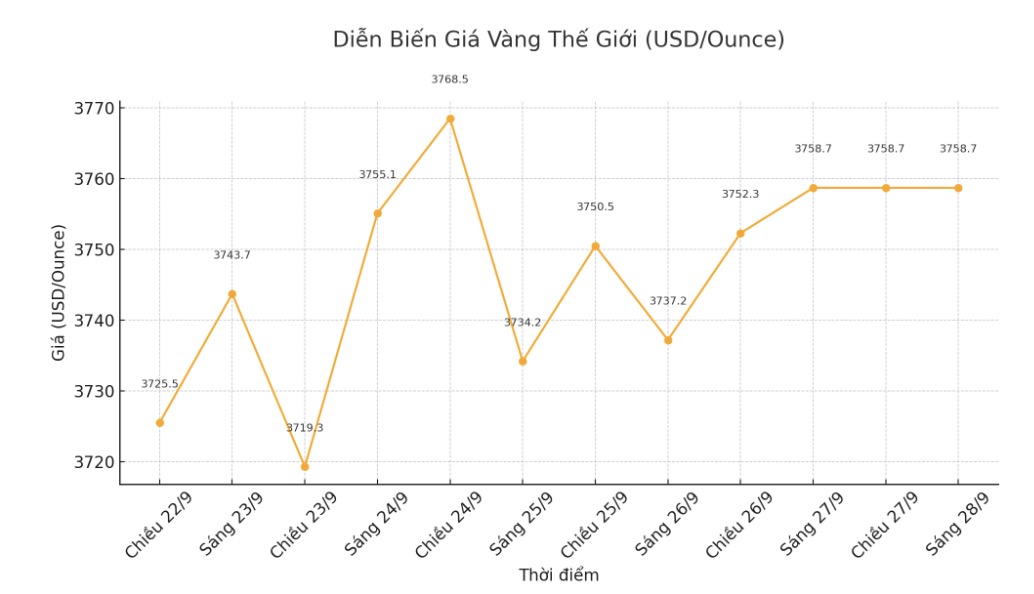

Spot gold increased to 74.7 USD/ounce last week, closing the trading week at 3,758.7 USD/ounce. During the week, gold prices hit a record $3,790.82/ounce at one point. For the whole week, the metal has gained about 2.5%. US gold futures for December ended the session up 1% to $3,809/ounce.

Tai Wong - an independent metals trader commented: "The monthly PCE is on track, although personal income and spending are 0.1 percentage points higher than the forecast. nothing in this dataset prevents the Federal Reserve from continuing another cautious cut at its October meeting.

Data shows that the US PCE price index increased by 2.7% over the same period in August, as forecast in the Reuters survey.

According to the CME FedWatch tool, investors now see an 88% probability of an interest rate cut in October and a 65% chance of another cut in December.

Regarding trade, US President Donald Trump announced a new tariff on imported drugs, trucks and furniture, effective from October 1.

I am optimistic about gold next week because the metal is still in a long-term uptrend against all currencies, said Mr. Colin Cieszynski, chief strategist at SIA Wealth Management.

Mr. Darin Newsom - senior market analyst at Barchart.com commented: "Gold prices will increase next week. Why? The increase is currently very strong, I do not recommend selling fake or fighting the trend".

Sharing the same view, Mr. Rich Checkan - Chairman and COO of Asset Strategies International said: "Although there are opinions that gold is being overbought, the trend is still in favor of the increase next week. Central banks have not stopped hoarding gold. In addition, the falling gold/ silwer ratio (GSR) shows that individual investors are starting to get involved: they often buy both gold and silver. Silver has accelerated - a sign that small-scale cash flow is returning to the market.

In addition, the risk of the US government having to close and a spending bill is certain to surpass the ceiling, I think gold prices will increase further next week, he said.

Other metals, spot silver rose 2.6% to $46.41/ounce, hitting a more than 14-year high; palladium rose 2.8% to $1,284.77, heading for a weekly gain. platinum rose 2.5% to $1,568.21, its highest in more than 12 years.

Analysts and traders said that silver and platinum are accelerating in the context of high gold prices, as investors switch to "softer-priced" options.

Chinas commitment by General Secretary and President Xi Jinping to cut Chinas net emissions by 7 decite by 2035 also stimulates the purchase of silver - the metal used in solar panels, said Wong.

He said the sentiment was also supported by Freeport (an American mining group) declaring force majeure at the Grasberg copper mine.

Notable economic data next week

Monday: Waiting for signing a house contract (USA).

Tuesday: JOLTS job positions (USA), Consumer confidence index (USA).

Wednesday: ADP Private sector Employment Report (US), ISM Manufacturing PMI.

Thursday: Application for weekly unemployment benefits (US).

Friday: US Non-farm Payrolls, ISM Services PMI.

See more news related to gold prices HERE...