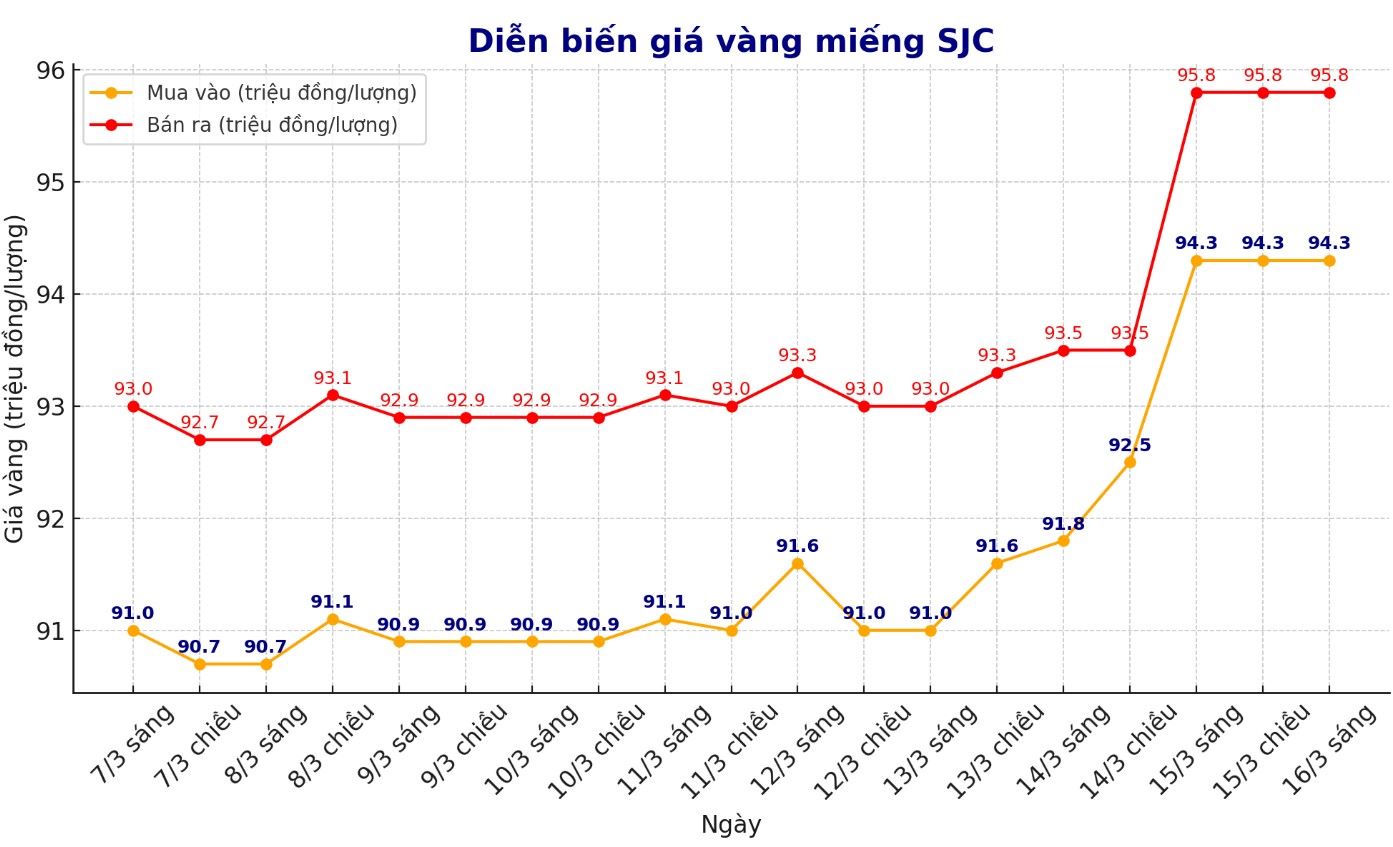

SJC gold bar price

At the end of the trading session of the week, DOJI Group listed the price of SJC gold at VND94.3-95.8 million/tael (buy in - sell out).

Compared to the closing price of last week's trading session (March 9, 2025), the price of SJC gold bars at DOJI increased by VND3.4 million/tael for buying and VND2.9 million/tael for selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 1.5 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at VND94.3-95.8 million/tael (buy in - sell out).

Compared to the closing price of last week's trading session (March 9, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by VND3.4 million/tael for buying and VND2.9 million/tael for selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company Group SJC is at 1.5 million VND/tael.

If buying SJC gold at DOJI Group and Saigon Jewelry Company SJC in the session of March 9 and selling it in today's session (March 16), gold buyers at DOJI Group and Saigon Jewelry Company SJC will both make a profit of 1.4 million VND/tael.

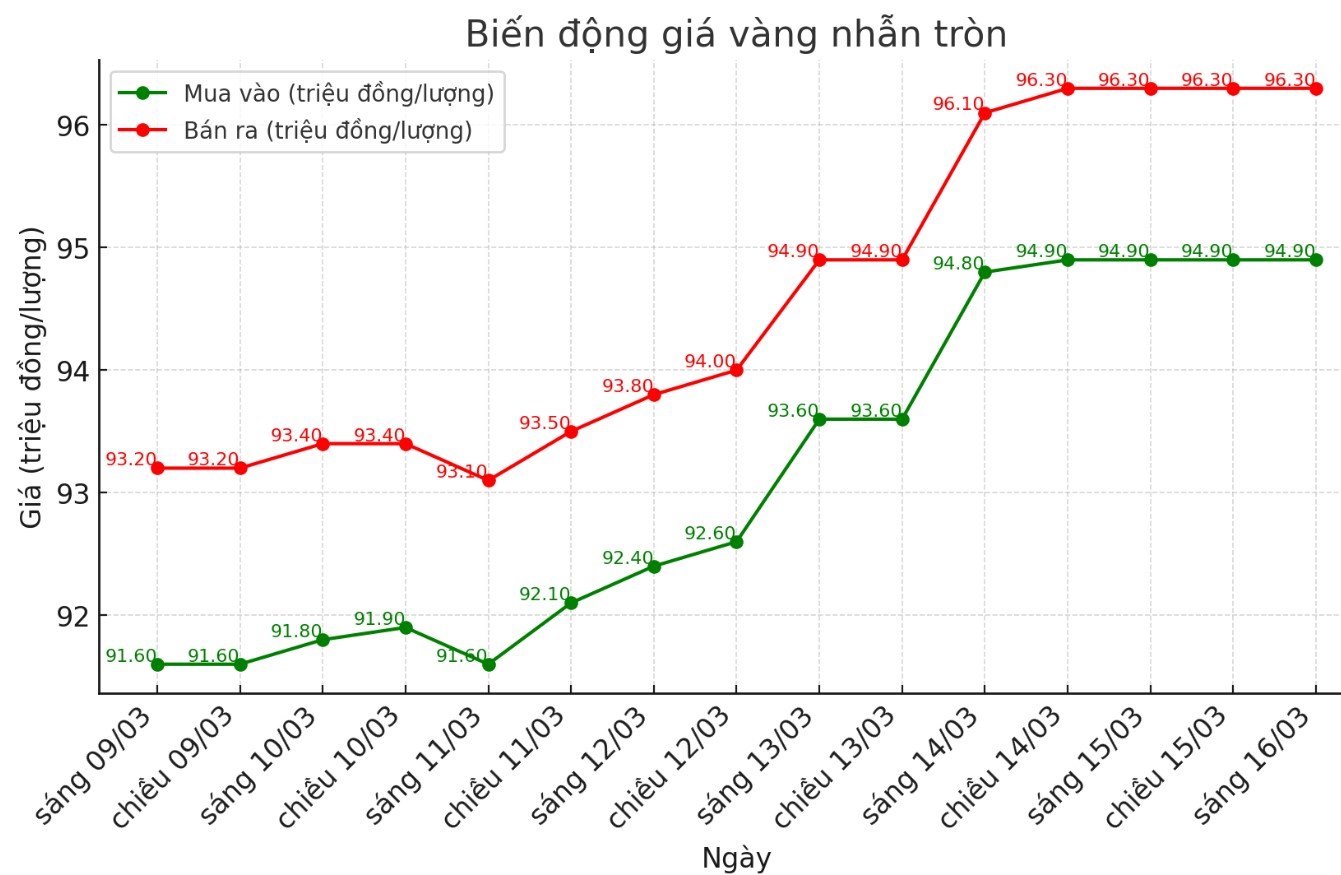

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at VND94.9-96.3 million/tael (buy - sell); an increase of VND3.3 million/tael for buying and an increase of VND3.1 million/tael for selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.4 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 95-96.6 million VND/tael (buy - sell); an increase of 3.3 million VND/tael for both buying and selling compared to the closing price of the previous trading session. The difference between buying and selling is at 1.6 million VND/tael.

If buying gold rings in the session of March 9 and selling in today's session (March 16), buyers at DOJI and Bao Tin Minh Chau will both earn a profit of 1.7 million VND/tael.

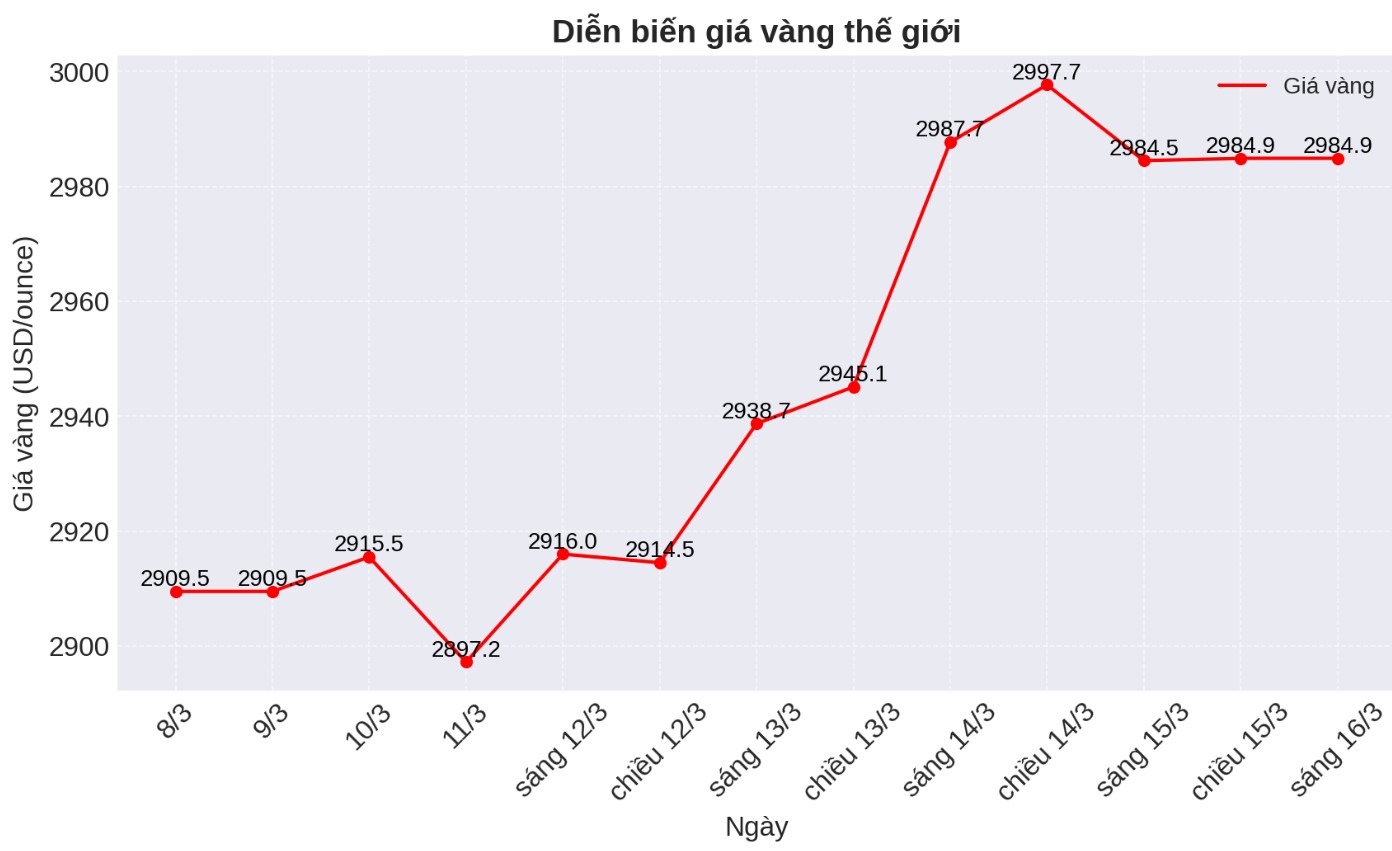

World gold price

At the end of the trading session of the week, the world gold price listed on Kitco was at 2,984.9 USD/ounce, up 75.4 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

World gold prices are anchored high in the context of the USD decreasing. Recorded at 8:30 a.m. on March 16, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 103.710 points (down 0.13%).

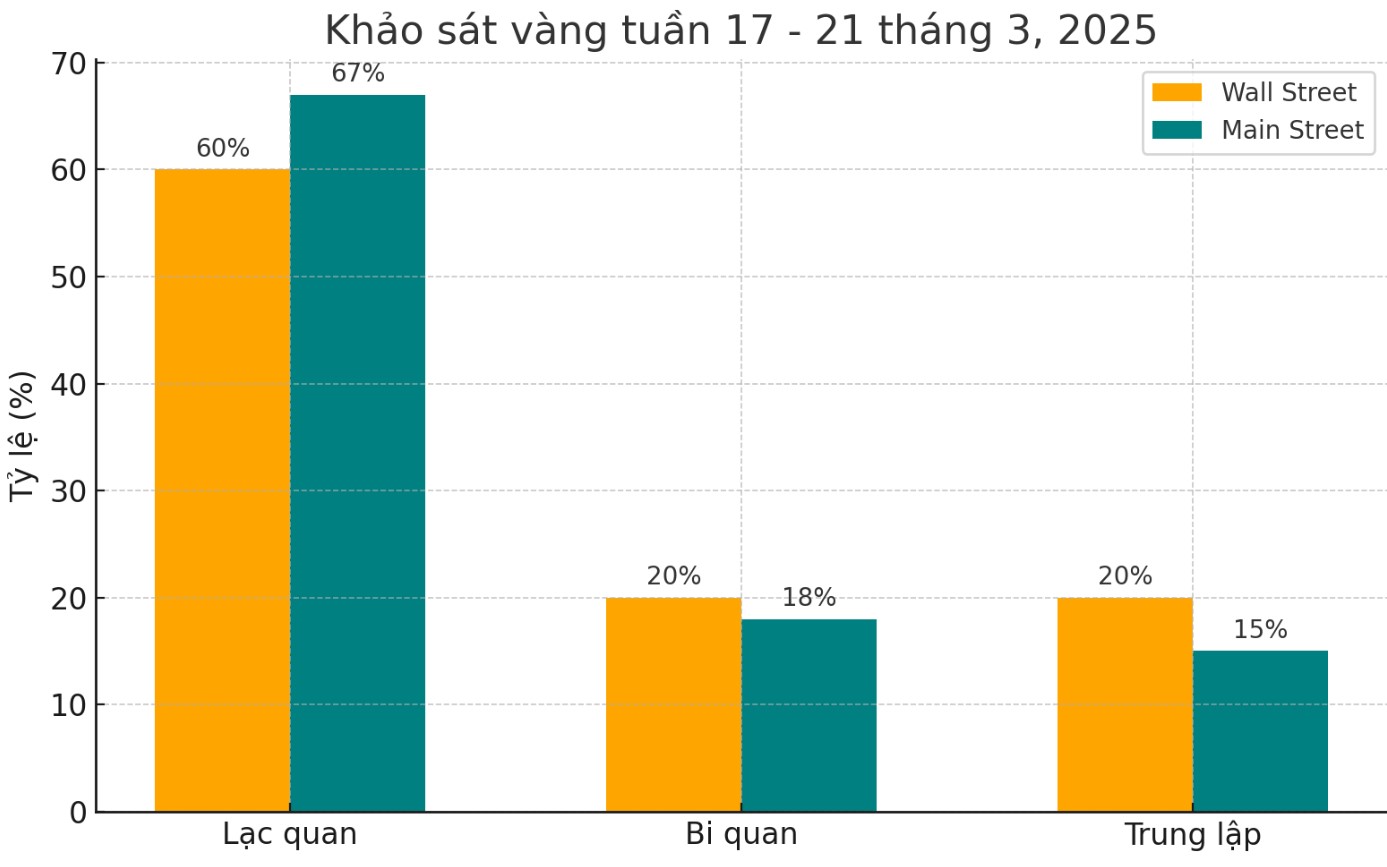

The latest weekly gold survey from Kitco News shows that optimism is still strong among experts and retail investors, despite record high prices. Most opinions predict that gold prices will continue to increase next week.

15 analysts participated in the Kitco News gold survey. Nine experts, or 60%, predict gold prices will continue to rise next week. Three analysts, or 20%, predict gold prices will fall. The remaining three experts see gold prices moving sideways.

Meanwhile, 262 people participated in Kitco's online survey, with investor sentiment almost unchanged from last week.

175 retail traders, or 67%, expect gold prices to surpass $3,000 next week. Meanwhile, another 47 people, accounting for 18%, predict gold prices will fall. The remaining 40 investors, accounting for 15% of the total, predict gold prices will move sideways in the coming days.

Adrian Day, chairman of Adrian Day Asset Management, commented: "Gold prices will increase. The central bank continues to buy strongly, and gold will surpass the $3,000/ounce mark. This round figure is not a barrier for foreign central banks or those who buy gold in their own currency.

Although US President Donald Trump may try to ease trade tensions and come up with a more concrete plan, concerns abroad remain. In addition, North American buyers are finally taking part in the gold buying trend, adding a source of demand that has been absent for the past two years," Day added.

Economic calendar affecting gold prices next week

Next week will be a volatile week for gold, as the market receives many important economic news.

Central banks continue to dominate the event schedule, with the Bank of Japan announcing the interest rate decision on Tuesday, followed by the US Federal Reserve (FED) on Wednesday and the Swiss National Bank and the Bank of England on Thursday.

In addition, many important US economic data will also be released, including Retail Sales and Empire State Production Index on Monday, Housing Construction Start-up and Construction Permit data on Tuesday. By Thursday, the market will monitor the Weekly Unemployment Report, available home sales and the FED Philadelphia Production Survey.

See more news related to gold prices HERE...