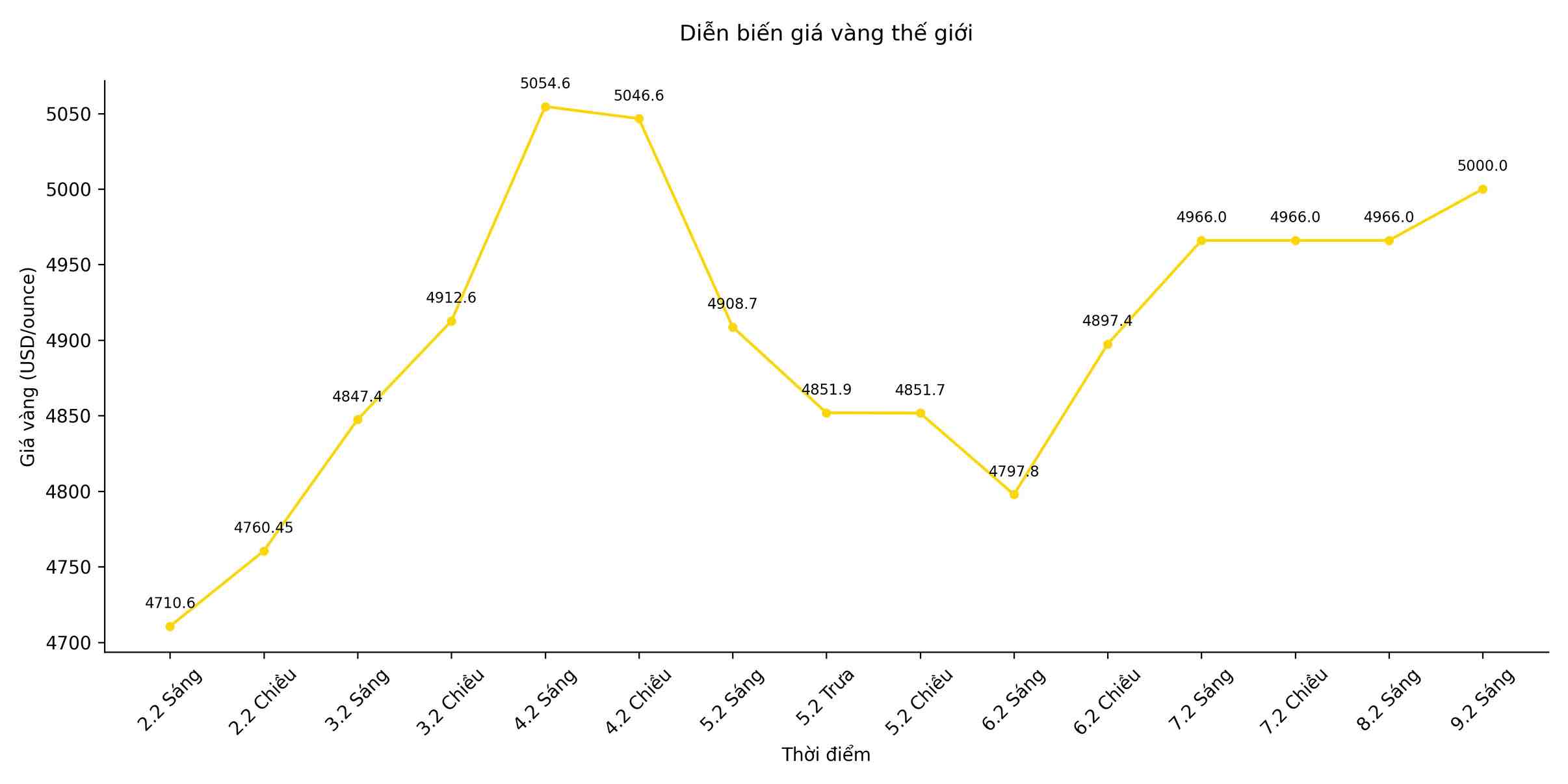

Gold prices exceeded the 5,000 USD/ounce mark as bottom-fishing buying power returned to the market after a rarely seen volatile week for the precious metal group.

In the early trading session, spot gold prices at one point increased by 1.7%, and were supported by the overwhelming victory in the election of incumbent Japanese Prime Minister Sanae Takaichi. This result strengthens expectations of a looser fiscal policy and prolonged pressure on the Yen - a factor that is often beneficial for gold when investors seek better value-saving channels. Silver prices also went up.

Previously, the precious metal had plummeted from historical peaks at the end of last month, after a record price increase that was assessed as too fast and too strong. As of the closing session on Friday, gold prices had decreased by about 11% compared to the all-time high set on January 29, but still increased by about 15% from the beginning of the year to date.

The multi-year-long rise of gold accelerated in January, as a strong speculative wave added momentum to the market, which was backed by increased geopolitical tensions and the return of "anti-devaluation trading". Accordingly, investors withdrew capital from government bonds and currencies to switch to tangible assets like gold. US Treasury Secretary Scott Bessent said that Chinese traders were one of the reasons behind the sharp fluctuations in gold prices last week.

Despite volatile trading for many sessions after a historic drop, gold prices have recovered about half of their decline. Many major banks such as Deutsche Bank AG and Goldman Sachs Group Inc. still place their confidence in gold's recovery prospects thanks to long-term supporting factors. Data released at the end of the week showed that the central bank of China bought more gold for the 15th consecutive month, emphasizing that official demand is still very persistent.

In the near future, traders will closely monitor US economic data to have more clues about the policy direction of the US Federal Reserve (Fed). The January jobs report scheduled to be released on Wednesday is expected to show signs of a return to stability in the labor market, while inflation data will be released on Friday.

The candidate nominated by President Donald Trump for the next Fed Chairman, Mr. Kevin Warsh, once expressed support for a new agreement between the US central bank and the Treasury Department that increased long-standing concerns about the Fed's independence.

In this morning's trading session, gold prices increased by 1.3% to 5,028.77 USD/ounce. Silver prices increased by 1.7% to 79.18 USD. Platinum and palladium also simultaneously went up. The Bloomberg Dollar Spot index, a measure of the strength of the USD, went sideways after falling 0.4% in the previous session.