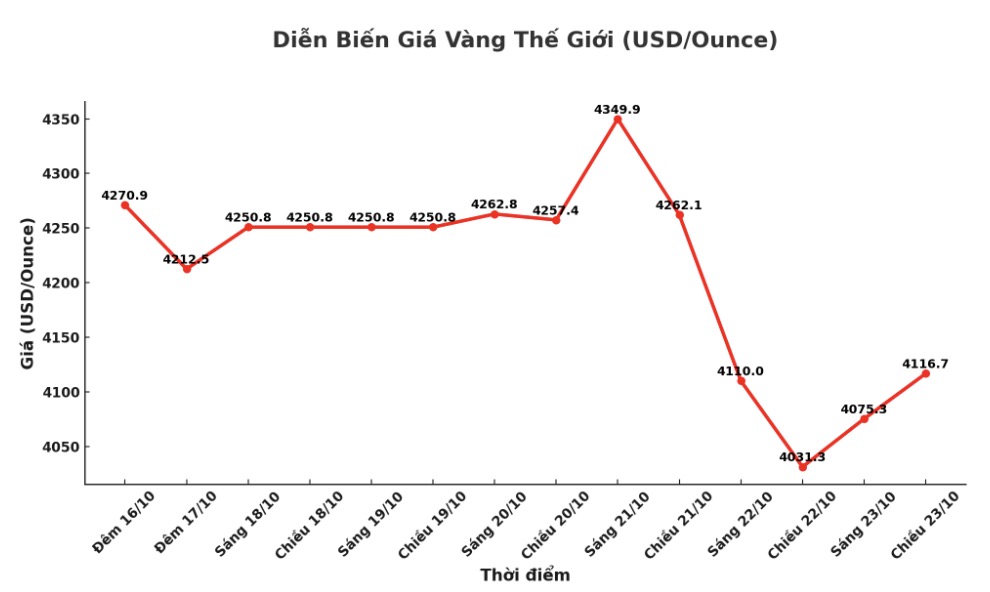

Investors are looking for a solution to the biggest drop in years for gold and silver on Tuesday, but according to one expert, there is no need for any "consensus", the previous skyrocketing increase is a big enough reason.

In the latest report, Ms. Nicky Shiels - Head of Metallurgy Research and Strategy at PAMP Agency - pointed out that the gold market took only 30 weeks to increase from $3,000 to $4,000/ounce.

Previous $1,000 rally cycles took more than 10 times as long (from about 240 to 650 weeks), she said. Current prices are extremely high, the momentum is mature, and any unreasonable market can plummet without a clear reason.

Regarding the scale of the sell-off on Tuesday, Ms. Shiels said that SPDR Gold Shares (NYSE: GLD) has recorded a discount of four standard deviations - an event with a probability of only occurring once in 63 years.

Although gold is still under technical selling pressure after the shock, the market is currently holding the initial support level above $4,000/ounce. The latest spot gold price was at 4,030 USD/ounce, down more than 2% on the day.

Ms. Shiels said that after this fluctuation, it may take more time than expected for precious metals to regain stability. However, it is too early to conclude whether this is a market c crash or just a short-term correction.

According to her, in previous declines, gold and silver were often supported by investors' "buy when prices drop". But the current situation is different, when gold prices are at $4,000/ounce.

Gold is no longer an asset with fluctuations below 20%, but around 30%, which has become a resistance for capital flows seeking asset preservation, said Ms. Shiels. Investors will have to tighten risk limits, causing liquidity in the market to narrow.

Despite the uncertainty, Ms. Shiels expects gold prices to remain stable in the range of 4,000 - 4,500 USD/ounce in the short term.

The accumulation period after Liberation Day, when gold prices fluctuated within the range of 3,100 - 3,400 USD/ounce for the past 5 months of the summer, is the model that gold and silver should aim for today: a stable price range of 4,000 - 4,500 USD/ounce (equivalent to new 3,100 - 3,400 USD and 45 - 50 USD/ounce for silver ("new 35 - 40 USD), helping the market have time to breathe, liquidity and risk appetite return, while establishing a more reasonable value level - she emphasized.

See more news related to gold prices HERE...