The People's Bank of China (PBoC) announced on Saturday that it had continued to add gold to foreign exchange reserves in May, marking the seventh consecutive month of buying.

Krishan Gopaul, senior analyst for EMEA at the World Gold Council, wrote: Date released by the Peoples Bank of China shows that their gold reserves increased by nearly 2 tons in May. This raises the total net gold purchases since the beginning of the year to 17 tons, bringing the total gold reserves to 2,296 tons.

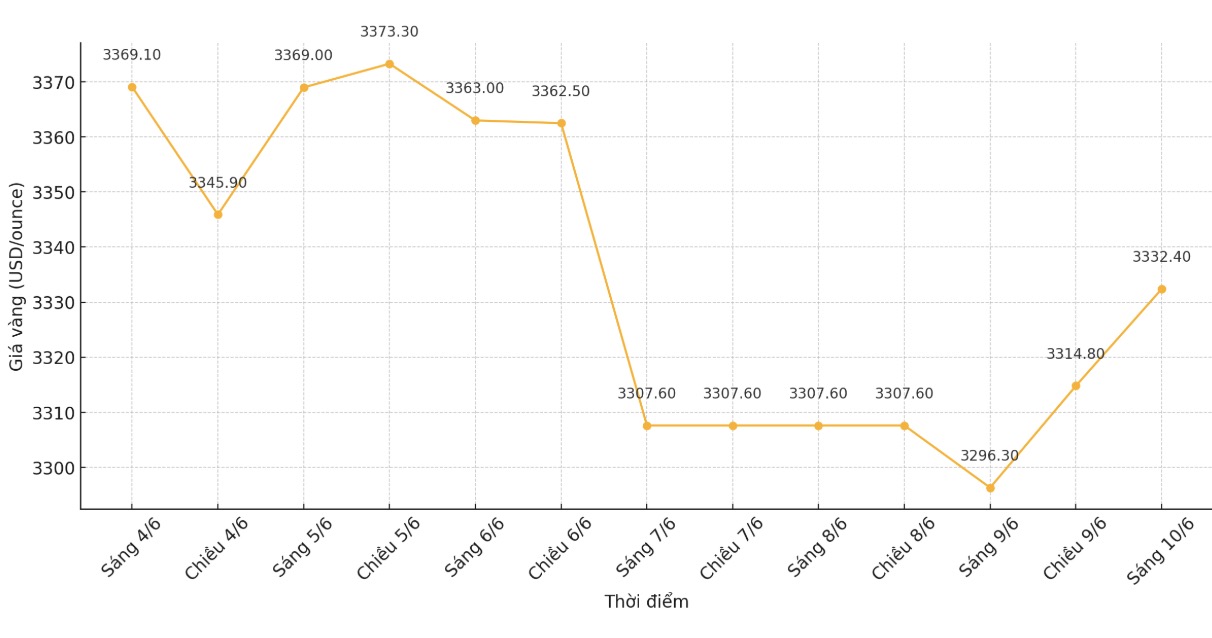

China's gold reserves were valued at $241.99 billion at the end of May, down slightly from $243.59 billion at the end of April, according to the PBoC. Gold prices once hit a historic peak of over $3,500/ounce in April, thereby helping to increase the value of the country's gold holdings.

Last year, the PBoC suspended gold purchases for 6 months after a series of 18 consecutive months of increasing reserves. However, the bank has resumed gold purchases since November, following Donald Trump's victory in the US presidential election.

Recently, China has also made a move to loosen control of the domestic gold market. On May 27, the Shanghaieringering Expressway (SHFE) announced plans to open a domestic futures market for foreign investors and brokers to participate directly.

SHFE has announced 34 different proposals, including gold and silver options trading activities, risk prevention, to precious metals futures contracts. SHFE's goal is to "completely open the door for international investors" and support the internationallization of the yuan.

The changes are expected to allow foreign brokers and investors to directly participate in exchanges, instead of having to go through domestic intermediaries as at present. In addition, participants can also deposit in USD or other foreign currencies. This draft will be made public for comments until June 4.

SHFEs proposals are part of Chinas broader strategy to increase its influence in trading and pricing commodities such as gold and silver, commensurate with Chinas leading role in the production and consumption of these precious metals.

Previously, on April 21, the PBoC and three other government agencies also announced an investment plan in the localization of the Shanghai Gold Exchange (SGE) - including the construction of warehouses for international delivery with the ambition of competing with the London Metals Exchange (LME) in its global valuation role.

The announcement from the PBoC did not specify which products will be the focus of the new initiative, but the Shanghai Gold Exchange is currently trading mainly precious metals such as gold, silver and platinum.