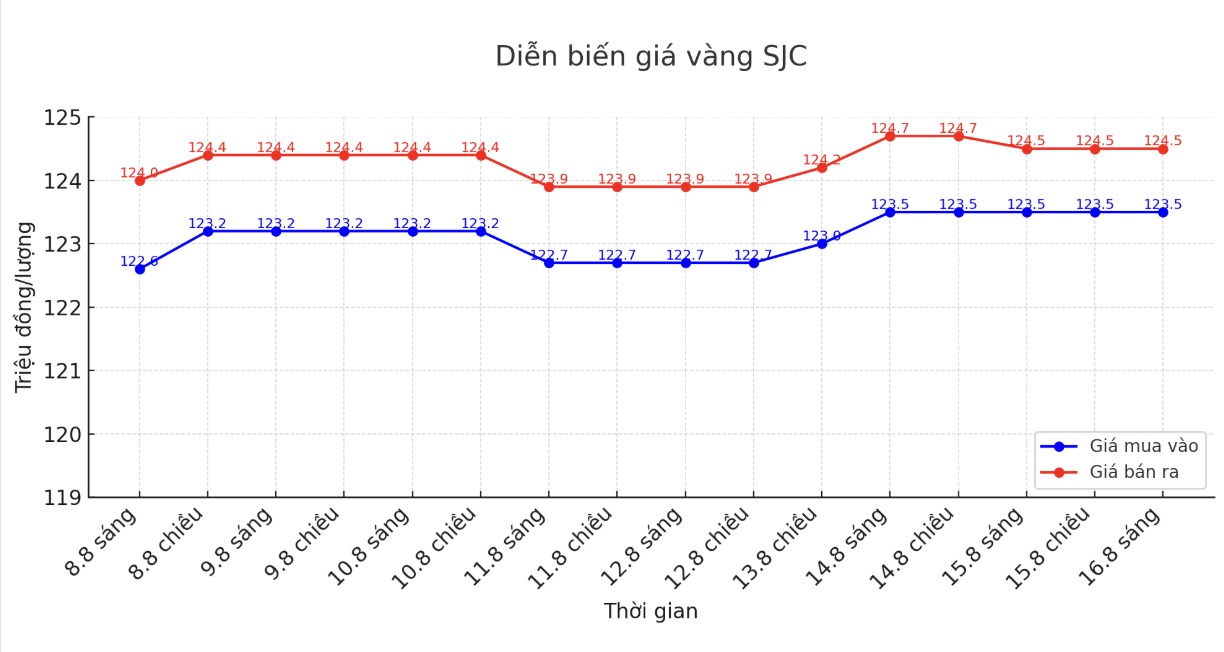

Updated SJC gold price

As of 9:15 a.m., the price of SJC gold bars was listed by DOJI Group at 123.5-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 123.5-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 122.7-124.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 1.8 million VND/tael.

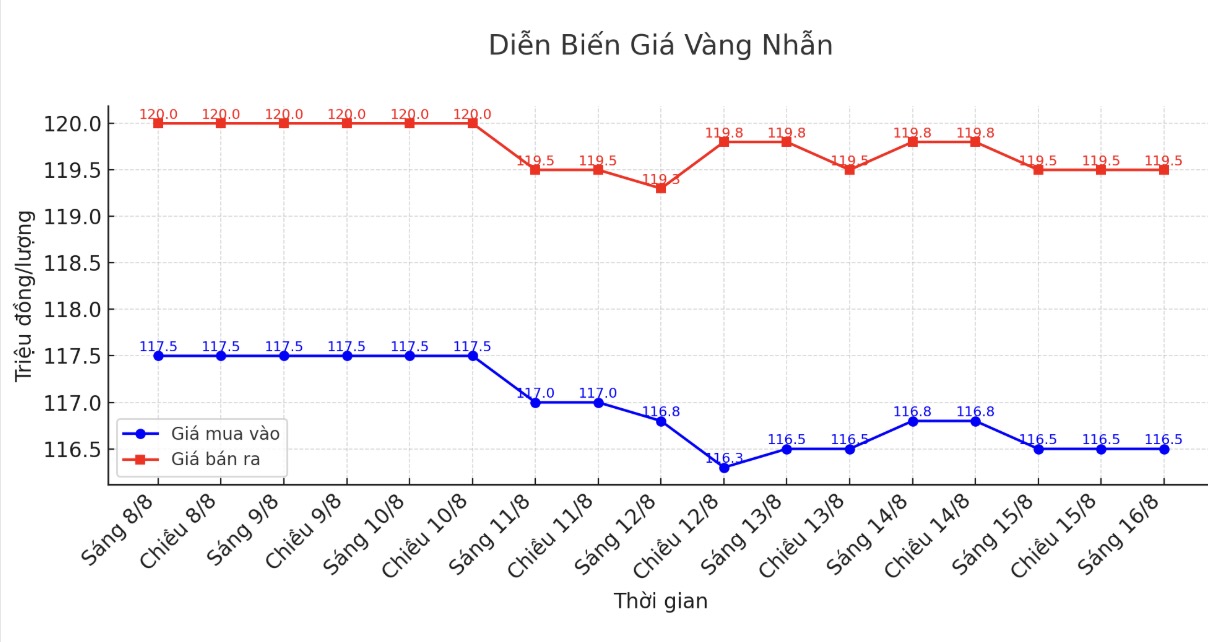

9999 round gold ring price

As of 9:15 a.m., DOJI Group listed the price of gold rings at 116.5-111.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.8-119 1.8 million VND/tael (buy - sell), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.4-1194 million VND/tael (buy in - sell out), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

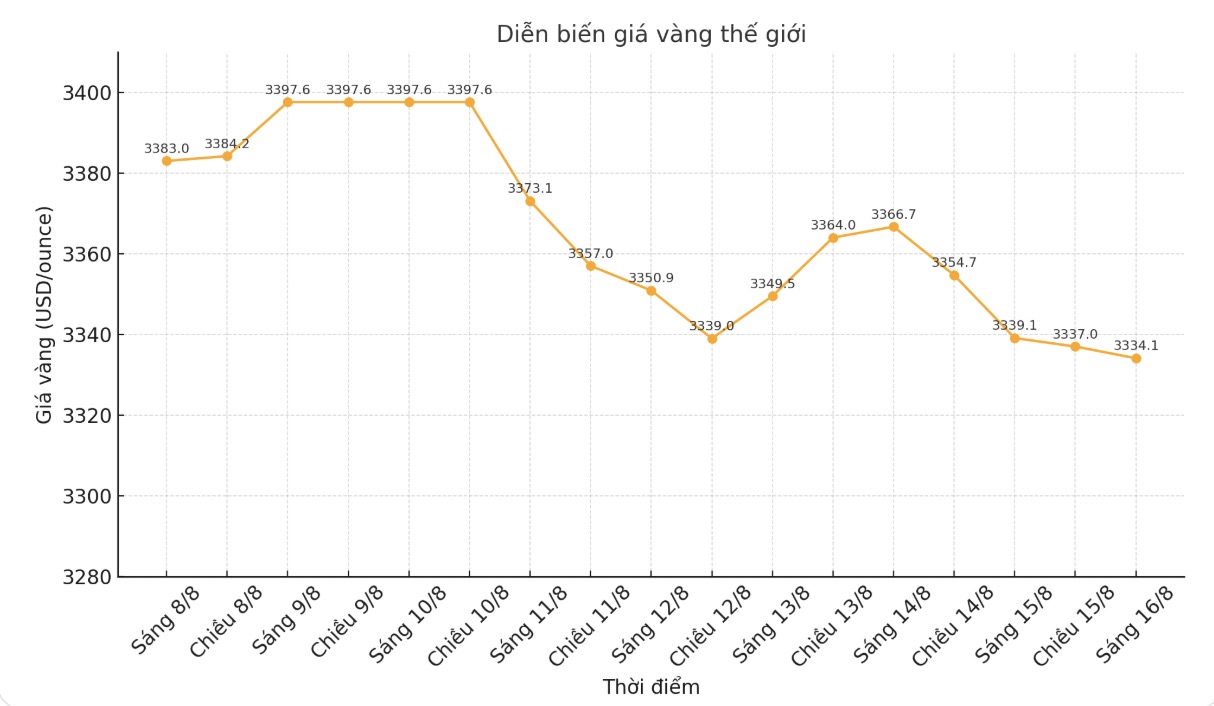

World gold price

At 9:15 a.m., the world gold price was listed around 3,334.1 USD/ounce, down 5 USD compared to a day ago.

Gold price forecast

According to Ole Hansen - Head of Commodity Strategy at Saxo Bank, strong PPI data will contribute to pushing the Fed's preferred inflation index, the core personal consumption expenditure (PCE) index, up in July. This is likely to make the Fed more cautious in upcoming interest rate cuts.

A strong US dollar makes gold expensive for investors holding other currencies, thereby reducing demand for gold and putting pressure on prices. Conversely, as the US dollar weakens, gold becomes cheaper for international buyers, boosting demand and supporting rising prices.

Meanwhile, Mr. Ryan McIntyre - managing partner at Sprott Inc, said that gold prices could witness strong fluctuations when the market fully assesses the impact of US public debt.

He said that strong buying power from central banks for gold since the Russia-Ukraine conflict broke out is still a solid support factor for the market. This buying power not only helps maintain gold prices at a high level but also strengthens investors' confidence.

"Although gold prices were steady on Friday, further volatility could come depending on the outcome of the US-Russia summit in Alaska," said Lukman Otunuga, senior analyst at FXTM.

US President Donald Trump visited Alaska on Friday to attend a summit he called "highly valuable" with his Russian counterpart Vladimir Putin, to discuss many international and bilateral issues of mutual concern.

Meanwhile, analysts at ANZ Bank believe that macroeconomic and geopolitical risks may increase in the second half of the year, strengthening the attractiveness of gold as a safe haven.

ANZ commented: "The outlook for gold price increases remains intact, supported by the prospect of increasing tariffs, the global economy slowing down, the loose monetary policy of the US and the USD continuing to weaken".

Notable US economic data next week

There will be less data next week, but the Fed will be the focus for important events.

Tuesday: Announcement of housing data for construction and construction permits in July, Governor bowman said.

Wednesday: Minutes of the July FOMC meeting, Waller and Bostic speech, opening of the Jackson Hole Conference.

Thursday: Philadelphia Fed manufacturing index, weekly jobless claims, S&P Global comprehensive PMI in August, existing home sales in July.

Friday: FED Chairman Jerome Powell speaks at Jackson Hole an event closely watched by global investors.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...