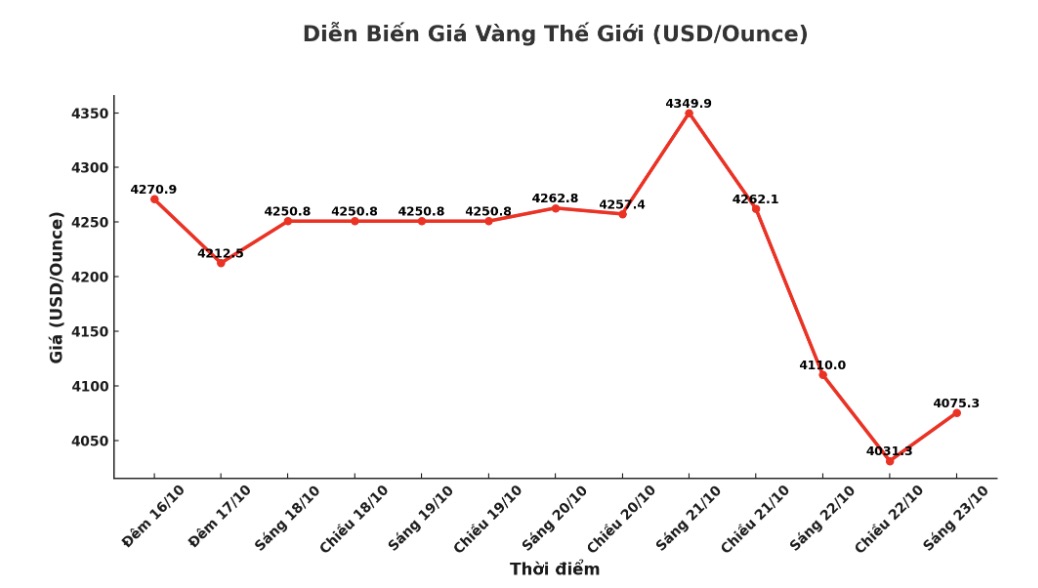

Gold and silver prices are undergoing an on time correction, with the stronger decline in silver clearly showing the liquidity gap between the two metals. However, according to Ole Hansen - Head of Commodity Strategy at Saxo Bank, both precious metals are still "iding" in investors' portfolios, and the underlying factors driving the increase have not changed.

The risk of an adjustment in gold and silver has increased in recent days, although strong demand before the Diwali has somewhat supported prices, Hansen said.

However, a prolonged technical rally, combined with a return to risk-off sentiment in the stock market, a stronger US dollar and a period of Diwali a period that often marks a weakening of physical demand from Asia has made traders more cautious, focusing on protecting profits rather than chasing new peaks, the expert said.

The underlying cause for Monday's deep decline is unknown, but gold's three failures to surpass $4,380 an ounce may have moved market sentiment from greed to fear, he said.

After that, the market saw a classic escape when the exit was too narrow to withstand the massive sell-off by traders using leverage and recent buyers falling into a state of loss, Hansen said. He said that silver has liquidity nine times lower than gold, so price fluctuations are often amplified both up and down.

After its strongest decline in many years, gold and silver recovered slightly in the Asian session.

This strong correction shows that the market has been overly One-sided, leading to a natural reset after a series of nine consecutive weeks of increase, in which gold prices increased by 31% and silver increased by 45%, Hansen said.

He added that in addition to the impact of a strong US dollar, the main factor causing the price adjustment is weak demand from India after Diwali. Silver rebounded from the $47.8 support zone, while gold was bought strongly above $4,000/ounce.

He said that this adjustment is necessary to avoid the formation of a "bubble" that could break more strongly later.

For silver, Hansen noted that the market is monitoring a US Section 232 investigation into the import of essential minerals, including silver, platinum and palladieu - a decision that could change the supply chain and short-term prices.

If the US does not impose tariffs, the amount of metals in the US could flow to Europe, reducing the shortage in London and narrowing the price gap between the two markets. Conversely, if there is a tax, metals in the US will become "stuck", causing a further shortage in the London market and silver prices can quickly return, even surpassing recent peaks, due to the phenomenon of temporary supply tightening - price squeeze rather than real demand".

Saxo Bank remains optimistic about gold and silver until 2026. After the necessary adjustment period, investors will realise that the factors driving this years record gains have not disappeared. Gold and silver are no longer overbought, but are still held in shortage in the portfolio, Hansen concluded.

In the short term, he said that meetings between US leaders with China and Russia - if they take place - will be key events that could affect the length of the current adjustment.

See more news related to gold prices HERE...