USD Index

On the morning of October 29, in the US market, the USD Index (DXY) measuring the fluctuations of the greenback against 6 major currencies decreased by 0.14%, standing at 98.68 points.

Most Asian currencies increased slightly on Tuesday (October 28) thanks to some optimism about improving US-China trade relations. Meanwhile, the US dollar fell slightly as the market awaited a widely predicted interest rate cut from the Federal Reserve this week.

The USD index and the USD futures contract both fell about 0.1% on Tuesday, extending the decline from the previous session.

The US dollar is largely affected by growing confidence that the Federal Reserve will cut interest rates by at least 25 basis points at the end of its two-day meeting on Wednesday.

Betting on a rate cut has been reinforced by weak consumer inflation data from last week, showing that inflation has cooled slightly in September.

broader uncertainties in the US economy, especially the cooling labor market and the ongoing government shutdown, are also expected to lead to further Fed easing in monetary policy.

Vietnamese equivalent to USD

In the domestic market, at the beginning of the trading session on October 29, the State Bank announced that the central exchange rate of the Vietnamese Dong decreased by 2 VND to the USD at 25,095 VND.

The reference USD exchange rate at the State Bank's Buying - Selling Transaction Office remains unchanged, currently at: VND 23,891 - VND 26,299, down VND 2 and VND 3 respectively.

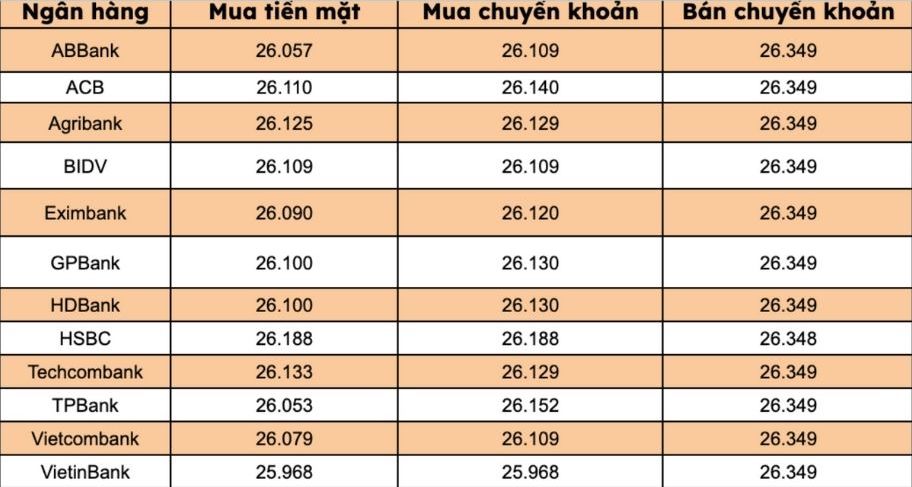

At most commercial banks, the USD price today increased and decreased depending on the brand.

Banks listed USD selling prices at VND26,349/USD, down VND2/USD.

The bank with the highest cash and transfer price of USD: HSBC (26,188 VND/USD).

The difference between buying and selling prices at banks ranges from 161-381 VND/USD.