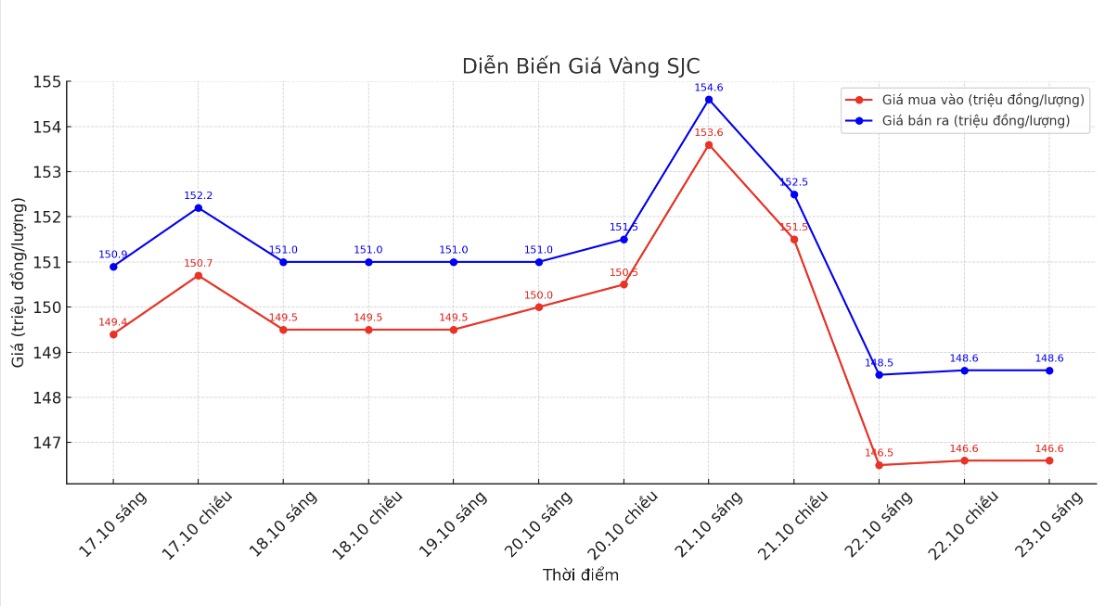

Updated SJC gold price

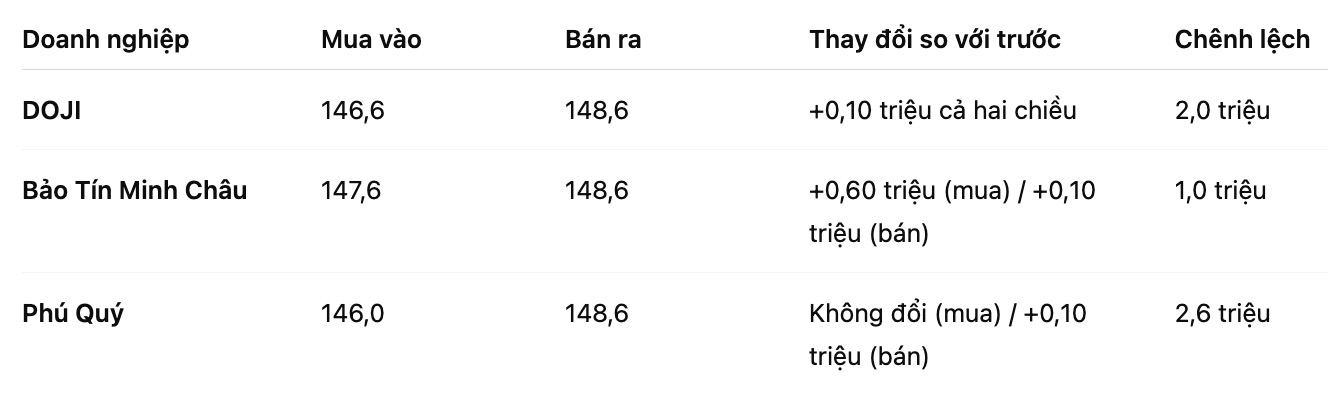

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at 146.6-148.6 million VND/tael (buy in - sell out), an increase of 100,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.6-148.6 million VND/tael (buy - sell), an increase of 600,000 VND/tael for buying and an increase of 100,000 VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 146-148.6 million VND/tael (buy - sell), keeping the same for buying and increasing by 100,000 VND/tael for selling. The difference between buying and selling prices is at 2.6 million VND/tael.

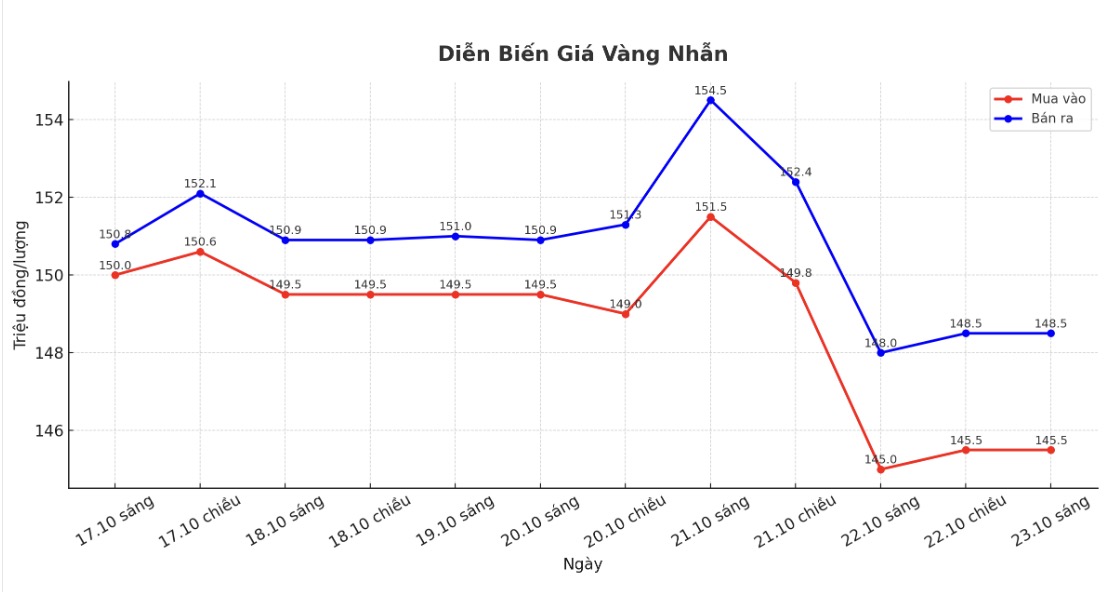

9999 round gold ring price

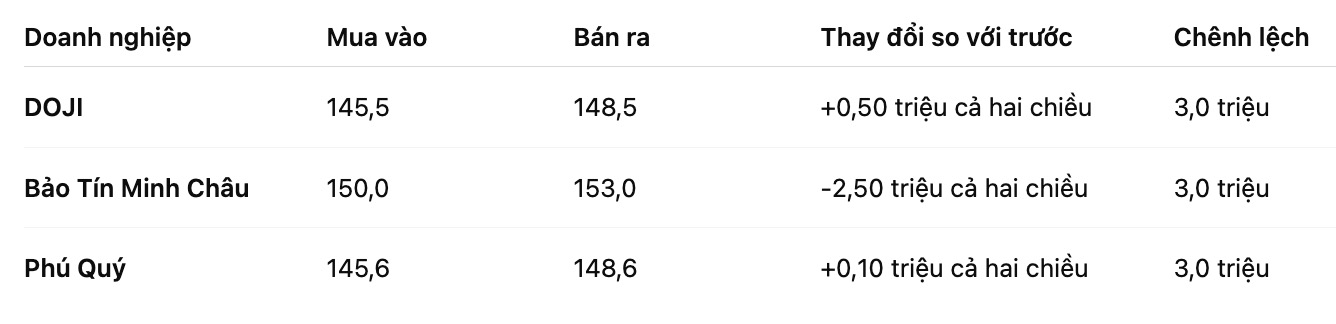

As of 9:00 a.m., DOJI Group listed the price of gold rings at 145.5-148.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 2.5 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.6-148.6 million VND/tael (buy - sell), an increase of 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

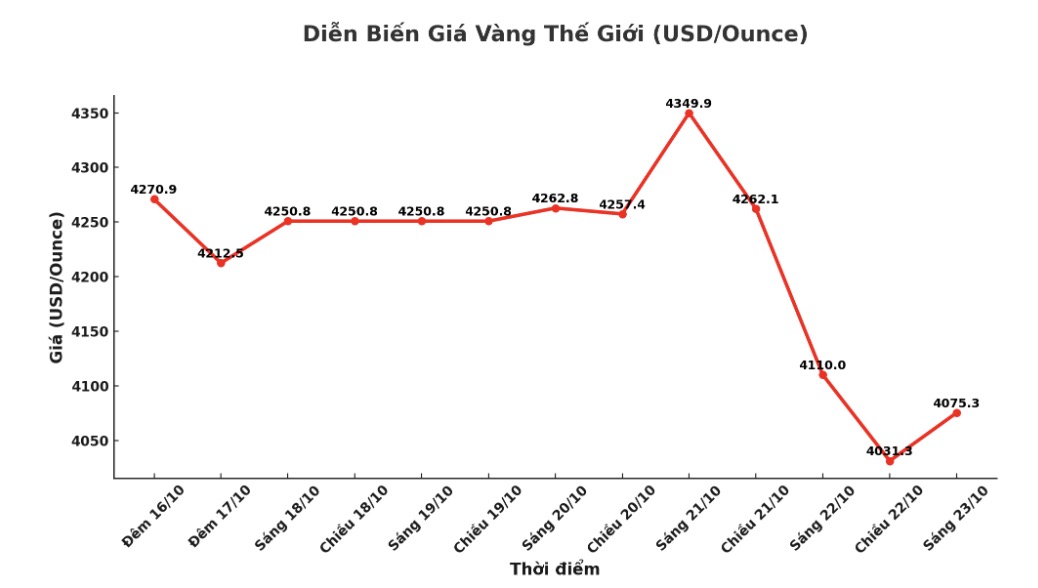

World gold price

At 9:00 a.m., the world gold price was listed around 4,075.3 USD/ounce, down 34.7 USD.

Gold price forecast

Gold and silver prices continued to struggle after a huge sell-off on Tuesday. These two metals witnessed the sharpest decline in the past 4-5 years.

According to analysts, the extreme fluctuations in the middle of the week have attracted investors' attention more closely, because if the liquidity imbalance continues, it can disrupt market creation activities, even spreading to other goods due to the widespread instability.

Mr. Jim Wyckoff - senior analyst at Kitco, the sharp declines in gold and silver due to concerns about the increase have gone too far and too fast.

Despite the sharp decline, according to market analyst Robert Minter - Director of ETF Investment Strategy at abrdn, the fundamental factors that have pushed the price of precious metals up have not changed.

In a recent interview with the press, Mr. Minter said that the recent sell-off, although dramatic, helped the gold and silver markets escape the state of "excessive buying".

If you liked gold and silver when prices were unsustainable last week, now you have to love them even more, because the market has become healthier, he said.

Technically, the buying power of bulls in the December gold futures market is weakening rapidly. The next upside target for buyers is to close above the strong resistance zone of 4,200 USD/ounce. In contrast, the short-term target for the bears is to pull prices below the important technical support zone of $3,900/ounce.

The first resistance zone was at $4,100 and then the night peak was $4,175. The nearest support zone is 4,021.2 USD and next is the psychological mark of 4,000 USD.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...