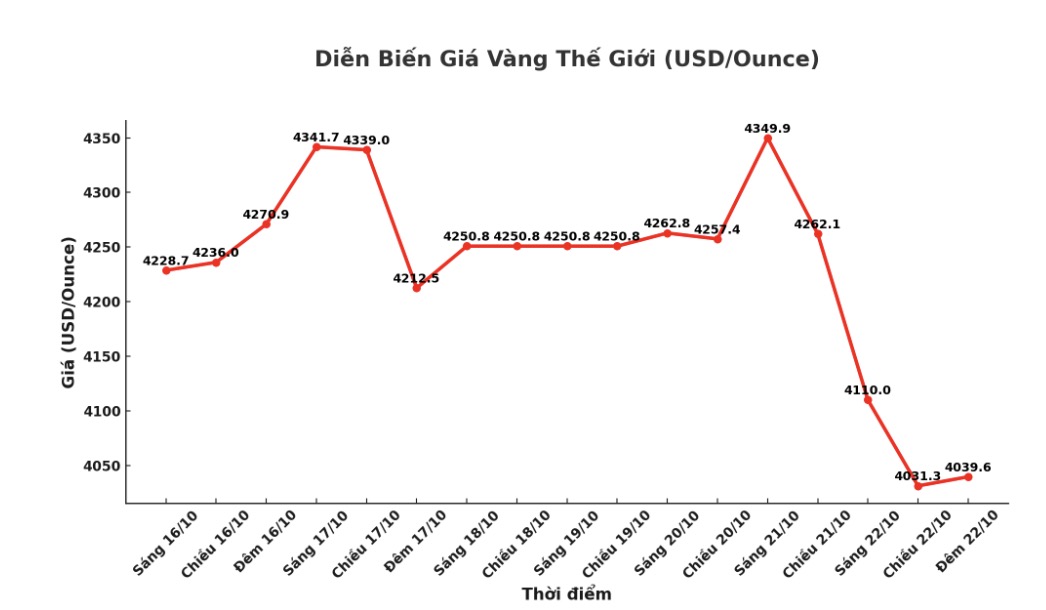

Gold and silver prices are under pressure, extending the strong sell-off momentum from yesterday (October 22) - the price decline has caused the entire financial market to pay attention.

Increased risk-off sentiment this week also put pressure on the two safe-haven metals. US stock indexes have recovered and approached the most recent record peak.

December gold contract fell 77.1 USD to 4,031.50 USD/ounce, while December silver contract fell 0.31 USD to 47.38 USD/ounce.

According to Jim Wyckoff - senior analyst at Kitco, the sharp declines in gold and silver are attracting special attention from the market. In last night's session, the two precious metals continued to fall sharply after recording their worst decline in many years on Tuesday, due to concerns that the increase had gone too far and too fast.

At one point yesterday, gold futures lost more than $250 an ounce, while silver fell more than $3.50 an ounce. According to analysts, the extreme fluctuations in the middle of the week have attracted investors' attention more closely, because if the liquidity imbalance continues, it can disrupt market creation activities, even spreading to other goods due to the widespread instability.

In the international market, global stocks fluctuated in different directions. US stock indexes are forecast to open for differentiation when the New York session begins.

Meanwhile, the US government is entering its 22nd day of closure, becoming the second longest in history, as the two parties remain stuck on the issue of expiring health benefits.

"The Senate Democratic leader has offered to meet US President Donald Trump before his trip to Asia this week, but Trump said he will only talk after the government reopens," said Jim Wyckoff.

The prolonged closure is getting worse, as a wave of federal civil servants prepare to miss their first payroll on Friday. Bloomberg said that the meeting between Trump and Republicans on Tuesday only reinforced the party's tough stance in refusing to negotiate, while the Democrats asked the Congress to approve a support package to reduce the burden of increasing health insurance fees.

World crude oil prices have stabilized after reports that India may reduce oil imports from Russia. WTI oil contract for December delivery on Nymex exchange this morning was trading around 58 USD/barrel, up about 0.8 USD compared to the previous session. The increased momentum comes from expectations that the US and India will soon reach a trade deal, in which India will gradually cut down on oil imports from Russia, helping to increase demand for alternative supplies.

President Trump said that Indian Prime Minister Narendra Modi has pledged to reduce Russian oil imports, while the Indian side only confirmed that there was a phone call without revealing details.

Technically, the buying power of bulls in the December gold futures market is weakening rapidly. The next upside target for buyers is to close above the strong resistance zone of 4,200 USD/ounce. In contrast, the short-term target for the bears is to pull prices below the important technical support zone of $3,900/ounce.

The first resistance zone was at $4,100 and then the night peak was $4,175. The nearest support zone is 4,021.20 USD and next is the psychological mark of 4,000 USD.

In other markets, the USD index increased slightly; the yield on the 10-year US Treasury note is at 3.95%.

Note: The gold market operates under two main mechanisms including the spot market - where prices reflect spot buying and selling transactions, and the futures market (futures) - where prices are set for future delivery transactions.

Due to liquidity factors and year-end position, the December gold contract is currently the most actively traded contract on the CME exchange.