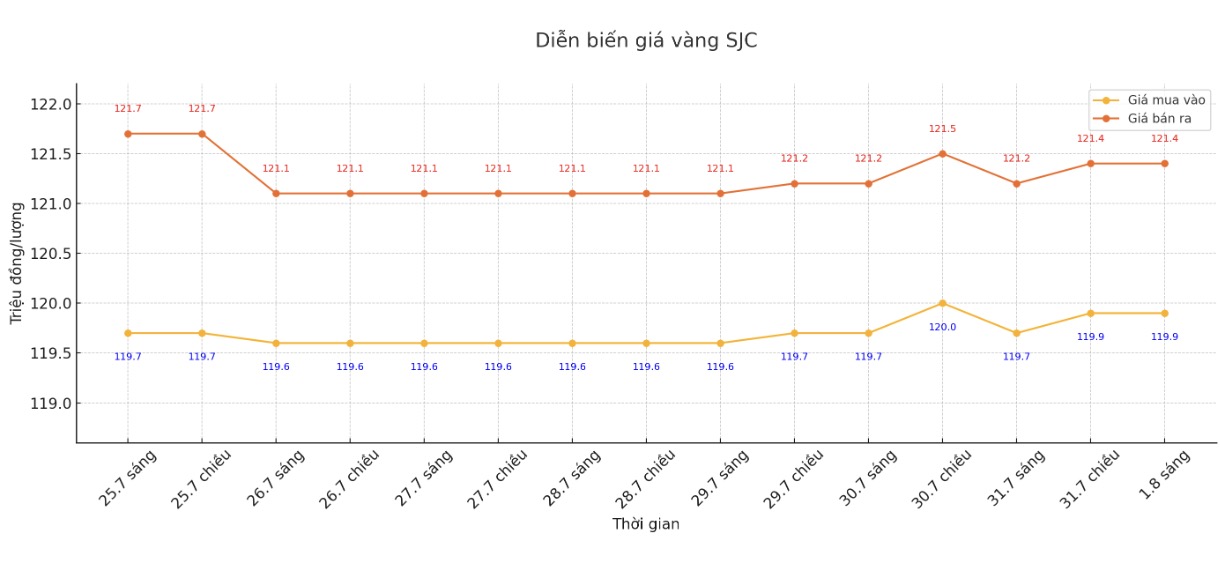

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND 119.9-121.4 million/tael (buy in - sell out), an increase of VND 200,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.9-121.4 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at VND 119.9-121.4 million/tael (buy in - sell out), an increase of VND 200,000/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

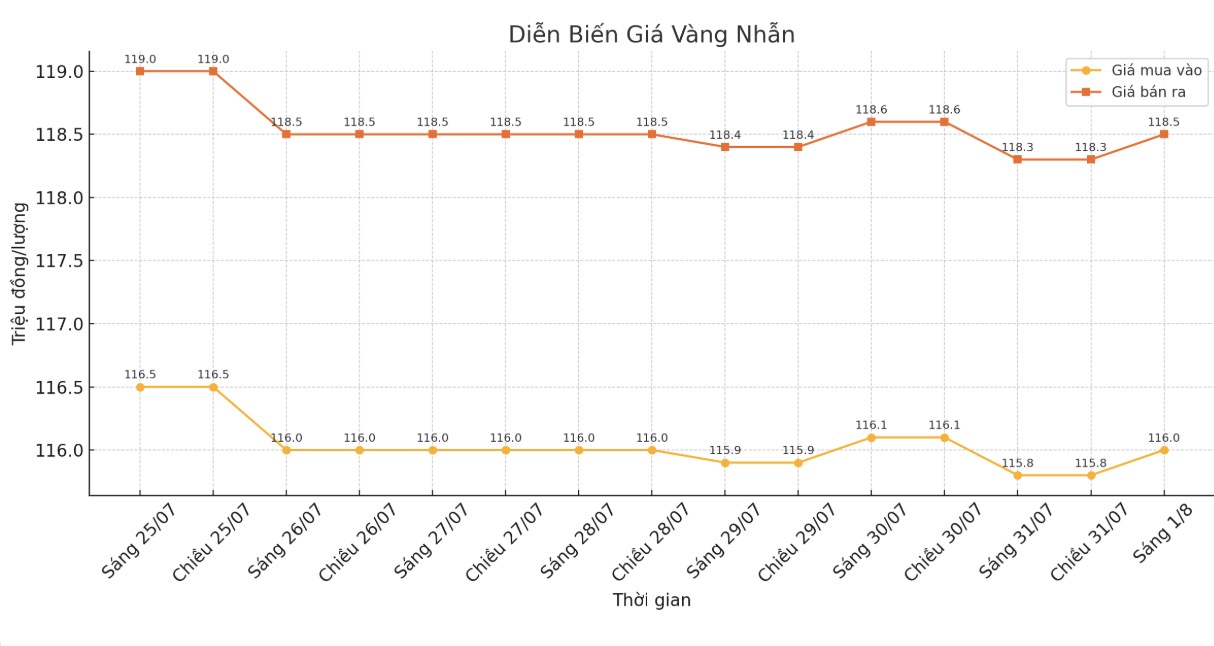

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 116-118.5 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114.9-117.9 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

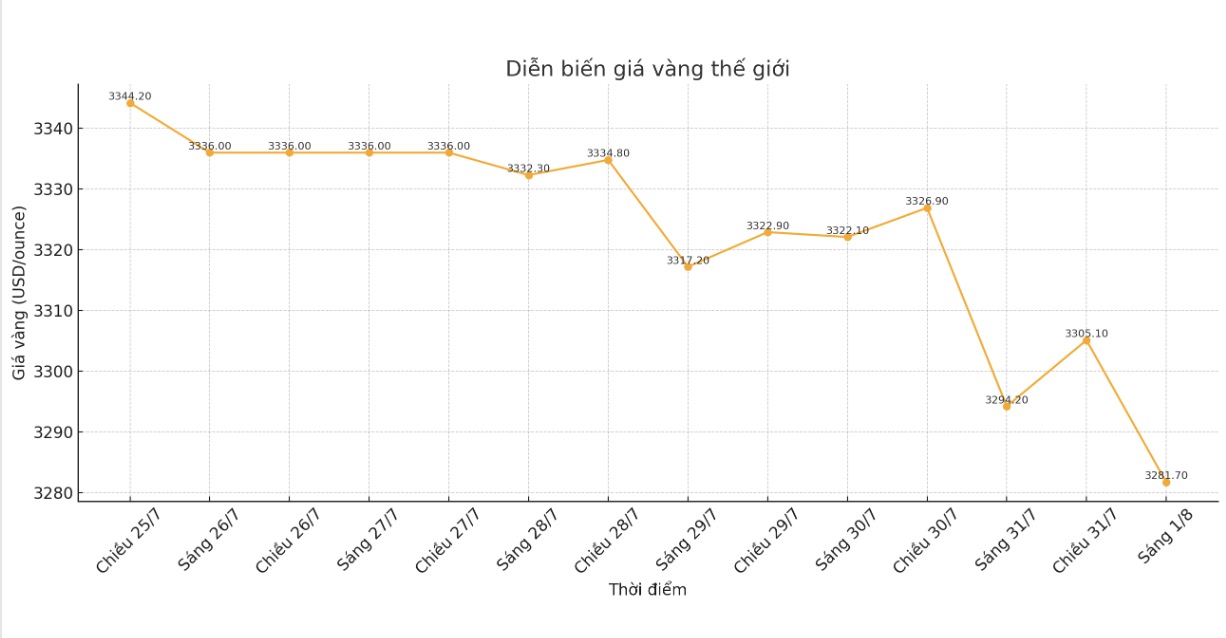

World gold price

At 9:00 a.m., the world gold price was listed around 3,281.7 USD/ounce, down 12.5 USD/ounce.

Gold price forecast

Mr. Tim Waterer - chief market analyst of financial services company KCM Trade, commented that gold prices below 3,300 USD/ounce have created great attraction, encouraging traders to buy. This is especially true in the context of current economic uncertainty, along with threats of additional tariffs from the US President Donald Trump administration.

Mr. Waterer said that the important support level is forming around 3,250 USD/ounce, which is likely to prevent further decline in gold prices. However, he warned that if this threshold is broken, gold prices could fall to $3,200/ounce.

Peter Grant - Vice President and senior metals strategist at Zaner Metals, said: "We are witnessing increased trade uncertainty as the expiration date of the tariffs on August 1 is approaching. It is a slight revival of safe-haven demand."

According to the World Gold Council (WGC)'s Gold Demand trend report for the second quarter of 2025, total demand for gold (including non-concentrated investments - OTC) in the second quarter reached 1,249 tons, up 3% over the same period in 2024, despite gold prices setting an all-time record. This increase is mainly due to strong investment demand in gold ETFs.

Demand for gold bars and gold bars which often decline in high-priced environments, also recorded a strong recovery.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...