.

Although many investors focus on upside potential, Shah spent more time simulating the downside scenario.

He said gold is at risk of falling to $3,800 an ounce, but his model shows that the market is still well supported around this level.

The price could fall below $4,000/ounce, but that would require a huge effort. It is almost impossible," he said.

In the bullish scenario, he said the rate would have to increase back to 5%. However, if that happens, the US economy is likely to fall into recession, making gold attractive as a safe-haven asset.

There must be a scenario where economic activity is too strong, forcing interest rates to increase again, and investors no longer see the need to hold gold. This is almost not shown at present. Every time gold finds a new level of support, the market becomes more unstable, causing prices to increase," he said.

In recent days, gold has found new momentum as market expectations have changed strongly. Last month, investors almost ruled out the possibility of the Fed cutting interest rates in December, but disappointing economic data has caused the balance toline back, with the probability of interest rate cuts now approaching 90%.

Shah said that while next week's monetary policy meeting will be important in shaping the outlook for the new year, a bigger supporting factor for gold is the uncertainty about who will lead the Fed when Chairman Jerome Powell's term ends in May.

He added that any political pressure that affects the Fed's independence will be a strong support for gold.

Shah also said that doubts about the Fed's independence could prompt other central banks to diversify their reserves into gold and reduce their dependence on the US dollar.

See more news related to gold prices HERE...