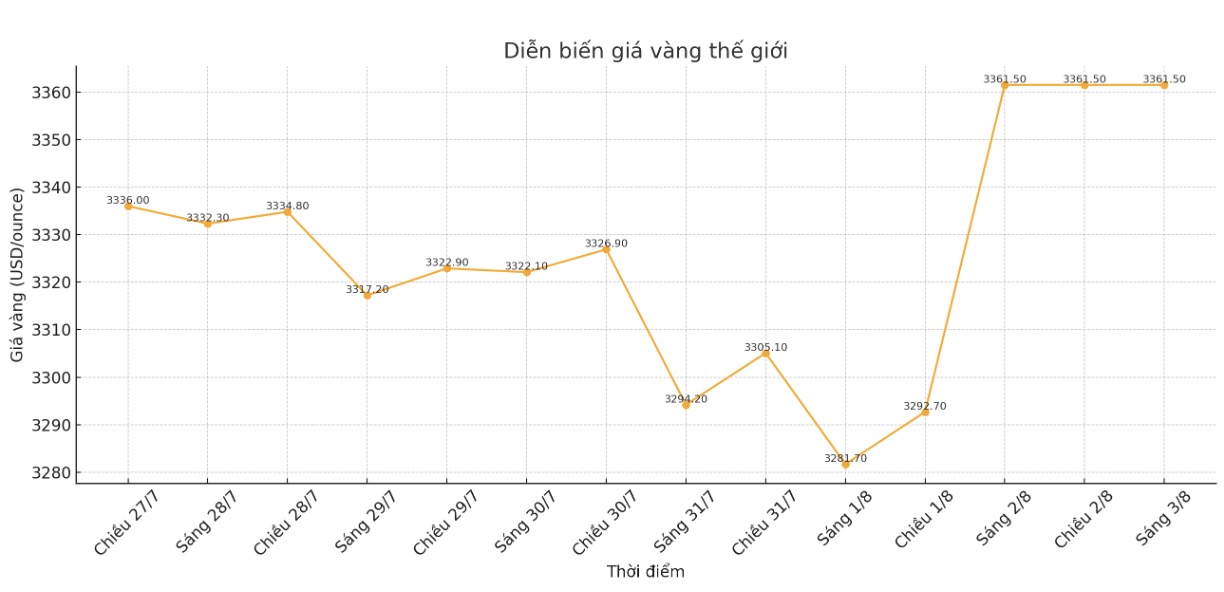

The gold market last week fluctuated dramatically and was full of surprises. The price trend is constantly reversing just because of a statement, an economic data or an expectation of change. When the trend seemed clear, the market immediately reacted strongly to any new signal.

This week, just one word from Federal Reserve Chairman Jerome Powell has rocked the market, pushing gold prices to a four-week low below $3,300/ounce.

After the Fed decided to keep interest rates unchanged on Wednesday, Mr. Powell signaled a "tail" at the beginning of the press conference when he stated: "We have not made any decision for September". In less than an hour, gold prices lost nearly $30 a share, or about 1%.

This brief statement forced the market to re-adjust expectations for a rate cut. By Thursday, the probability of a Fed easing in September had dropped to just 37%.

But just one day later, the disappointing jobs data released on Friday completely reversed the situation. Within just two minutes of the reports release, gold prices surged $30. Spot prices continued to rise and closed the session at 2,361.5 USD/ounce, up more than 2% on the day.

It is not difficult to understand why gold reacted so strongly. According to CME's FedWatch tool, the market currently has a 90% probability of the Fed cutting interest rates in September. In addition, there is a 50% chance that interest rates will decrease by a total of 1 percentage point before the end of 2025.

These drastic rate cuts have reappeared even as inflation remains strong. Analysts say this is ideal for gold, because real interest rates reduce the opportunity cost of holding precious metals.

Another important factor helping gold recover this week is strong investment demand. Investors are returning to gold to preserve their assets amid economic uncertainty.

According to the latest gold demand trend report from the World Gold Council, in the first half of 2025, investment demand for gold-backed ETFs reached its highest level since early 2020.

However, total ETF holdings are still significantly lower than 5 years ago. This shows that there is still room for growth, even when prices are approaching record highs.

See more news related to gold prices HERE...