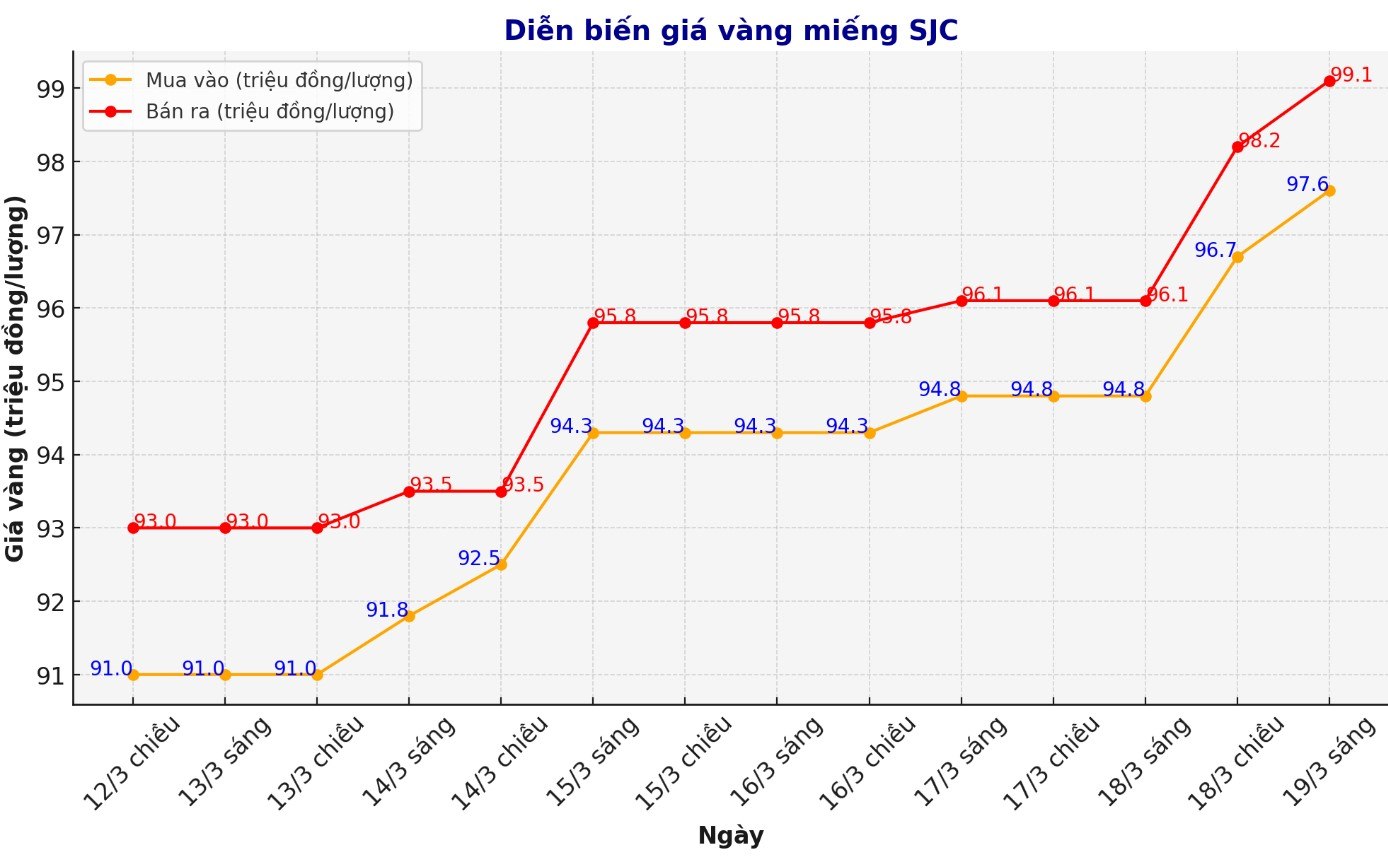

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 97.6-99.1 million VND/tael (buy in - sell out), an increase of 2.2 million VND/tael for both buying and selling. The difference between buying and selling prices is at 1.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 97.6-99.1 million VND/tael (buy - sell), an increase of 2.2 million VND/tael for both buying and selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 97.1-98.6 million VND/tael (buy - sell), an increase of 1.7 million VND/tael for both buying and selling. The difference between buying and selling prices is at 1.5 million VND/tael.

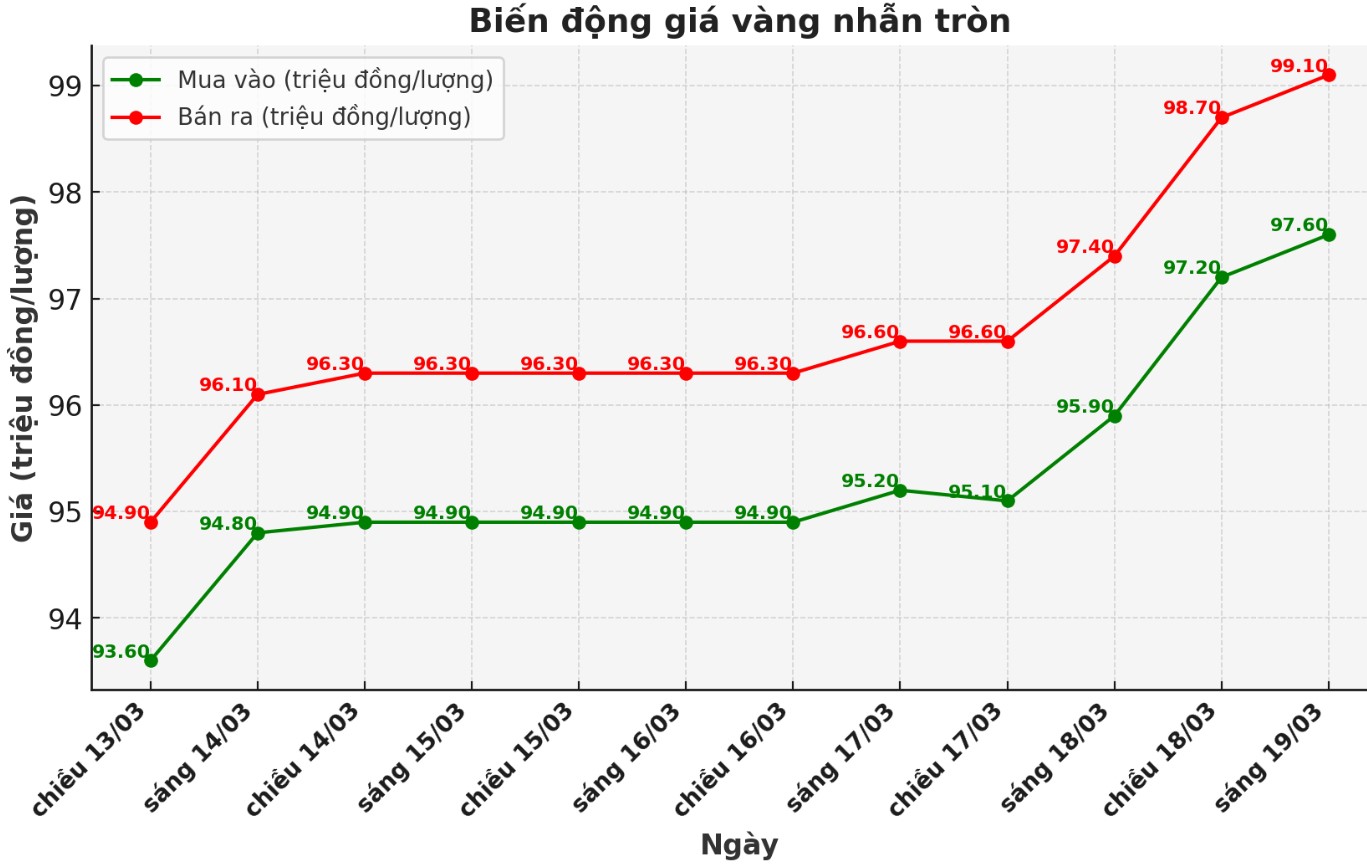

9999 round gold ring price

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 97.6-99.1 million VND/tael (buy - sell), an increase of 1.7 million VND/tael for both buying and selling. The difference between buying and selling is listed at 1.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 97.65-99.2 million VND/tael (buy - sell); an increase of 1.75 million VND/tael for buying and an increase of 1.7 million VND/tael for selling. The difference between buying and selling is 1.55 million VND/tael.

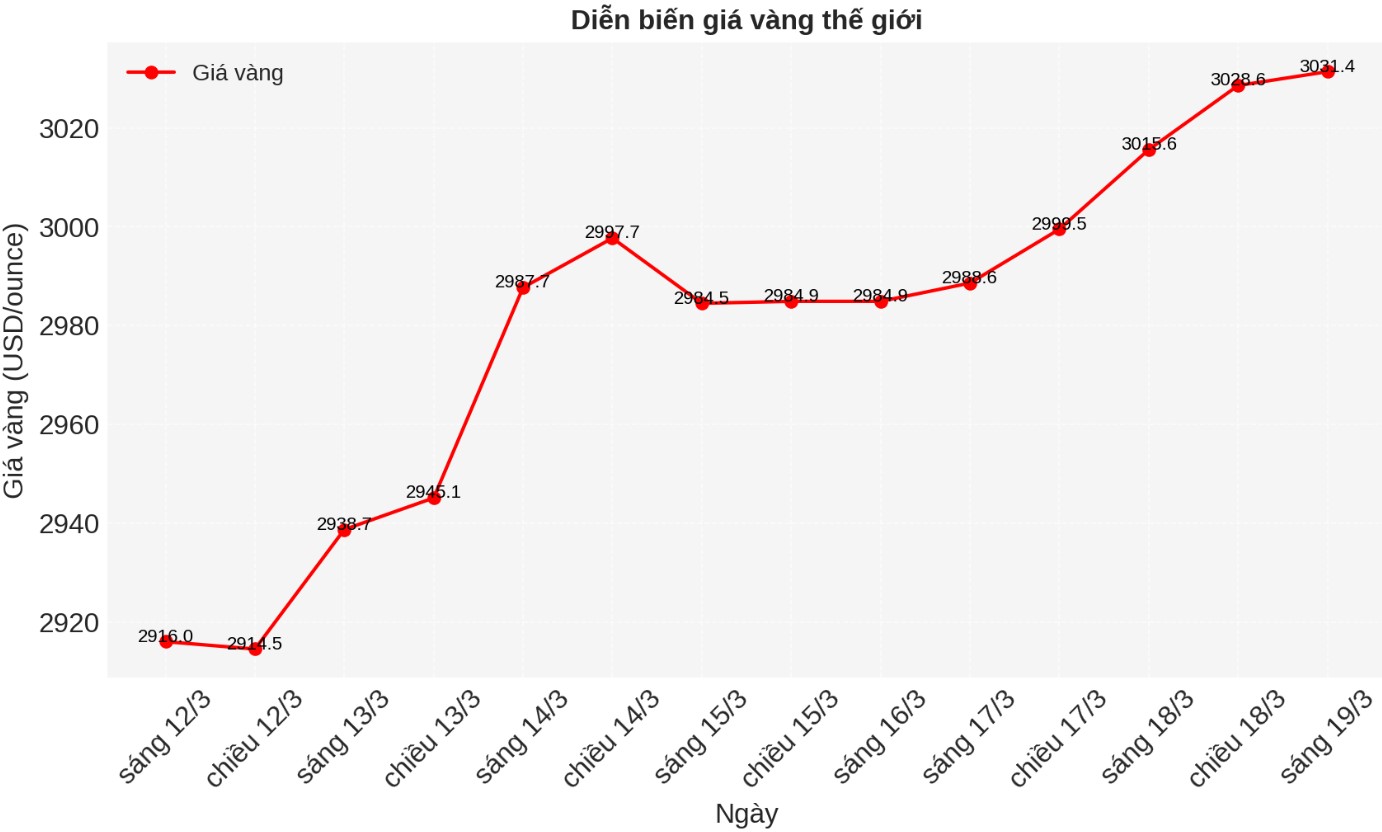

World gold price

This morning, the world gold price listed on Kitco was around the all-time high of 3,031.4 USD/ounce, up 21.5 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold price forecast

World gold prices increased despite the USD also showing a recovery trend. Recorded at 9:30 a.m. on March 19, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 102.940 points (up 0.05%).

The two major banks UBS and ANZ have just raised their gold price target to above the important threshold of 3,000 USD/ounce, showing the confidence of financial institutions in the upward momentum of the precious metal as geopolitical tensions and trade wars increase.

A report from the Investment Office of Swiss bank UBS on March 18 said: "Gold, a defensive asset that is benefiting from geopolitical instability, trade tensions and new expectations of the US cutting interest rates due to concerns about slowing economic growth".

The report reads: "US Treasury Secretary Scott Bessent said in an interview on Sunday that the current economic pressure is a period of "transition", but did not rule out the risk of recession.

Regarding the geopolitical situation, the Trump administration of US President Donald Trump last weekend escalated airstrikes targeting Houthi forces in Yemen in response to attacks on international maritime routes.

ANZ Bank also raised its short-term gold price forecast (0-3 months) to $3,100/ounce, while forecasting a 6-month increase to $3,200/ounce, according to a report released on the morning of March 19.

We maintain a positive view, thanks to strong momentum from geopolitical tensions, trade wars, loose monetary policies and strong demand for gold from central banks, ANZ said.

In the gold market, concerns about import tariffs have tightened liquidity in the London spot market, as supply flows into the US, ANZ said in a report. This has created price differences, increasing the gap between Comex futures and London spot prices.

Commodity experts at TD Securities said that the gold market may see a "fear of missing out" (FOMO) mentality, as speculators return to the market when prices fluctuate around $3,000/ounce, an important psychological threshold.

"With risky investment budgets tightened due to pressure from the stock market, macro funds have reduced their net buying position for gold to the lowest level since the summer of 2024, when gold prices traded about 500 USD/ounce lower than at present.

This will eventually boost FOMO sentiment, especially as gold prices enter an unprecedented range above $3,000 an ounce. Conversely, if the global price trend reverses, selling pressure will be limited because macro funds have significantly reduced their positions and algorithmic trading floors (CTAs) still have a lot of room before activating the first sell order" - analysts commented.

Important economic data for the week

Wednesday: Fed monetary policy decision.

Thursday: Swiss National Bank and Bank of England monetary policy decision, weekly jobless claims in the US, Philly FED manufacturing survey, existing home sales in the US.

See more news related to gold prices HERE...