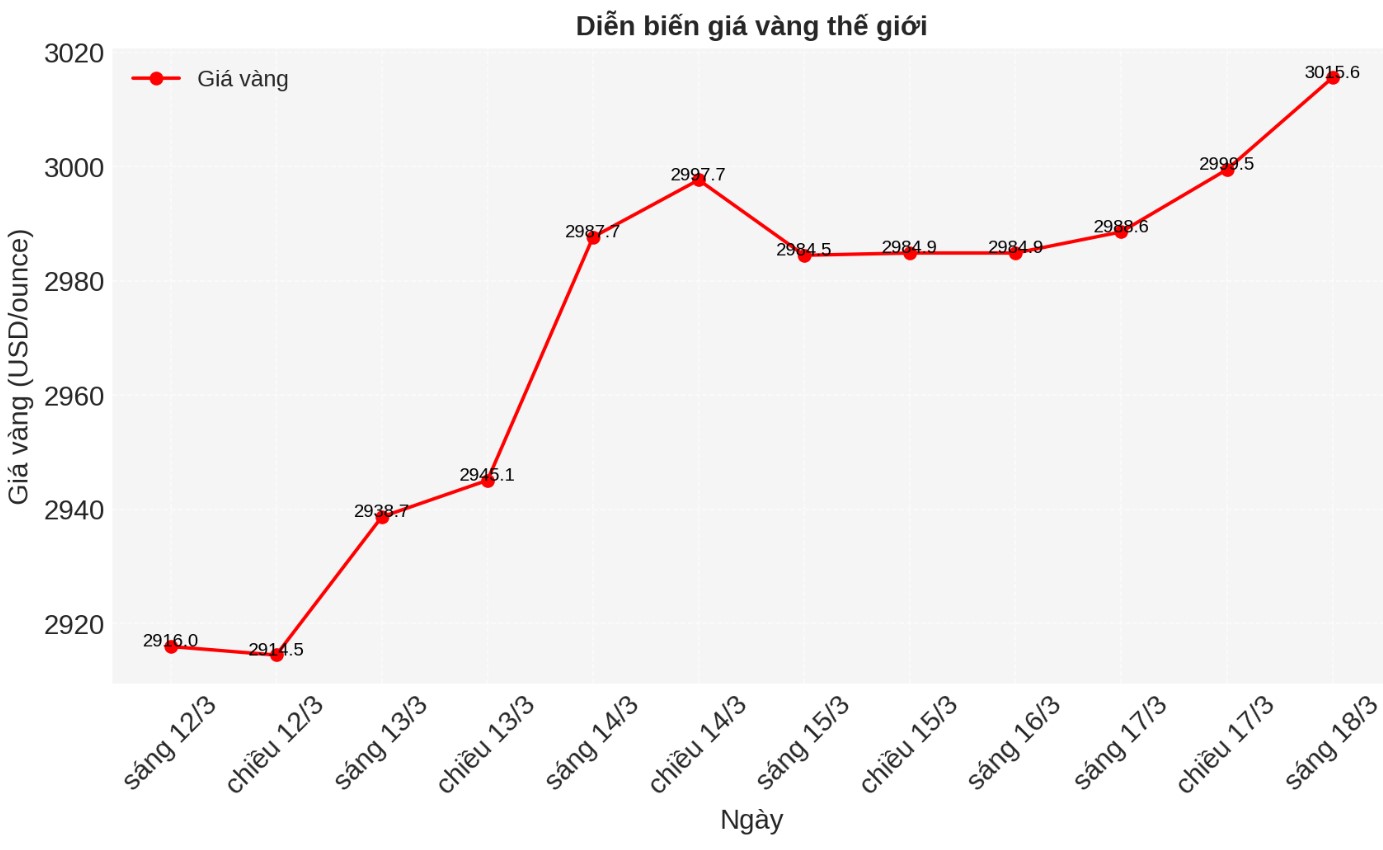

This morning (March 18, 2025), world gold prices continued to set new peaks, breaking previous record prices. As of 10:22 (Vietnam time), world gold was listed on Kitco at 3,015.6 USD/ounce.

In the latest research report released on Friday, Ole Hansen - Head of Commodity Strategy at Saxo Bank - said he would not be surprised if gold prices fell to $2,956/ounce, or even $2,930/ounce when investors took profits.

However, he also said that he sees any decline in the market as an opportunity to buy and emphasized the gold price target for 2025 of $3,300/ounce. Gold futures for April are trading near $3,006.50 an ounce.

Hansen noted that strong central bank demand, falling global interest rates and geopolitical instability are key factors driving gold's unprecedented rally from February 2024. He pointed out that gold prices have increased by 39% in the past 12 months and 14% since the beginning of 2025.

Hansen explained that the gold rally has been accelerated since the start of the new year. Global events, including economic uncertainty and the geopolitical crisis, have created an uncertain environment, contributing to the gold price breakthrough. Hansen said a perfect storm is forming in the gold market.

Stock market adjustments, especially for companies with recent strong stock market increases but currently facing changes in the US economy, have prompted investors inside and outside the US to seek other opportunities.

These factors have increased the risk of recession, with slowing growth, higher unemployment and rising inflation. This could force the Federal Reserve to ease financial policy. The market is now expecting three 25 basis point rate cuts this year, rather than just one as predicted in January, he said.

Hansen pointed out that demand for gold investment from Western countries has increased as Trump's trade war and tariffs on imported goods have affected the stock market. While gold prices have risen 14% since the beginning of the year, the S&P 500 index has fallen nearly 4%.

Real asset managers, especially in the West, have needed a strong stock market and economic downside concerns to return to gold, and this is happening.

Many have retreated in 2022 as the Fed's rate hike has made gold retention costs unfeasible, but concerns about prolonged recession and lower financial costs are attracting them back, despite remaining cautious. This demand seems widespread, with funds turning from securities to short-term safe havens such as US Treasury bonds and gold," the expert said.

See more news related to gold prices HERE...