In a recent interview, Mr. Daniel Pavilonis - senior commodity broker at RJO Futures - re-analyzed the "standstill" price increase of silver and the sharp drop immediately afterwards - at least in the short term.

“Regarding silver, this is an extreme and rare fluctuation that has hardly ever happened in history. From the perspective of a professional trader, this development is completely unprecedented and very unbelievable. On the contrary, many investors enter the market with the same mindset as when trading Bitcoin, believing that the price will increase forever without stopping. It is the cash flow with that mentality that has poured into the metal market," he said.

According to Mr. Pavilonis, the difference between the long-standing "smart money" group and new investors in all-in is very clear, and these two groups interact with each other in unusual ways, affecting the entire market.

What makes me interested is that in my trading books, people who have been operating for many years, have good profit records, do not hold a larger position than new people - the type of "I only come here to trade metals", who are cryptocurrency traders, not really specializing in goods" - he said.

Both sides make money, at least in our portfolios" - he added - "But the largest amount of money, which is'astronomical', comes from people who buy options that are extremely far from market prices, as cheap as giving at the time of purchase - for example, the option to buy at $100 when silver is only traded around $39. Normally, buying a $100 option at $39/ounce is crazy.

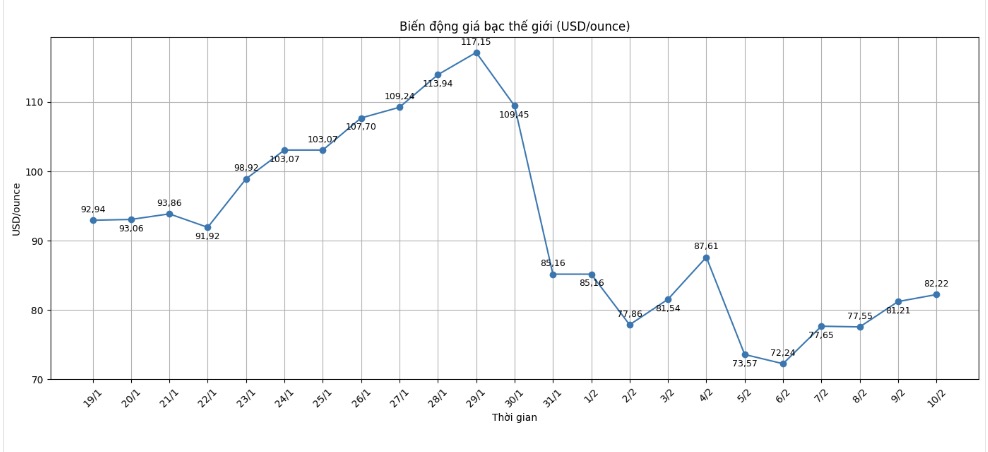

People often think silver has only increased slowly and steadily, like gold in the past few years. But this time, it has increased vertically".

Regarding the strong sell-off on January 30, Mr. Pavilonis said that there may have been very large short selling positions from some large banks, contributing to further deepening the decline.

“That may be true, but it is also possible that banks provide such information because they want to buy more, thereby creating room for prices to continue to rise. It is very difficult to determine the truth," he said.

According to him, in times of strong volatility like this, early profit-taking and strict risk control by professional investors sometimes make them miss big opportunities, while groups of investors who are willing to "take all", accept high risks, earn significant profits.

The key issue is that you don't know where the market will go, how high it will rise or when it will reverse" - he said - "You put in orders but don't know how far it can go. The biggest mistake is that from a full position, you reduce it to a quarter because you have reached the profit target.

Then the next morning when you wake up, the silver has increased by another 10 USD. You still have a position, but it is much smaller than the original. Then the silver increases to 70 USD... should you look at the 90 USD option now? How to manage the position? Finally, you gradually remove it, or just buy more options very far from the price. And then, almost not many people at our exchange still trade futures contracts when the silver exceeds 70 USD".

When prices far exceed the level that professional traders can trust, they begin to narrow their positions, essentially reselling them to speculative investors.

According to him, the biggest drawback is that during that period, investors considered "smart money" only held relatively small positions. On the contrary, many investors bought options at very high prices such as 100 USD, 130 USD or 150 USD right from when the new silver price was around 30-40 USD and continuously increased the trading scale.

He believes that these investors may not really believe that silver prices will reach the above levels. Instead, they only expect to take advantage of a part of the strong upward momentum, for example when silver prices rise to $60 or $70. Therefore, they continue to buy more, while professional traders gradually take profits and narrow positions to manage risks - still profitable, but unable to generate breakthrough profits like turning $20,000 options into $5 million.

The world gold and silver market operates based on two main pricing mechanisms. The first is the spot market, where prices are listed for buying and selling and immediate gold delivery transactions.

The second is the futures contract market, where prices are determined for gold delivery at a time in the future. Due to liquidity factors and position adjustments at the end of the year, the December gold futures contract is currently the most actively traded contract on the Chicago Mercantile Exchange (CME).