Recorded at some spontaneous foreign exchange points in Ho Chi Minh City, the price of black market foreign currency in recent days has tended to increase compared to the beginning of the month. On October 27, the common USD purchase price was around VND 27,509 - VND 27,517/USD, higher than the listed price at banks.

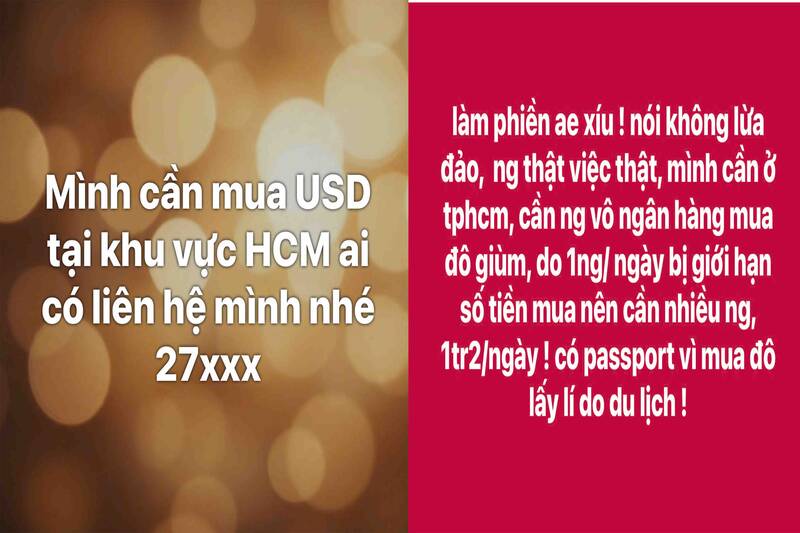

On social networking groups, foreign currency buying and selling activities are quite active. Many accounts posted to buy USD at prices several hundred to thousands of VND higher than the listed bank price per unit, with the commitment of "fast transactions, no fraud".

When contacted an account in Ho Chi Minh City, this person said that he only accepted transactions from 1,000 USD or more, and could go to his house if customers wanted, and exchange rare foreign currencies and old, torn USD.

Notably, many posts have appeared asking people to go to banks to buy foreign currency and pay from 400,000-1,200,000 VND/day, requiring a passport.

Transactions are mainly conducted through social networks and hand-to-hand, causing the free market to have potential risks for buyers. Users are easily victims of sophisticated scams that can lure participants into illegal activities and violate the law.

Meanwhile, at legal foreign currency exchange points such as commercial banks and stores licensed in the center of Ho Chi Minh City, transactions are taking place stably and in accordance with regulations. At these locations, mainly serving the needs of tourists, studying abroad or international payments, there is no phenomenon of large-scale foreign currency purchases.

Recently, the State Bank of Vietnam, Region 2 branch, has sent a request to economic organizations operating foreign exchange in Ho Chi Minh City and Dong Nai province regarding compliance with regulations in foreign exchange activities.

According to the State Bank of Vietnam, Region 2 branch, recently, due to the complicated developments of the world economy, the exchange rate between the Vietnamese Dong and the US Dollar in the market has not officially shown signs of increasing fluctuations and a difference has appeared with the transaction exchange rate in the banking system.

There is also a phenomenon of some subjects taking advantage of buying cash currencies for purposes such as traveling, working... at commercial banks and selling them outside to profit from the exchange rate difference between the formal market and the free market.

To proactively prevent and stop negative behaviors and law violations, and ensure a stable operation of the foreign exchange market, the State Bank of Vietnam, Region 2 branch, requires foreign exchange-invested economic organizations to strictly implement the provisions of the law on foreign exchange management, on preventing money laundering, terrorist financing and related legal provisions, in order to contribute significantly to stabilizing foreign exchange rates and the foreign exchange market.

During their operation, foreign exchange-invested economic organizations must continuously update relevant documents and regulations on foreign exchange, money laundering prevention, and terrorist financing, while strengthening processes and measures to ensure safety and security in the field of foreign exchange activities and other activities in general.

In case of detecting signs of violating legal regulations, the unit shall promptly report to the State Bank of Vietnam, Region 2 branch and competent authorities depending on the nature and severity of the violation to take appropriate handling measures.

Violations of foreign exchange activities will be punished according to the provisions of Decree No. 88/2019/ND-CP dated November 14, 2019 of the Government regulating sanctions for violations in the field of currency and banking (amended and supplemented in Decree No. 143/2021/ND-CP dated December 31, 2021 of the Government).