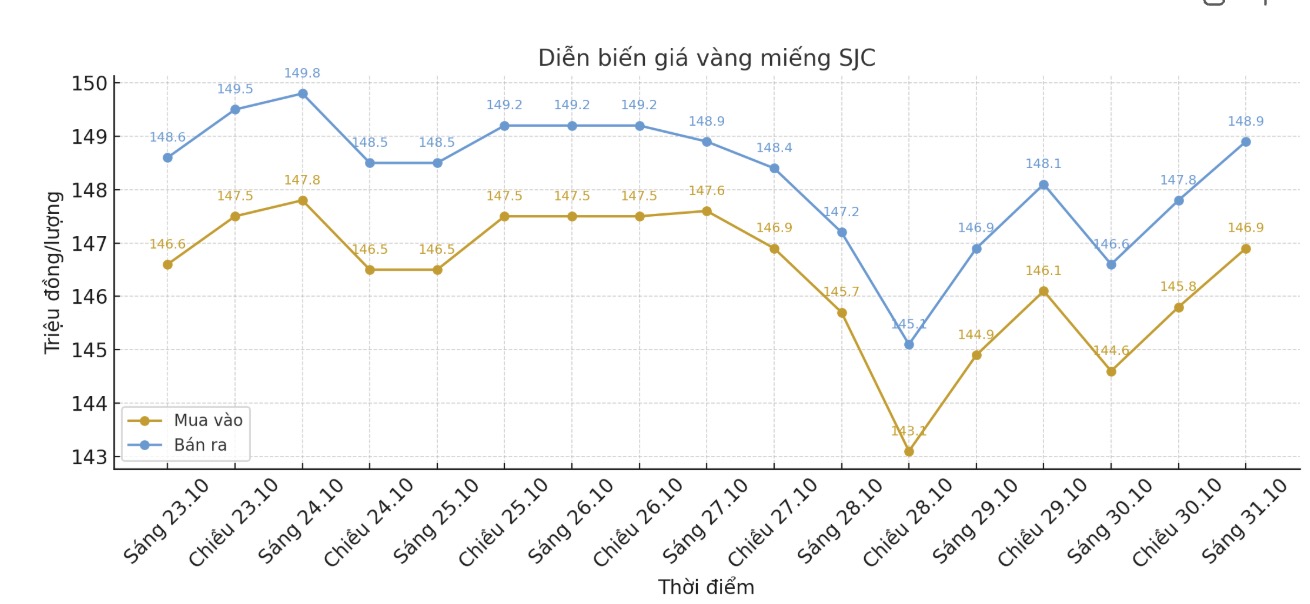

Updated SJC gold price

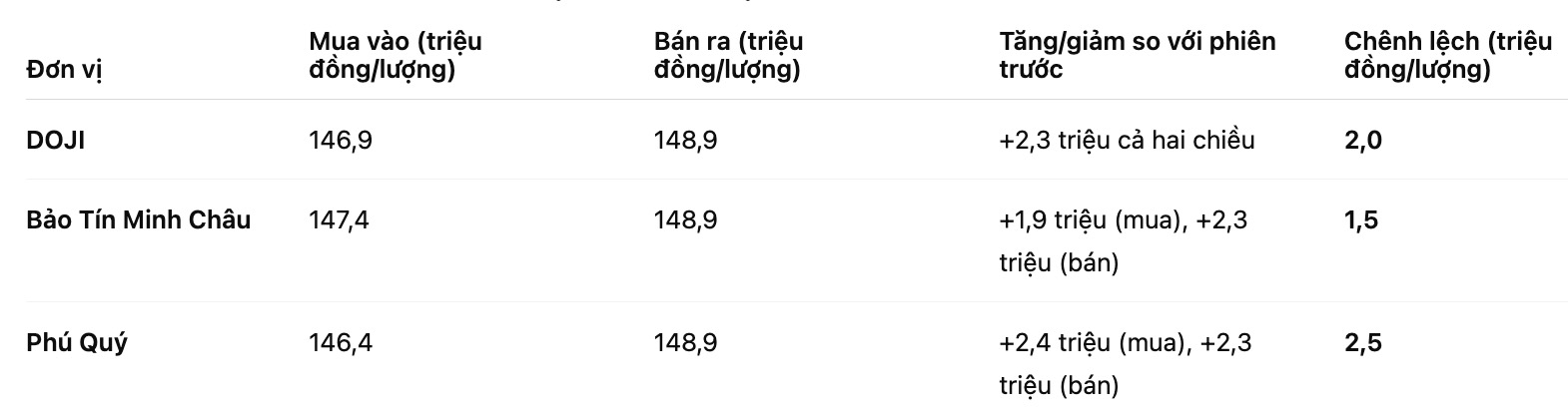

As of 10:40 a.m., DOJI Group listed the price of SJC gold bars at 146.9-148.9 million VND/tael (buy in - sell out), an increase of 2.3 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.4-148.9 million VND/tael (buy - sell), an increase of 1.9 million VND/tael for buying and an increase of 2.3 million VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 146.4-148.9 million VND/tael (buy - sell), an increase of 2.4 million VND/tael for buying and an increase of 2.3 million VND/tael for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

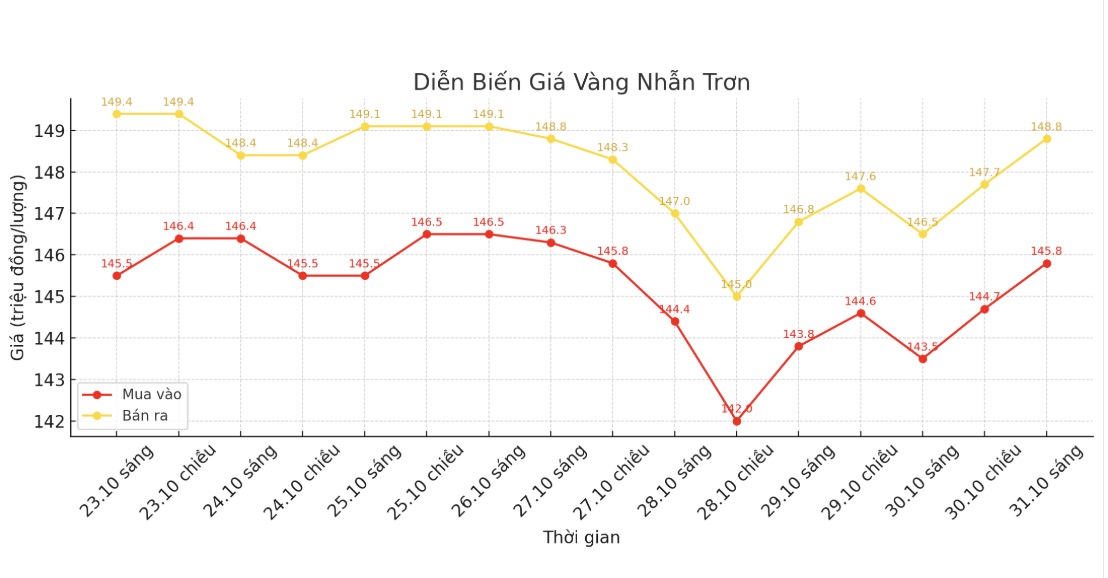

9999 round gold ring price

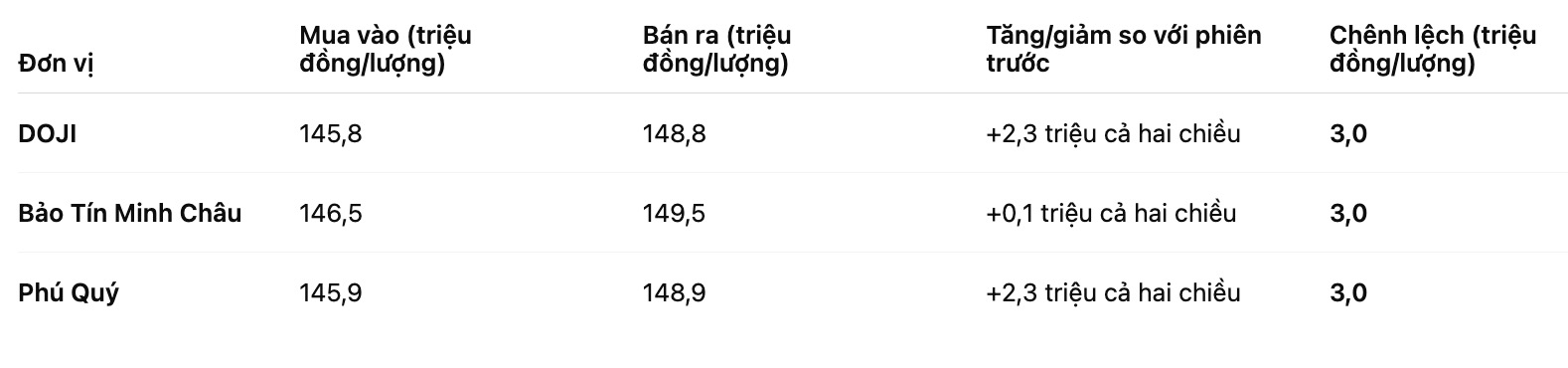

As of 9:40 a.m., DOJI Group listed the price of gold rings at 145.8-148.8 million VND/tael (buy - sell), an increase of 2.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 146.5-149.5 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.9-148.9 million VND/tael (buy - sell), an increase of 2.3 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

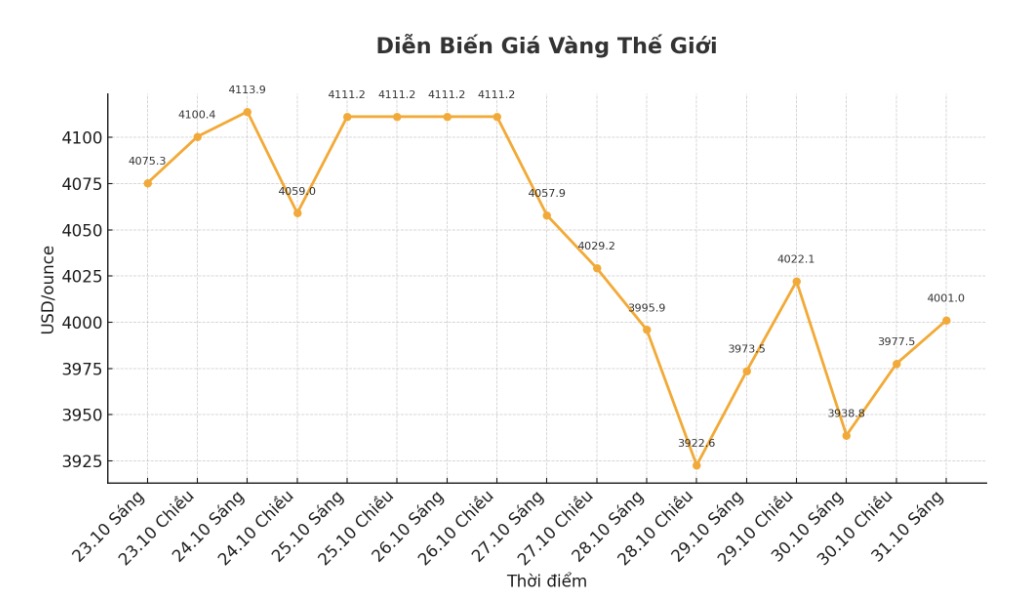

World gold price

At 10:45, the world gold price was listed around 4,001 USD/ounce, up 62.2 USD.

Gold price forecast

World gold prices rebounded strongly after Federal Reserve Chairman Jerome Powell gave more "hawlish" statements than expected on monetary policy on Wednesday, putting pressure on the precious metal market later that day and throughout the night.

The Federal Open Market Committee (FOMC) lowered the federal interest rate target range by 0.25% on Wednesday, in line with market expectations, with disagreements in both directions.

However, Mr. Powell warned investors not to expect too much about the possibility of a rate cut in December, emphasizing the growing division within the Fed in terms of employment prospects and inflation. He said: "continuing to cut interest rates at the December meeting is not certain - it is far away to say so."

Mr. Powell's tough tone has caused US Treasury bond prices to fall (increase yields), leaving the possibility of the Fed cutting interest rates in December at only average.

Notably, gold prices kept their upward momentum against the euro, even as the European Central Bank (ECB) decided to keep interest rates unchanged.

On Thursday, ECB announced that it will keep interest rates unchanged for three main tools: deposit interest rate at 2.00%, principal refinancing interest rate at 2.15% and frontier lending interest rate at 2.40%. This decision is completely in line with market forecasts.

According to the central bank's monetary policy statement, the board is taking time to assess the current economic situation.

The economy continues to grow despite many challenges in the global environment. A strong labor market, a healthy financial balance sheet of the private sector and previous interest rate cuts by the Board of Directors continue to be important factors helping the economy maintain resilience.

However, the outlook remains uncertain, especially due to global trade disputes and geopolitical tensions," the ECB said in a statement.

The central bank affirmed that it will ensure stable inflation around the 2% target in the medium term and will "monitor data and make decisions at each meeting".

The ECB stressed that interest rate decisions will be based on assessments of inflationary prospects, surrounding risks, the latest economic and financial data, as well as developments in core inflation and the effectiveness of monetary policy. The Board of Directors did not make any prior commitments on a specific interest rate roadmap.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...