Update SJC gold price

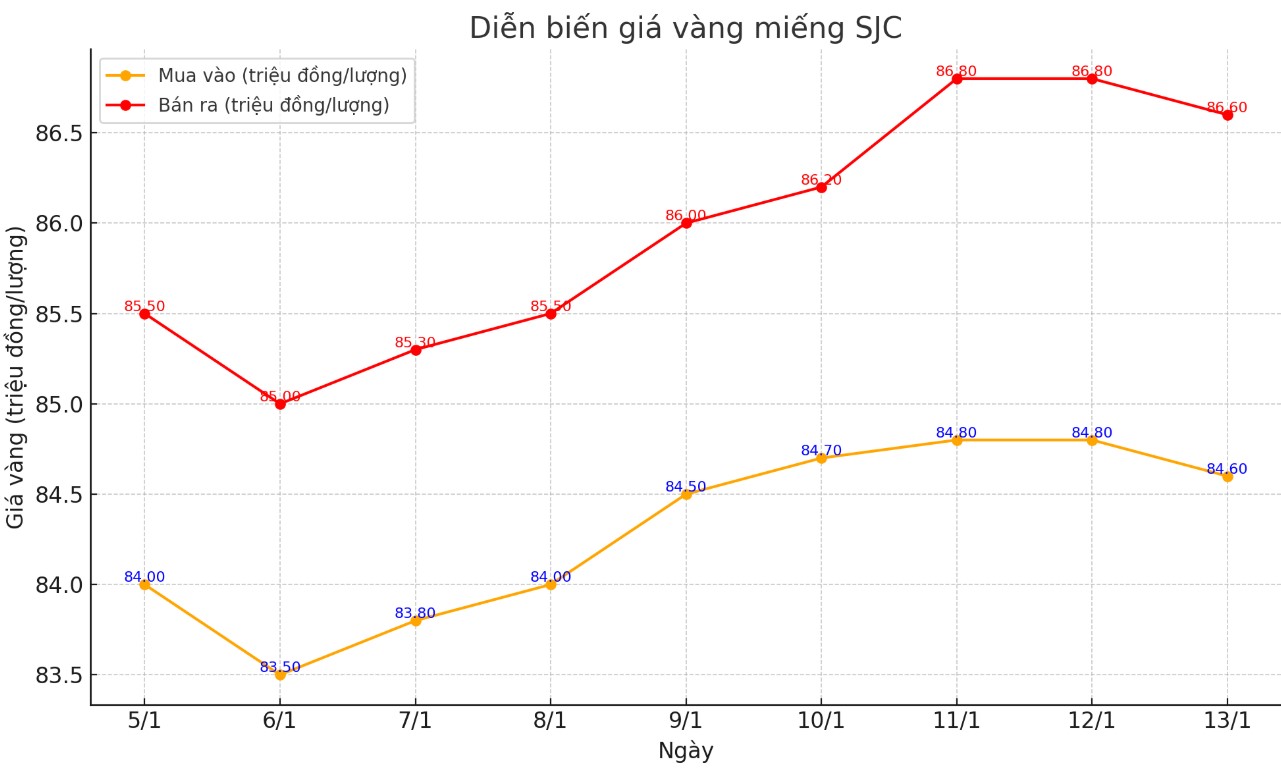

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84.6-86.6 million/tael (buy - sell); down VND200,000/tael for both selling and buying.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 84.6-86.6 million VND/tael (buy - sell); down 200,000 VND/tael for both selling and buying.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.8-86.8 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

Price of round gold ring 9999

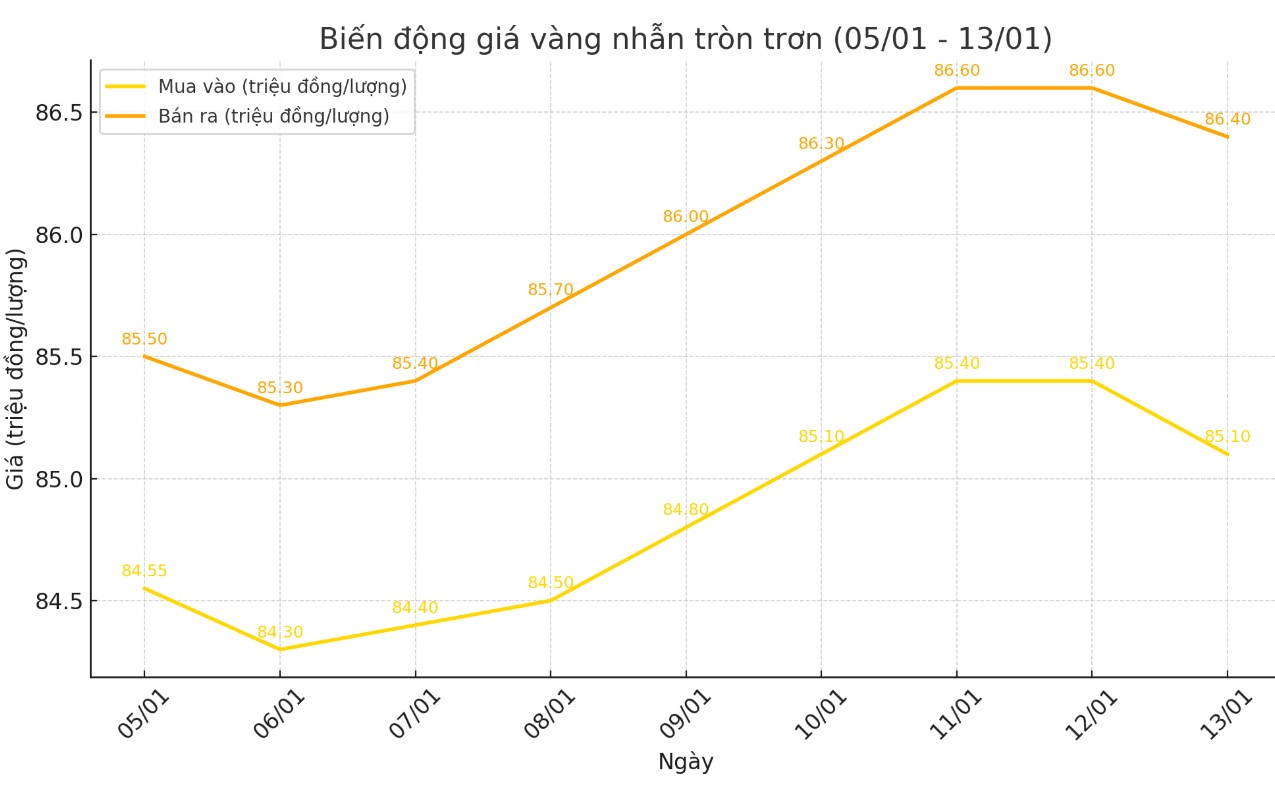

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.1-86.4 million VND/tael (buy - sell); down 300,000 VND/tael for buying and down 200,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 85.2-86.6 million VND/tael (buy - sell), down 500,000 VND/tael for buying and down 400,000 VND/tael for selling compared to early this morning.

World gold price

As of 8:50 a.m., the world gold price listed on Kitco was at 2,686.4 USD/ounce, down 6.6 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell slightly amid an increase in the US dollar. At 9:14 a.m. on January 13, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 109.510 points (up 0.02%).

According to Kitco - Financial markets experienced a sharp move last Friday, as both gold and the US dollar showed remarkable resilience, defying initial reactions to the US December non-farm payrolls report. Despite an initial sell-off, both assets closed higher, defying conventional market expectations.

The U.S. Labor Department reported that nonfarm payrolls rose by 256,000 in December, beating the median Reuters forecast of 160,000 and above November’s revised 227,000. The strong jobs data triggered a surprise reaction across a range of assets.

Gold's gains defied expectations of many traders who said such a strong jobs report would be bearish for the metal. That's because the data increased the odds that the Federal Reserve would not cut interest rates in January to 97.3%, with a 74% probability that the Fed will maintain the current federal funds rate between 4.25% and 4.5% at its March FOMC meeting.

However, by early this morning, the world gold market had shown signs of decline. It is worth noting that despite the fall in gold prices, many experts still gave very positive assessments of the precious metals market.

In an interview with Kitco News, Kathy Lien, Director of FX Strategy at BK Asset Management and co-founder of BKForex.com, said:

“I think the price action in gold reflects what is happening in the equity markets, where traders are worried about rising US bond yields and the implications for borrowing costs and economic growth. If the Fed doesn’t cut rates sooner this year, it will cause more pain later,” she said.

Although gold prices are expected to remain volatile in 2025 due to the impact of US monetary policy and demand for safe-haven assets, Ms. Lien said she is still looking for trading opportunities on the upside.

“Overall, I am bullish on gold this year and will look for buying opportunities rather than selling,” she said.

Meanwhile, Nitesh Shah, head of commodity and macroeconomic research at WisdomTree Europe, said gold is an excellent portfolio diversifier because it allows investors to improve returns while effectively controlling risk.

“36% of the 800 professional investors surveyed said diversification was the main reason they held gold. Our analysis shows that gold has a low correlation with both stocks and bonds, so it makes a strong contribution to diversification efforts,” the expert said.

See more news related to gold prices HERE...