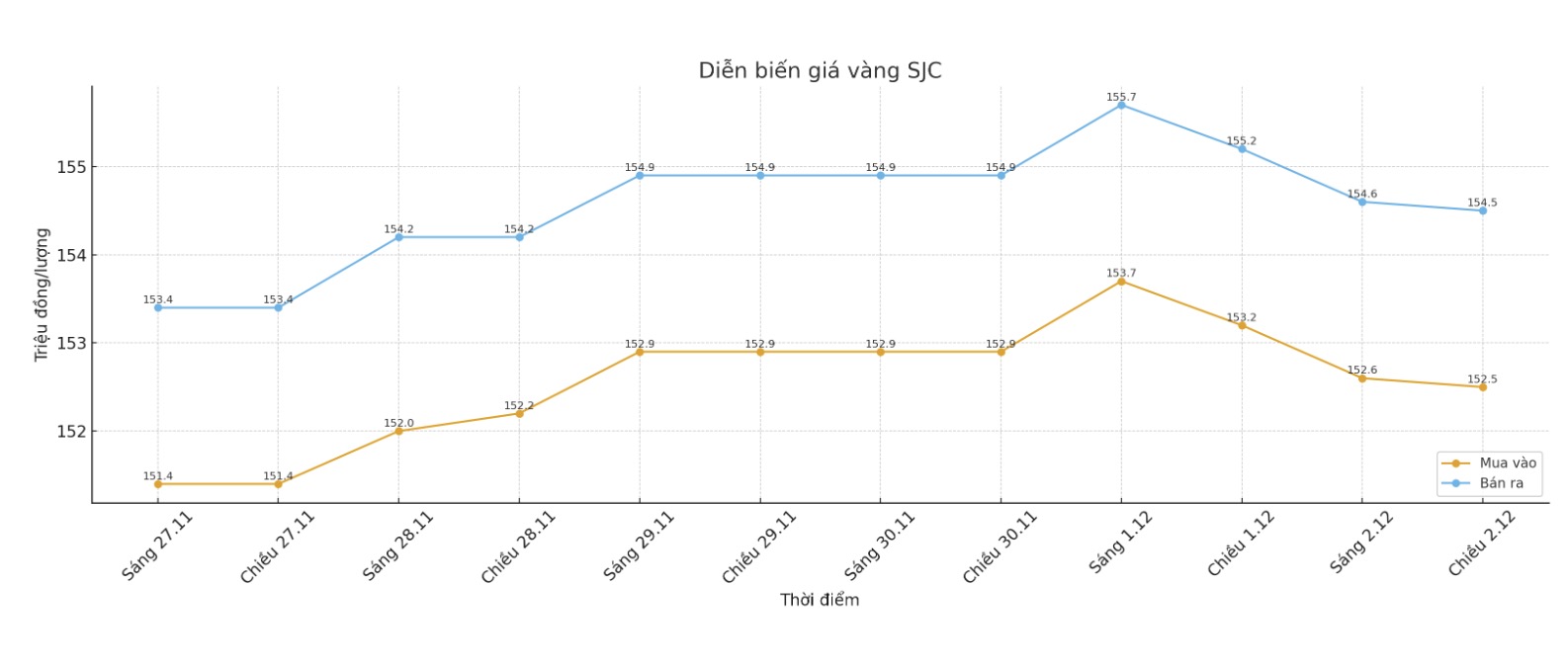

Updated SJC gold price

As of 9:25, the price of SJC gold bars was listed by DOJI Group at 152.8-154.8 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 153.3-154.8 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.8-154.8 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

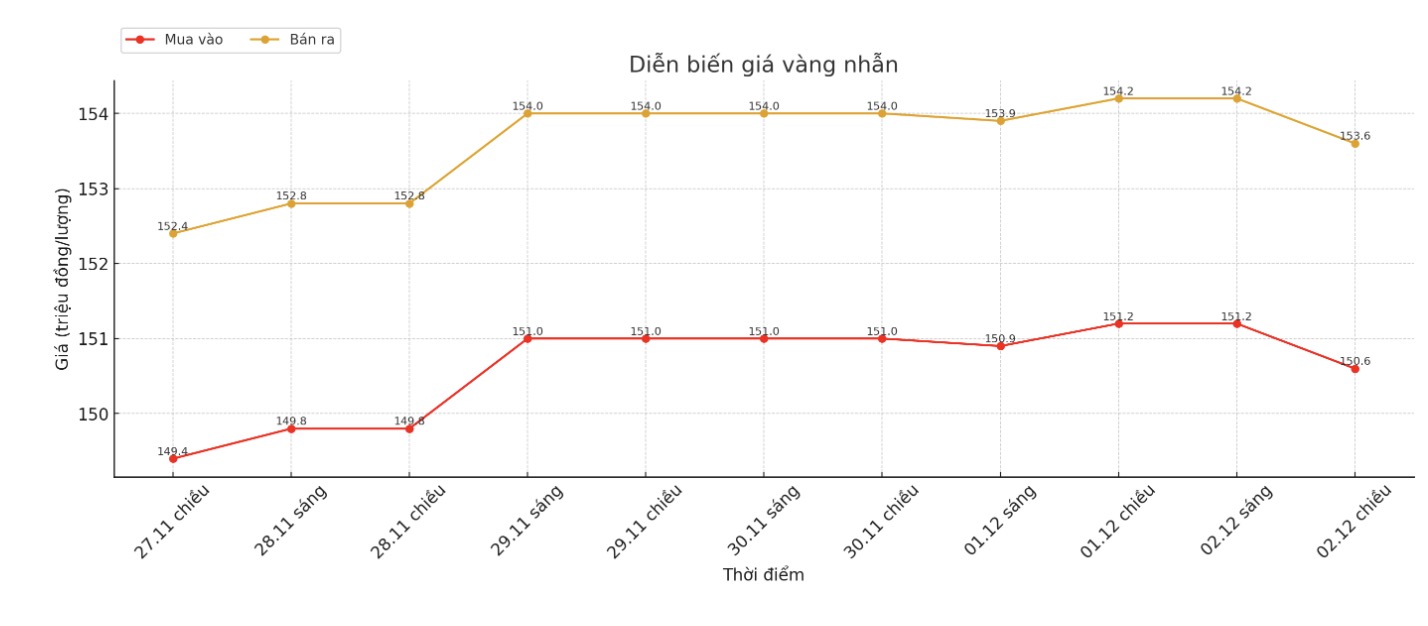

9999 round gold ring price

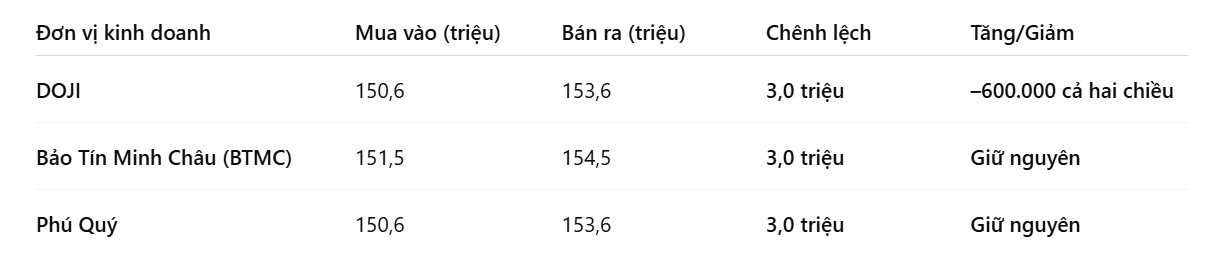

As of 9:25, DOJI Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 151.5-154.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.6-153.6 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

At 9:25, the world gold price was listed around 4,219.3 USD/ounce, up 1 USD compared to a day ago.

Gold price forecast

The gold price increase slowed down partly due to profit-taking activities from short-term futures traders and the risk-off sentiment in the market in general.

Gold prices have previously hit a six-week high. The precious metal has broken out after the latest data showed that the US manufacturing sector weakened last month. The Institute for Supply Management (ISM) announced on Monday that the Manufacturing PMI fell to 48.2 in November, after 48.7 in October. The key figure was lower than expected, with experts predicting 48.6.

In China, gold demand has also stagnated due to the impact of the cancellation of value-added tax incentives for some types of gold purchased through the Shanghai Gold Exchange and the Shanghai Financial Stock Exchange from January 1-11. The new tax policy in the country is expected to increase the cost of gold used in jewelry and industry, significantly reducing consumer demand.

In some other countries such as Singapore or Japan, gold is sold at or above the standard price of about 2.5 USD/ounce. The widespread high gold price, combined with the trading disruption at CME Group in the US, is making the Asian gold market cautious, although gold is forecast to continue to increase in the long term, thanks to expectations that the US Federal Reserve (Fed) will cut interest rates in December.

According to precious metals analysts at Heraeus, the strong increase in expectations of the Fed cutting interest rates is supporting gold prices. Analysts said that the possibility of a rate cut at the December Fed meeting has skyrocketed, although economic data is still mixed. They said that the two factors of employment and inflation, as well as other economic data, did not show a clear weakening to the extent necessary to cut interest rates, but consumer confidence declined sharply in November.

Technically, the next bullish target for February gold buyers is to close above the strong resistance level at a record high for the contract: $4,433/ounce. In contrast, the nearest downside target for the bears is to pull prices below the solid technical support level at $4,100/ounce.

The first resistance level peaked in the night session: 4,269.2 USD/ounce, followed by 4,300 USD/ounce. First support was at the bottom in the night session at $4,210.2 an ounce and then $4,200 an ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...