On Monday evening ( EDT), US President Donald Trump announced that he would fire US Federal Reserve Governor Lisa Cook, a move considered the most serious attack on central bank independence, while also stirring up the market and politics and pushing gold prices up sharply.

Mr. Trump posted a " dismissal letter" on the Truth Social platform, accusing Ms. Cook of giving false information in two mortgage loan applications in 2021, before she was appointed to the Fed.

With her dishonest behavior and the potential for financial crimes, the American people cannot trust her integrity, and so can I. Trump wrote.

Lisa Cook is the first woman of color to hold the position of Fed Governor. Her dismissal is almost certain to be brought to court and could end at the Supreme Court, as the 2023 FED Act only allows a president to be removed from office for a legitimate reason, which is understood as corruption or serious lack of responsibility.

If successful, Mr. Trump could nominate a replacement, thereby reshaping the Fed Board of Governorsorsors (14 years term). The council now has six members, one seat vacant after Ms. Adriana Kugler resigned on August 8.

Mr. Trump nominated Stephen Miran - Chairman of the Economic Advisory Council, to this position.

This move immediately faced a backlash from the Democratic Party. Senator Elizabeth Warren called it a blatant embezzlement of power, a violation of the Fed Act and a must be rejected by the courts findings.

The leader of the Senate minority Chu Chu Chu Schumer warned that Mr. Trump is "playing a dangerous Jenga game with the pillar of the US economy" and will "crush" the independence of the Fed.

The financial world is also concerned. Jamie Cox - CEO of Harris Financial Group - commented: "It is not clear what is more worrying - the government directly intervenes in the FED or holds a large stake in private enterprises. Lessons from the financial crisis show that government-held bank stocks have been clinically dead for 10 years.

He said Trump is taking the lead in monetary policy by implying that interest rates will soon fall, causing short-term bond yields to plummet and yield curves to plummet.

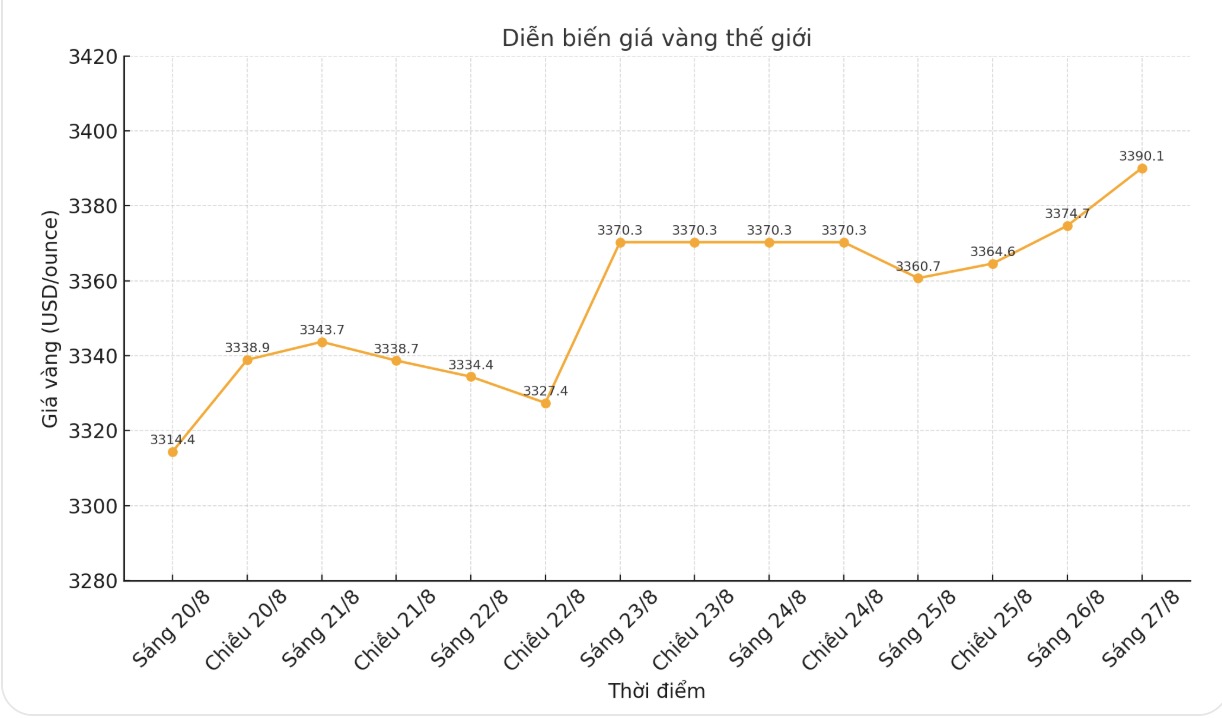

The gold market immediately reacted. Spot gold prices skyrocketed from $3,351/ounce at 8pm (New York time) to $3,385/ounce in just one hour. At the time of writing (7:00 a.m. on August 27 - Vietnam time), the world gold price was listed around 3,390.4 USD/ounce, up 18 USD compared to a day ago.