Gold prices increased in the trading session on Thursday, as new US sanctions against Russia and the possibility of issuing additional export control measures against China increased geopolitical risks, while investors waited for important US inflation data this week to find more signals on the interest rate roadmap.

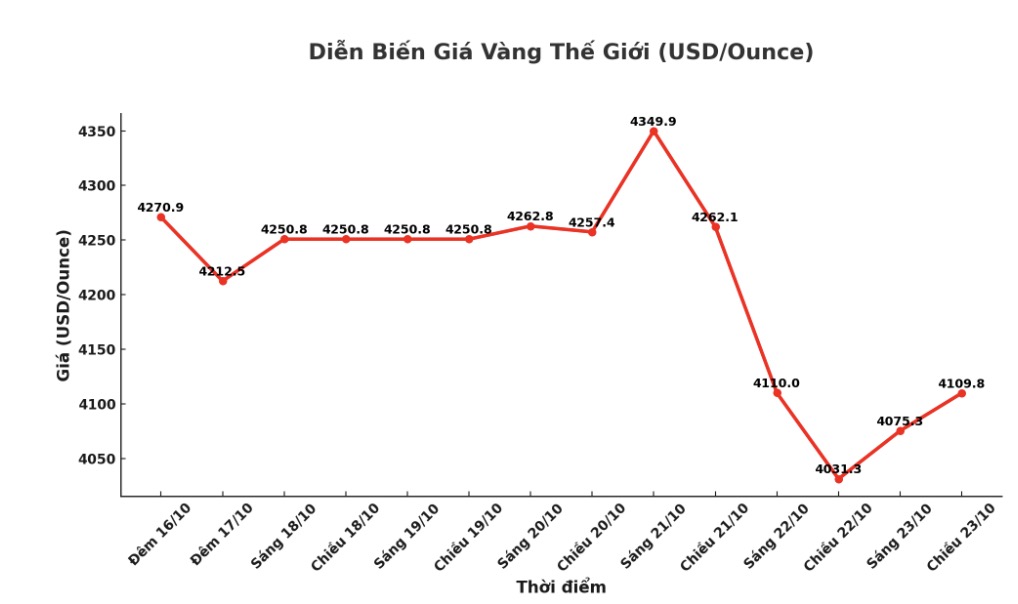

Spot gold increased by 0.7%, to 4,123.39 USD/ounce at 06 27 GMT, while December gold futures in the US increased by 1.8%, reaching 4,138.10 USD/ounce.

The Trump administration is considering a plan to limit a range of high-tech exports to China - from laptops to rocket engines - in response to Beijing's expansion of control of rare earth exports in the latest measure.

In another development, US President Donald Trump has imposed sanctions on Russia - the first of his second term - targeting major oil and gas corporations such as Lukoil and Rosneft.

Mr. Brian Lan - CEO of Gold Silver Central, commented: "In the long term, the outlook for gold prices is still positive, but in the short term, investors need to be cautious because the fluctuations are at a very large level."

The focus this week is the US Consumer Price Index (CPI) report, due out on Friday after being delayed due to government shutdowns. The report is expected to show core inflation remaining at 3.1% in September.

Investors have almost completely priced in the possibility of the US Federal Reserve (FED) cutting interest rates by another 25 basis points at its meeting next week.

Gold often tends to increase in a low interest rate environment, due to the opportunity cost of holding non-yielding assets such as gold decreasing.

Mr. Mark Haefele - global investment director of UBS, commented in a report: "We continue to consider gold as an effective portfolio diversification tool, and the next increase to about 4,700 USD/ounce is completely possible if there are adverse factors in the macro economy or politics."

Gold prices have risen about 57% since the beginning of the year, hitting an all-time record of $4,381.21/ounce on Monday, supported by geopolitical and economic uncertainty, expectations of a Fed rate cut, and persistent buying from central banks.

In other precious metals, spot silver rose 1.2% to $49.10 an ounce, while platinum fell 1.1% to $1,603.70 an ounce, and palladium lost 0.9%, to $1,445.4 an ounce.

See more news related to gold prices HERE...