Updated SJC gold price

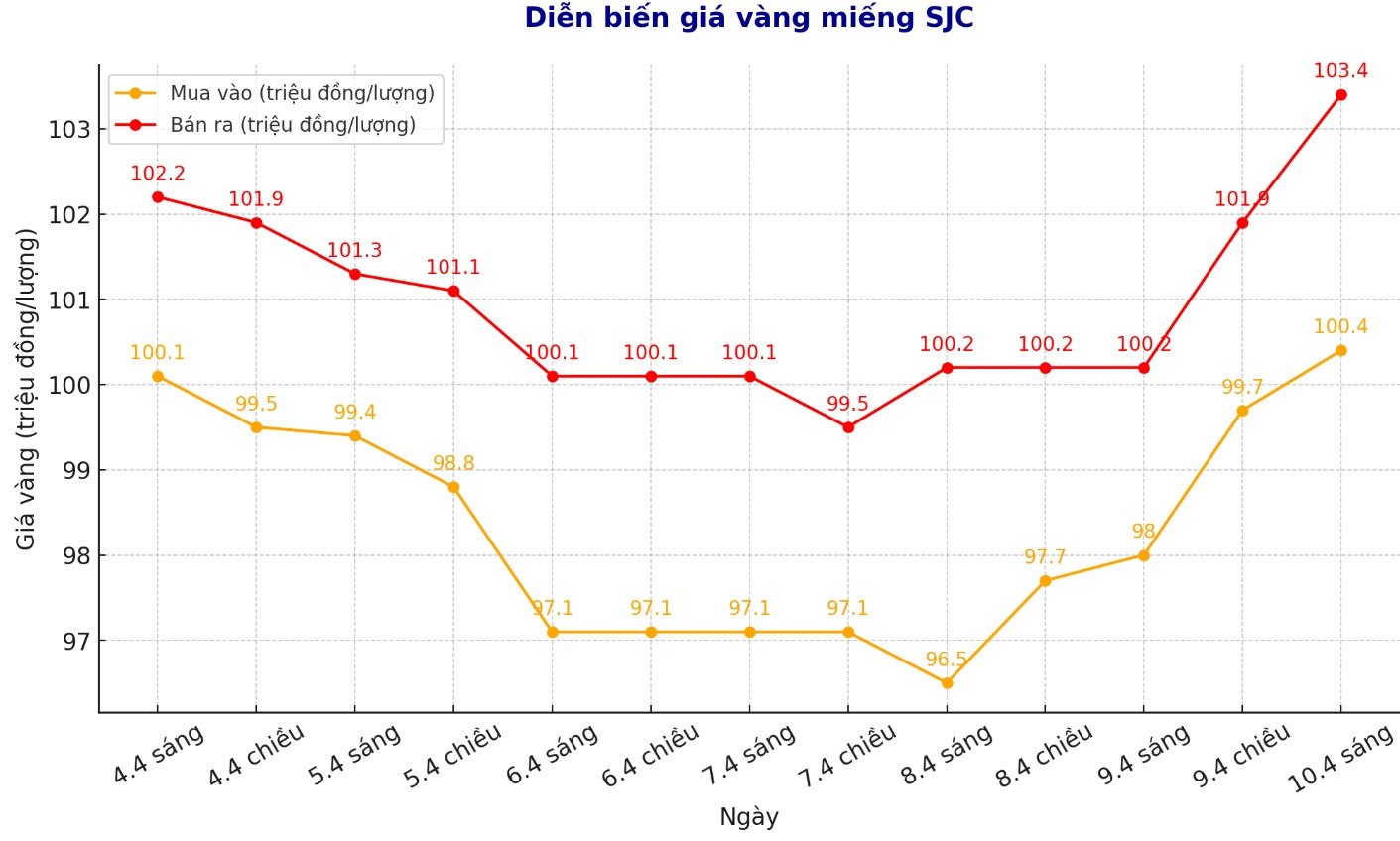

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 100.4-103.4 million VND/tael (buy - sell), an increase of 2.4 million VND/tael for buying and an increase of 3.2 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

At the same time, DOJI Group listed the price of SJC gold bars at VND100.14.103.4 million/tael (buy - sell), an increase of VND2.4 million/tael for buying and an increase of VND3.2 million/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 100.4-103.4 million VND/tael (buy - sell), an increase of 2.3 million VND/tael for buying and an increase of 3.2 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

9999 round gold ring price

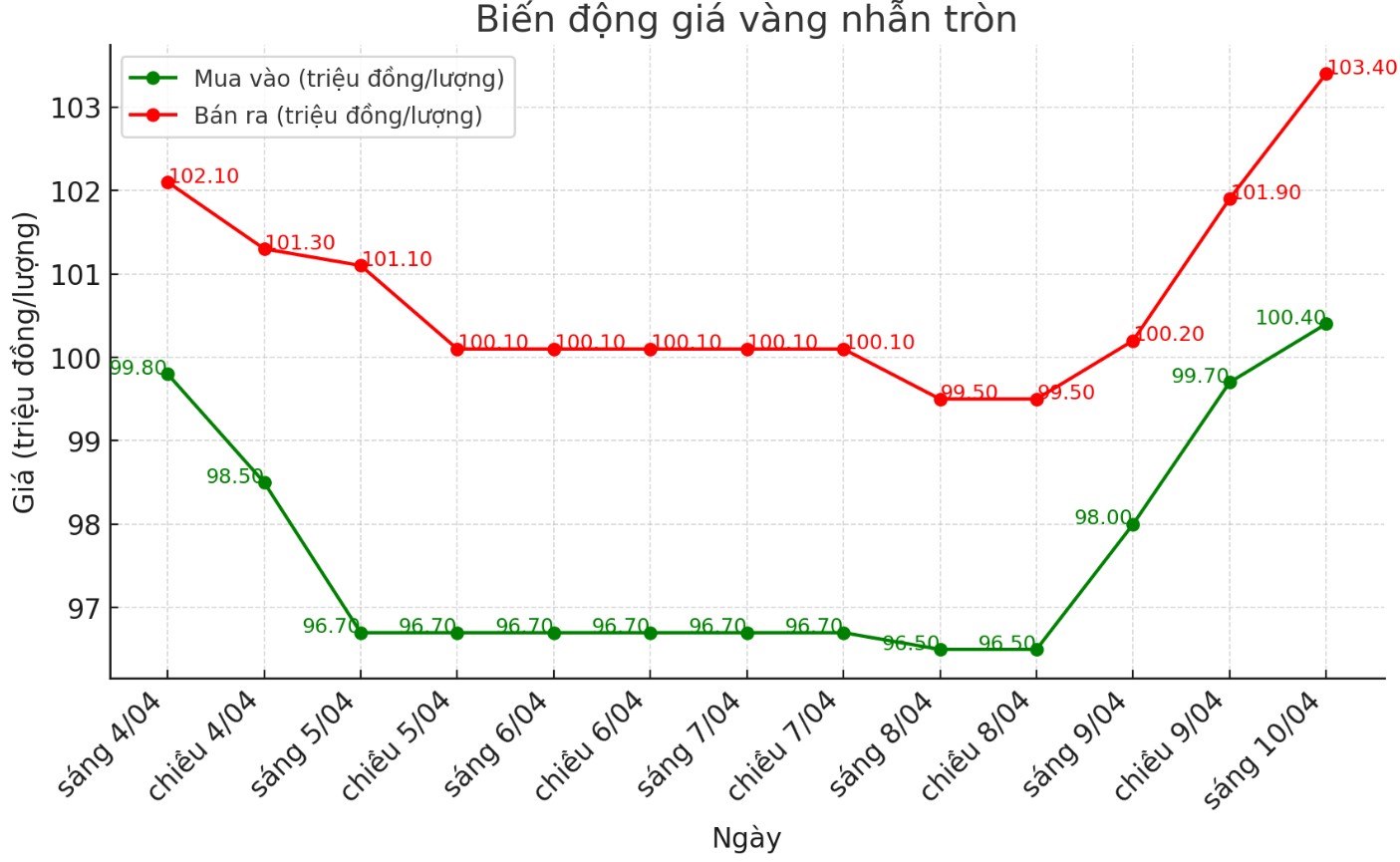

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 100.4-103.4 million VND/tael (buy - sell), an increase of 2.4 million VND/tael for buying and an increase of 3.2 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 100.5-103.5 million VND/tael (buy - sell), an increase of 2.2 million VND/tael for buying and an increase of 3.1 million VND/tael for selling. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase.

In the context of many fluctuations in the world gold market, the large difference between buying and selling in the domestic market is a clear warning sign. If gold prices turn down, buyers will face a huge loss. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

World gold price

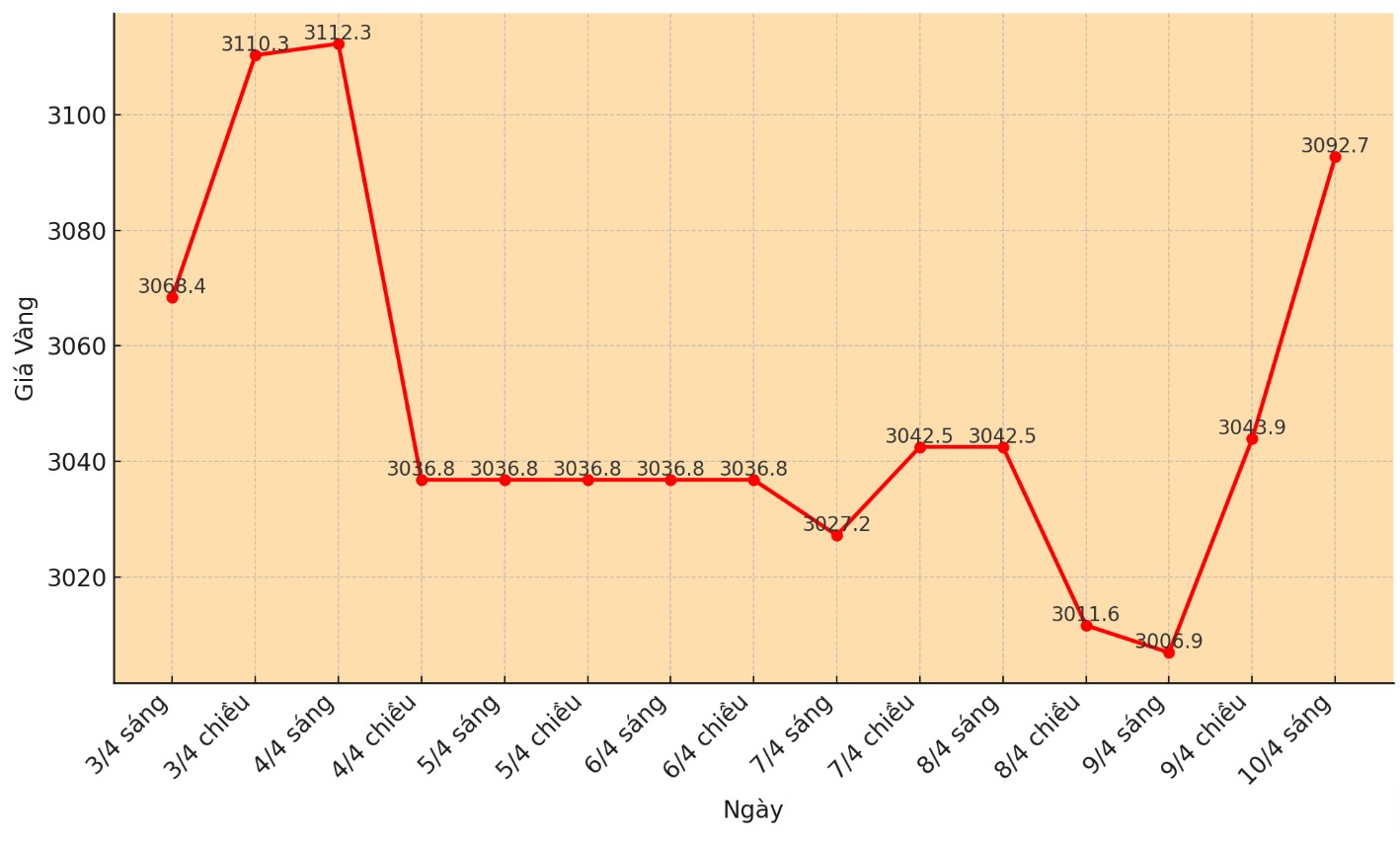

At 8:54, the world gold price listed on Kitco was around 3,092.7 USD/ounce, up 85.8 USD compared to the beginning of the trading session yesterday morning.

Gold price forecast

According to Kitco, the market witnessed a strong price increase. All assets affected in previous trading sessions increased sharply. This comes after news that US tariffs, apart from China, will be postponed for 90 days.

US President Donald Trump announced on social media at 1:30 p.m. on April 9 (local time) about the decision to postpone the 90-day tax because more than 75 trade partners have not paid and have contacted the US to "discuss" some of the issues he has raised.

Precious metals prices have increased sharply ahead of Mr. Trump's surprise announcement. Gold prices have risen more than 3% to a record high of $3,099 an ounce just before the news was released.

However, even as seeking shelter eased, gold fell $50 in a matter of minutes. The money flow into the market then quickly brought gold back to nearly $3,100/ounce at 3:40 EDT.

According to some analysts, gold is still in a strong uptrend and is not expected to face strong selling pressure, as some investors still want to keep assets safe even when market sentiment has improved.

The market is currently in an unprecedented situation, and traders will act quickly as new news continues to affect their sentiment. In this context, as concerns about the US economic downturn increase and the US Federal Reserve (FED) may cut interest rates four more times, demand for gold as a safe-haven asset may remain high," said Ricardo Evangelista, senior analyst at ActivTrades, in a note.

Minutes from the Fed's most recent meeting showed policymakers warned of the risk of high inflation and slowing growth. Investors are now waiting for the US consumer price index report on Thursday to clarify these warnings.

According to the FEDwatch tool, traders are pricing in a 55% chance of a Fed rate cut in May, which could support gold prices.

See more news related to gold prices HERE...