International financial markets are in a cautious state as trade and policy tensions between the US and Europe show signs of increasing, causing global stocks to fall in the first sessions of the week. In that context, gold continues to play its role as a safe haven and continuously hits new peaks.

According to Bloomberg, tough statements related to trade between the US and some European countries are raising concerns about the possibility of increasing volatility in the financial market.

The risk of reciprocal tax retaliation measures is said to be able to worsen investor sentiment, in the context that the market has just been supported by relatively stable business results and large capital flows into the field of artificial intelligence (AI).

Developments in the bond market also contributed to increasing pressure on risky assets. US government bond yields rose to their highest level in more than 4 months, after the bond sell-off wave in Japan spread to global debt markets.

US 30-year bond yields rose 9 basis points to 4.93%, while 10-year terms rose 7 basis points to 4.287%, the highest level since the beginning of September. According to Bloomberg, concerns about Japan's fiscal outlook have caused long-term bond yields in this country to soar, leading to pressure to raise yields in many other markets, including Europe and the US.

Meanwhile, the International Monetary Fund (IMF) has just slightly increased its global economic growth forecast, but still warns of many potential risks. According to the World Economic Outlook report released earlier this week, the IMF forecasts that the global economy in 2026 will grow by 3.3%, higher than the 3.1% level set in October last year, while forecasts for 2027 remain unchanged at 3.2%. The IMF believes that strong spending on technology, especially artificial intelligence in North America and Asia, is playing an important growth engine, but also notes that if productivity expectations are not met, the financial market may face the risk of strong corrections.

In Asia, the Chinese economy continued to show signs of slowing down in the latest quarter. According to published data, GDP growth in the past quarter reached 4.5% compared to the same period last year, the lowest level since the country reopened after the pandemic.

Although industrial production in December remained stable, retail sales and investment weakened more strongly than forecast. For the whole year, China's GDP increased by 5%, in line with the set target, but the growth prospects in the context of increased trade protection are assessed as still facing many challenges.

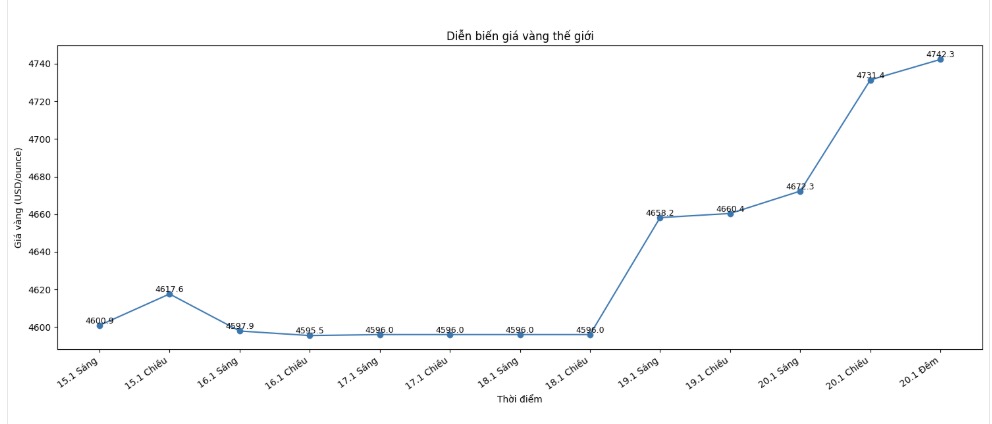

Technically, experts believe that buyers on the February gold futures market are aiming for the next goal of closing above the strong resistance zone of 4,800 USD/ounce. In the opposite direction, sellers will find ways to push prices below the important support zone of 4,500 USD/ounce.

The nearest resistance level is currently at a record high of 4,742.9 USD/ounce, followed by the 4,800 USD/ounce mark. Important support levels are at 4,650 USD/ounce and 4,622.2 USD/ounce respectively. Market assessment by Wyckoff is currently at 9.5 points, showing that the upward trend is still clearly dominant.

On the commodity market, world crude oil prices increased slightly and fluctuated around 60 USD/barrel. The USD index weakened sharply, while the yield of US 10-year bonds is currently at 4.287%, a significant increase compared to the previous week, continuing to support the upward momentum of gold prices.

See more news related to gold prices HERE...