Update SJC gold price

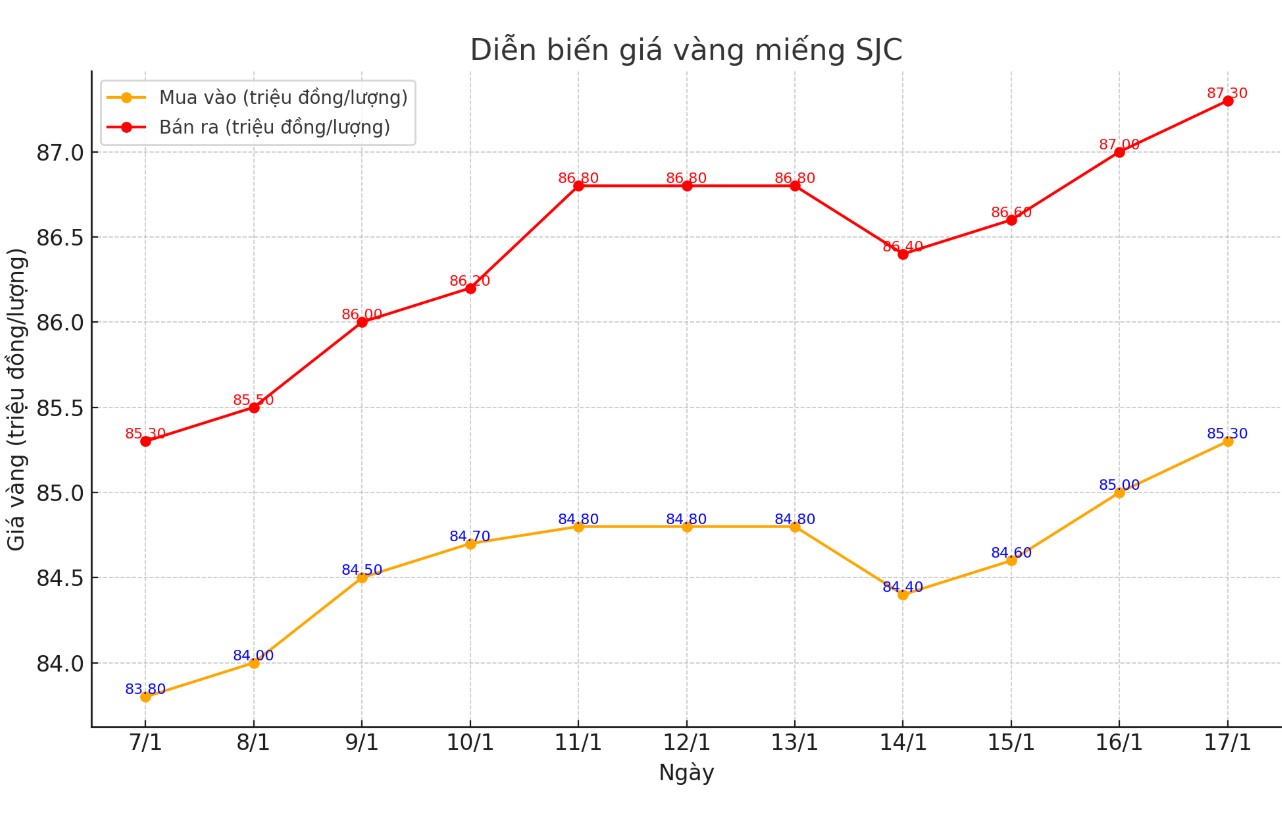

As of 7:00 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND85.3-87.3 million/tael (buy - sell); an increase of VND300,000/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 85.3-87.3 million VND/tael (buy - sell); an increase of 300,000 VND/tael for both buying and selling.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 85.3-87.3 million VND/tael (buy - sell); increased 300,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

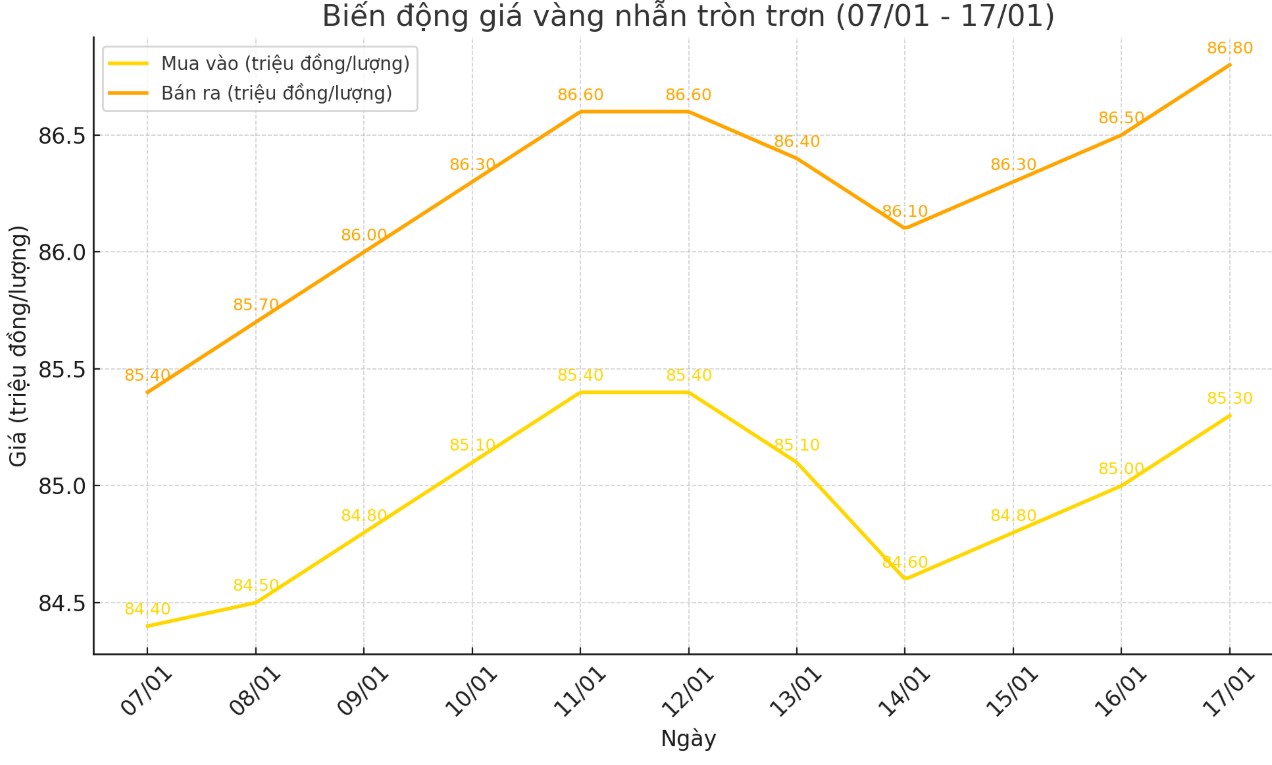

As of 5:45 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 85.2-86.7 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both selling prices compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 85.55-87.25 million VND/tael (buy - sell), an increase of 100,000 VND/tael for buying and 300,000 VND/tael for selling compared to early this morning.

World gold price

As of 5:30 p.m., the world gold price listed on Kitco was at 2,704.1 USD/ounce, down 1.5 USD/ounce compared to the same time in the previous session.

Gold Price Forecast

World gold prices increased slightly as the USD index decreased. Recorded at 5:40 p.m. on January 17, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.995 points (up 0.08%).

Gold is trading at record highs despite a manufacturing survey from the Philadelphia Federal Reserve Bank that beat expectations and returned to positive territory this month.

The regional central bank said on Thursday its manufacturing business outlook index rose to 44.3 in January, up from a revised -10.9 in December. The reading was much better than economists had expected, who had expected the index to hit -4.0 this month.

“Responses from the January manufacturing business outlook survey pointed to an overall increase in manufacturing activity in the region. The indices for current activity, new orders and shipments all rose sharply. Overall, businesses continued to record overall price increases and both price indices were above their long-term averages. Firms also continued to report increases in employment,” the report said.

Ajay Kedia, director of Kedia Commodities in Mumbai, India, said gold prices were supported by the weakening of the US dollar after this week's inflation data reinforced expectations of a rate cut by the US Federal Reserve. "If gold breaks through $2,720 an ounce, it could rise to $2,770 an ounce," Kedia said.

Expectations for a Fed rate cut increased after data on January 15 showed that core US inflation was lower than expected. FED Governor Christopher Waller also emphasized that if US economic data continues to weaken, the FED could make 3-4 interest rate cuts this year.

US President-elect Donald Trump is set to begin his second term next week, and analysts say his policies are likely to spur inflation in the US. “The increased uncertainty from the new administration and potential policies is making gold an attractive trading instrument in the short-term volatility environment,” said Michael Langford, chief investment officer at Scorpion Minerals.

See more news related to gold prices HERE...