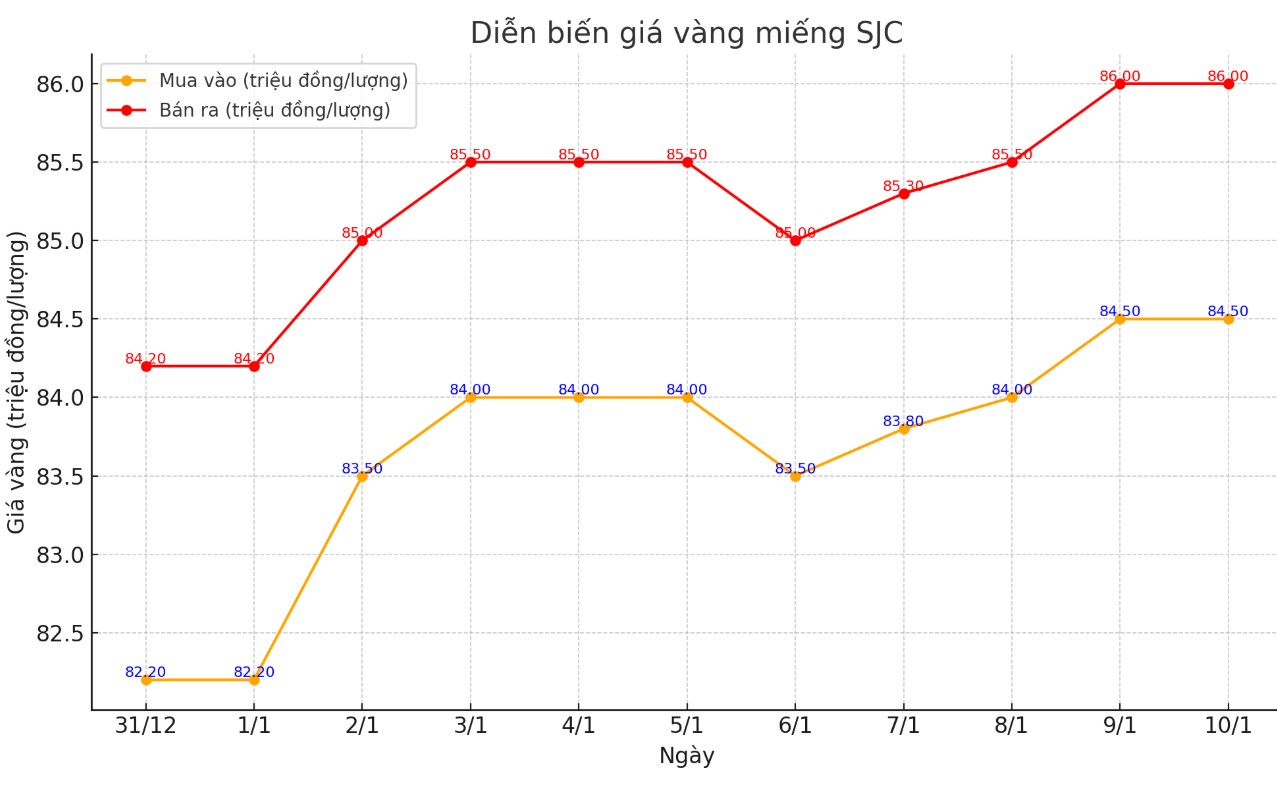

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.5-86 million/tael (buy - sell); an increase of VND500,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.5-86 million VND/tael (buy - sell); an increase of 500,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.7-86 million VND/tael (buy - sell); increased 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.3 million VND/tael.

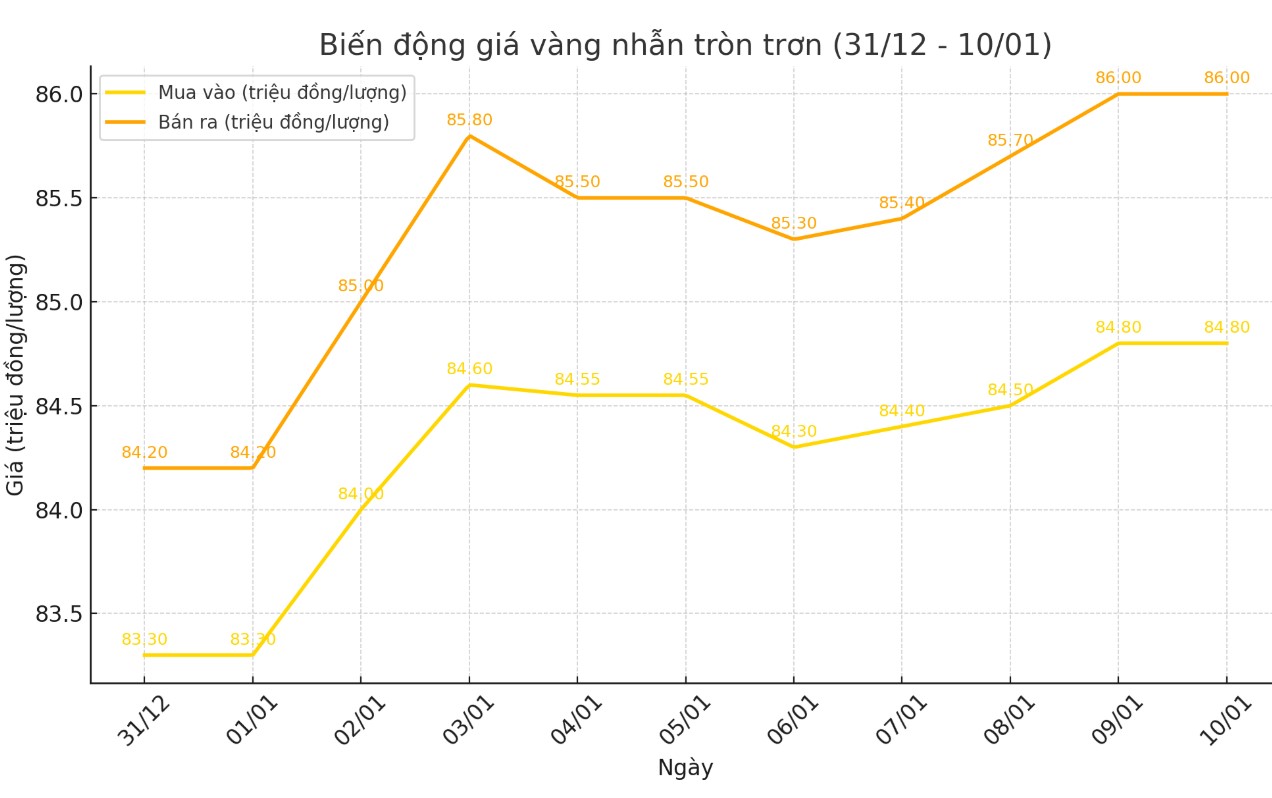

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.8-86 million VND/tael (buy - sell); an increase of 300,000 VND/tael for both buying and selling compared to the beginning of the trading session yesterday afternoon.

Bao Tin Minh Chau listed the price of gold rings at 84.9-86.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and 300,000 VND/tael for selling compared to the beginning of the trading session yesterday afternoon.

World gold price

As of 1:30 a.m. on January 10 (Vietnam time), the world gold price listed on Kitco was at 2,670.9 USD/ounce, up 13.9 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold Price Forecast

World gold prices increased despite the USD's increase. Recorded at 1:30 a.m. on January 10, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 109 points (up 0.06%).

Gold prices rose on safe-haven demand amid the UK budget crisis. Gold futures for February delivery rose $14.60 to $2,687.10 an ounce.

UK financial markets plunged overnight as concerns grew about the government's budget deficit, sending the pound to its lowest level in more than a year against the dollar.

The yield on 10-year UK government bonds rose to 4.92%, and the FTSE 250 index fell for a third consecutive day. This situation is being closely watched by global markets, with concerns about the risk of financial contagion.

In the United States, the government and stock markets were closed to honor former President Jimmy Carter. Other U.S. markets were open as usual or with reduced trading hours.

The key U.S. economic data this week is the December jobs report, due Friday. The report is expected to show nonfarm payrolls rose by 160,000, compared to 227,000 in November.

Major peripheral markets today saw Nymex crude oil futures also rise slightly, trading around $74.00/barrel. The yield on 10-year US government bonds is currently around 4.6%.

Technically, the February gold bulls remain in command in the short term. The bulls’ next upside price objective is a close above solid resistance at $2,700/oz. The bears’ immediate downside price objective is a break below the November 2024 low technical support at $2,565/oz.

See more news related to gold prices HERE...