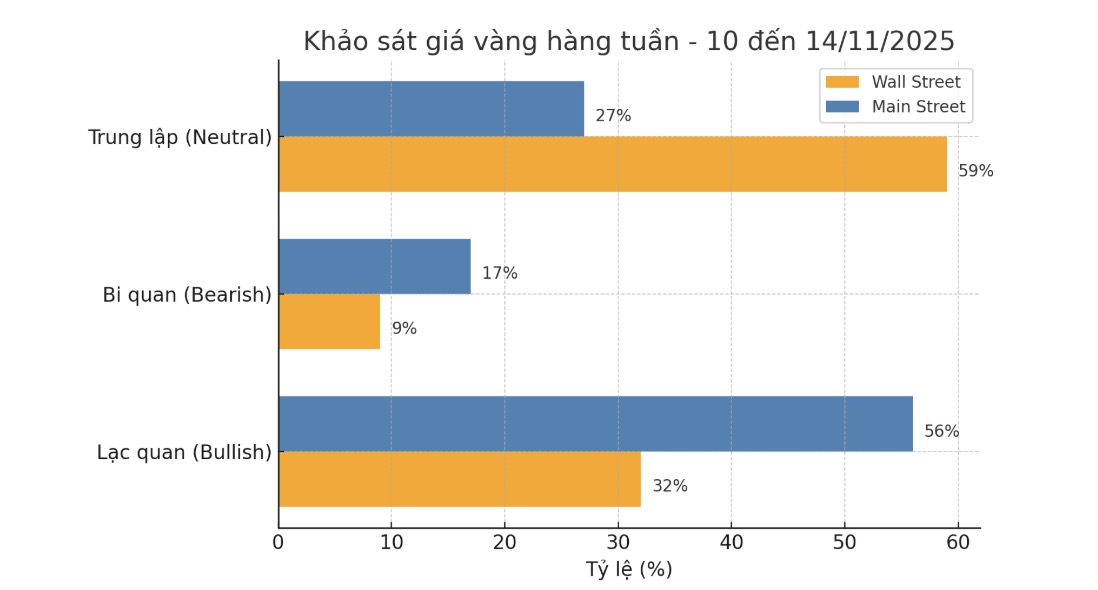

After two weeks of sharp decline, the gold market has somewhat eased selling pressure. However, the fact that prices closed at the end of the week at a neutral state shows that the trend is still unclear. Most Wall Street experts are cautious, while individual investors remain optimistic.

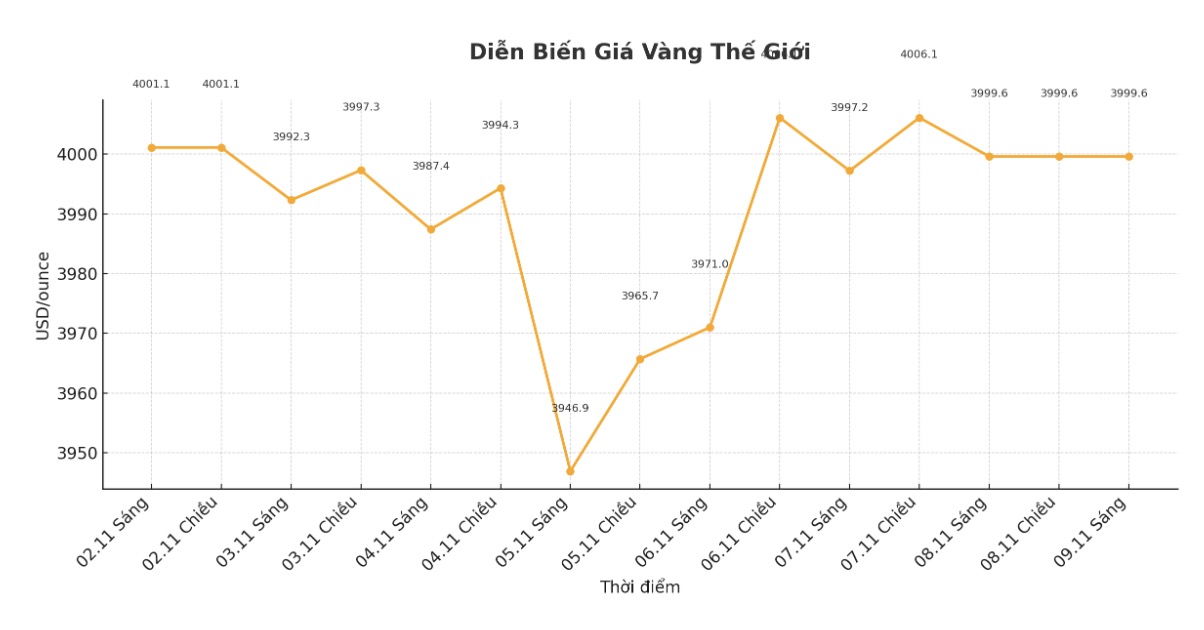

The $4,000/ounce mark continues to be an important psychological threshold for the gold market, as prices are heading to close around this area for the second consecutive week. Spot gold prices ended the week at $4,001.76/ounce, down less than $1 from last week's closing price.

The latest weekly gold survey by an international financial information platform shows that many experts believe that the long-term upside prospects for this precious metal are still firmly maintained.

This week, 21 Wall Street experts participated in the gold price survey. Of these, 13 people (59%) are neutral on the short-term gold price trend. At the same time, 7 experts (32%) predicted that gold prices would increase next week, while only 2 people (9%) said that prices would decrease.

For small investors, the online survey on social networks recorded 221 votes. Of these, 123 (15.7%) expect gold prices to rise next week. In contrast, 39 people (17.6%) predict prices will decrease, while 59 people (26.7%) believe the market will move sideways in the short term.

Recently, bulls have built a solid floor price zone for the market. However, they still need a new positive basic catalyst to trigger a strong increase - something that has not yet appeared," said Mr. Jim Wyckoff - Senior Technical Analyst at Kitco.com.

I see the current sideways gold around $4,000 an ounce as a typical break in a structural uptrend, said Aaron Hill, chief analyst at FP Markets. Prices have fluctuated in the range of 3,950 - 4,060 USD/ounce over the past week.

This is an adjustment period after a spectacular increase of more than 48% since the beginning of the year, driven by safe-haven demand amid geopolitical tensions and central bank purchases.

The current main question - which direction is the risk leaning towards - in my opinion is still leaning towards an uptrend, with the base scenario towards the target of 4,200 USD/ounce by the end of the year. However, if prices break above $3,950 an ounce, it could signal a short-term decline to $3,900 an ounce or less.

Mr. Darin Newsom - Senior Analyst at Barchart.com - said that in the current context of instability and geopolitical fluctuations, the gold price movement is no different from "a gamble tossing coins" - unpredictable or unpredictable. However, he still maintains a positive view on this precious metal.

Can gold prices increase again? Maybe. But is that certain to happen? Absolutely not. We cant know what the US president will say, what he will do or what he will post next. Like many other markets - although not too extreme - the gold market is now affected by " winds" from a single individual with a social media account. I didn't think the market was designed to operate in this way, but that is the reality we are facing," he said.

Unfortunately for investors, the lack of US key economic data has caused the market to lack the necessary basic drivers. The US government's closure, now lasting for 38 days - the longest in history - is leaving the market at a deadlock.

See more news related to gold prices HERE...