Not only profit-taking, the strengthening USD also puts pressure on the entire group of precious metals, as the market waits for important US jobs data to be released this week.

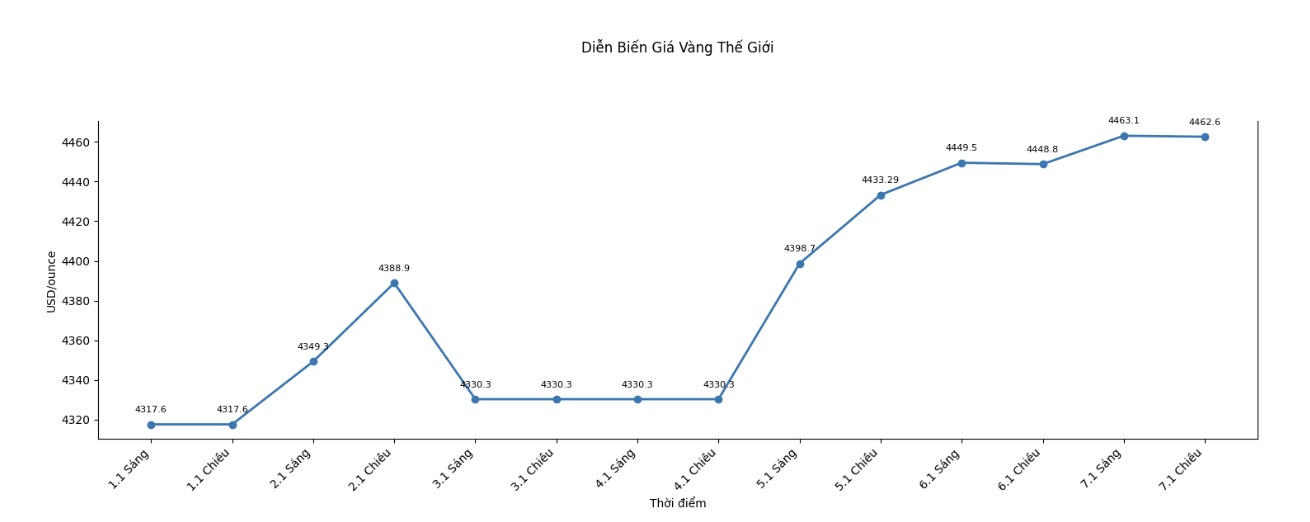

Spot gold fell 1.1% to 4,449.38 USD/ounce at 7:15 GMT (ie 14:15 Vietnam time). Previously, this precious metal once reached a record high of 4,549.71 USD/ounce on Monday last week.

US gold futures for February delivery fell 0.8% to 4,460.50 USD/ounce.

According to Mr. Kyle Rodda - senior financial market analyst at Capital.com, gold prices are currently "not too much affected by fundamental factors, but mainly due to speculative activity... the price trend in general still leans towards increasing, but two-way fluctuations are appearing".

He added that the USD is also contributing to putting pressure on gold prices.

The greenback remained near its highest level in more than two weeks, making USD-denominated assets more expensive for investors holding other currencies.

Investors currently expect the US Federal Reserve (Fed) to cut interest rates at least twice this year, and closely monitor the US non-farm employment report released on Friday to find more clues about policy orientation. Previously, JOLTS and ADP data on private sector employment released on Wednesday could also affect market sentiment.

Fed Governor Stephen Miran - who will end his term at the end of this month - said on Tuesday that the US needs to cut interest rates sharply to maintain the growth momentum of the economy.

Non-profit assets such as gold often perform well in low-interest environments and during periods of geopolitical or economic instability.

Geopolitically, Caracas and Washington have reached an agreement allowing a maximum of 2 billion USD of Venezuelan crude oil to be exported to the US.

In other precious metals, spot silver fell 2.5% to 79.27 USD/ounce, from a historic peak of 83.62 USD/ounce reached on December 29.

Platinum fell sharply by 6.2% to $2,291.24/ounce, far behind the record high of $2,478.50/ounce recorded on Monday last week, although it had previously increased by more than 3% in the session.

Palladium also decreased by 4.7%, trading at $1,736.93/ounce.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.