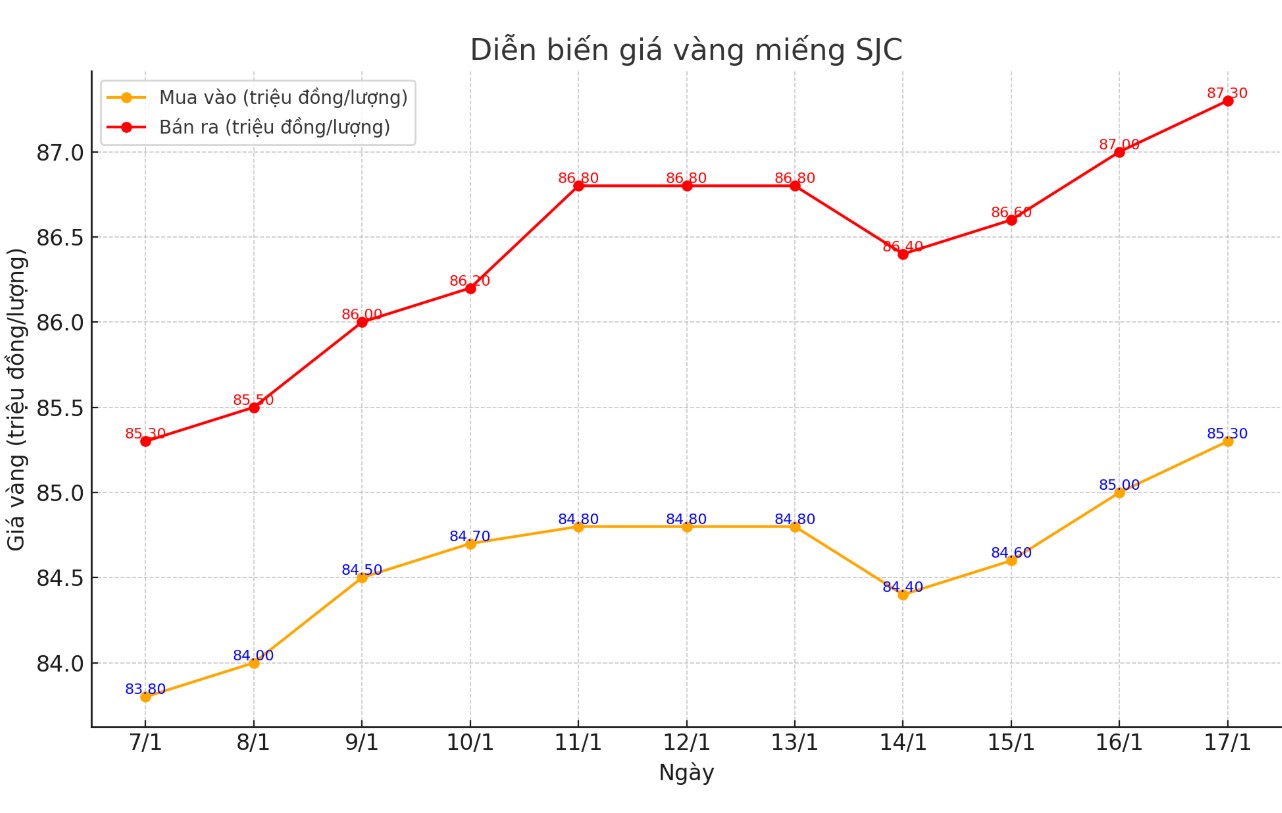

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND85.3-87.3 million/tael (buy - sell); an increase of VND300,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 85.3-87.3 million VND/tael (buy - sell); an increase of 300,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 85.3-87.3 million VND/tael (buy - sell); increased 300,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

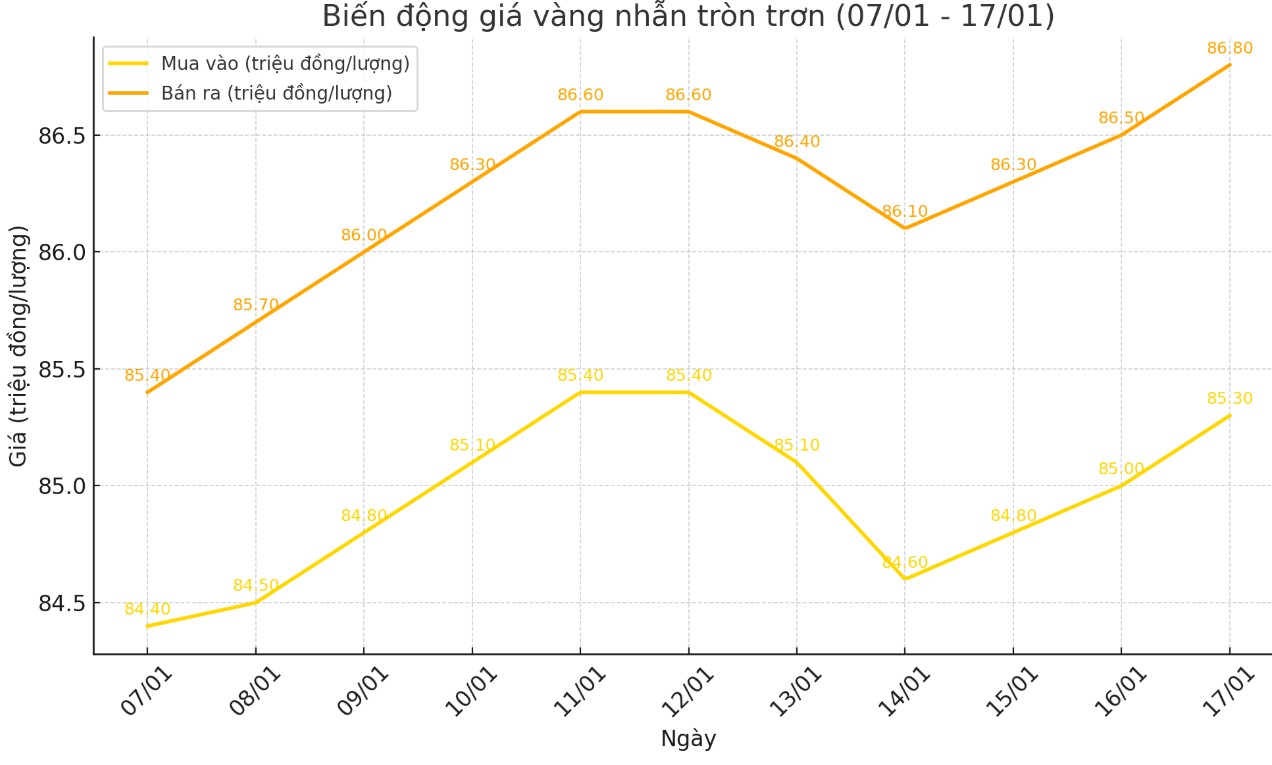

Price of round gold ring 9999

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.3-86.8 million VND/tael (buy - sell); an increase of 300,000 VND/tael for both selling prices compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 85.75-87.25 million VND/tael (buy - sell), an increase of 300,000 VND/tael for both buying and selling compared to early this morning.

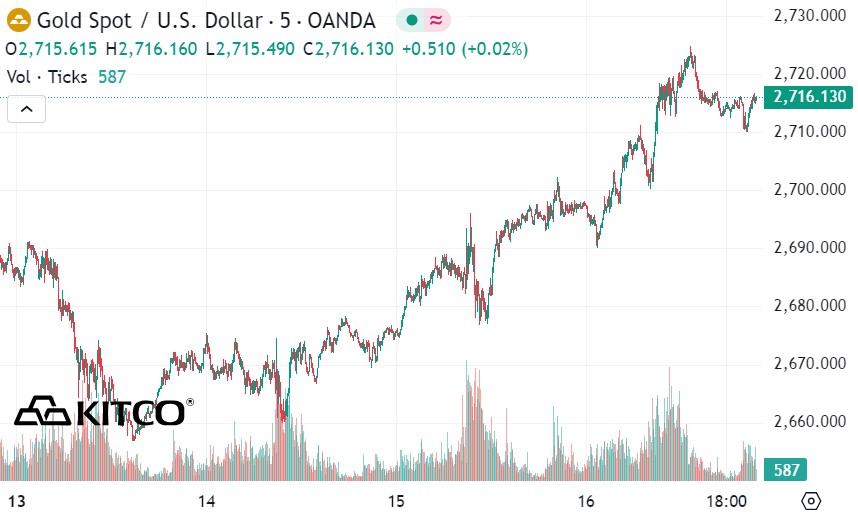

World gold price

As of 9:40 a.m., the world gold price listed on Kitco was at 2,716.1 USD/ounce, up 19.1 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased as the USD tended to decrease. Recorded at 9:40 a.m. on January 17, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 108.760 points (down 0.01).

Gold is trading at record highs despite a manufacturing survey from the Philadelphia Federal Reserve Bank that beat expectations and returned to positive territory this month.

The regional central bank said on Thursday its manufacturing business outlook index rose to 44.3 in January, up from a revised -10.9 in December. The reading was much better than economists had expected, who had expected the index to hit -4.0 this month.

“Responses from the January manufacturing business outlook survey pointed to an overall increase in manufacturing activity in the region. The indices for current activity, new orders and shipments all rose sharply. Overall, businesses continued to record an overall increase in prices, and both price indices were above their long-term averages. Firms also continued to report increases in employment,” the report said.

Gold prices rose to a fresh session high just minutes after the manufacturing data was released, along with December retail sales and weekly jobless claims.

“Nearly 51% of businesses reported an increase (up from 19% last month), far outpacing the 7% reporting a decrease (down from 30%). 41% of businesses reported no change in current activity (down from 45%). The new orders and current shipments indexes both rose sharply in January. The new orders index rose 47 points to 42.9, its highest level since November 2021. Meanwhile, the shipments index rose 39 points to 41.0, its highest level since October 2020,” the report said.

The fall in inflation has raised hopes of a more dovish policy from the US Federal Reserve (FED) this year, said senior analyst Jigar Trivedi of Reliance Securities.

“Core inflation unexpectedly slowed, while core consumer prices did not surprise significantly higher. This could support bullion demand, as progress in deflation could prompt the Fed to ease monetary policy, reducing the opportunity cost of holding the precious metal.”

Meanwhile, market analyst Han Tan of Exinity Group said that gold will find itself in a supportive environment, as long as market participants can maintain expectations of a Fed rate cut in 2025.

See more news related to gold prices HERE...