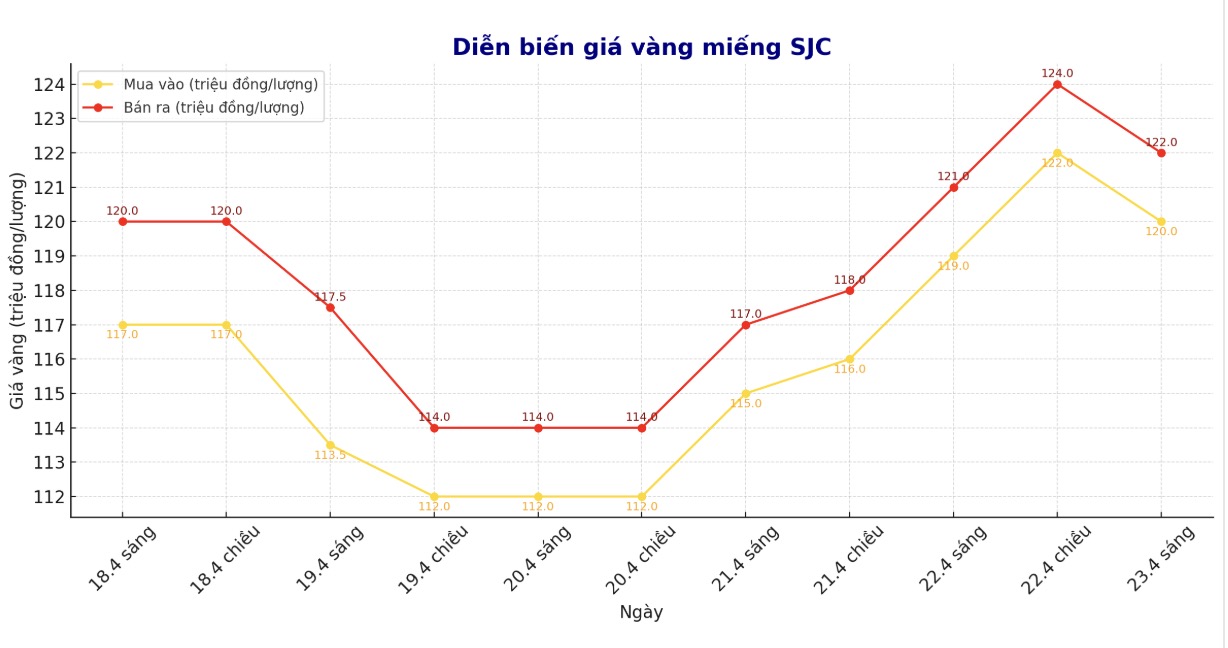

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND120-122 million/tael (buy - sell), an increase of VND1 million/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 120-122 million VND/tael (buy - sell), an increase of 1 million VND/tael for both buying and selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117-120 million VND/tael (buy - sell), down 2 million VND/tael for buying and down 1 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

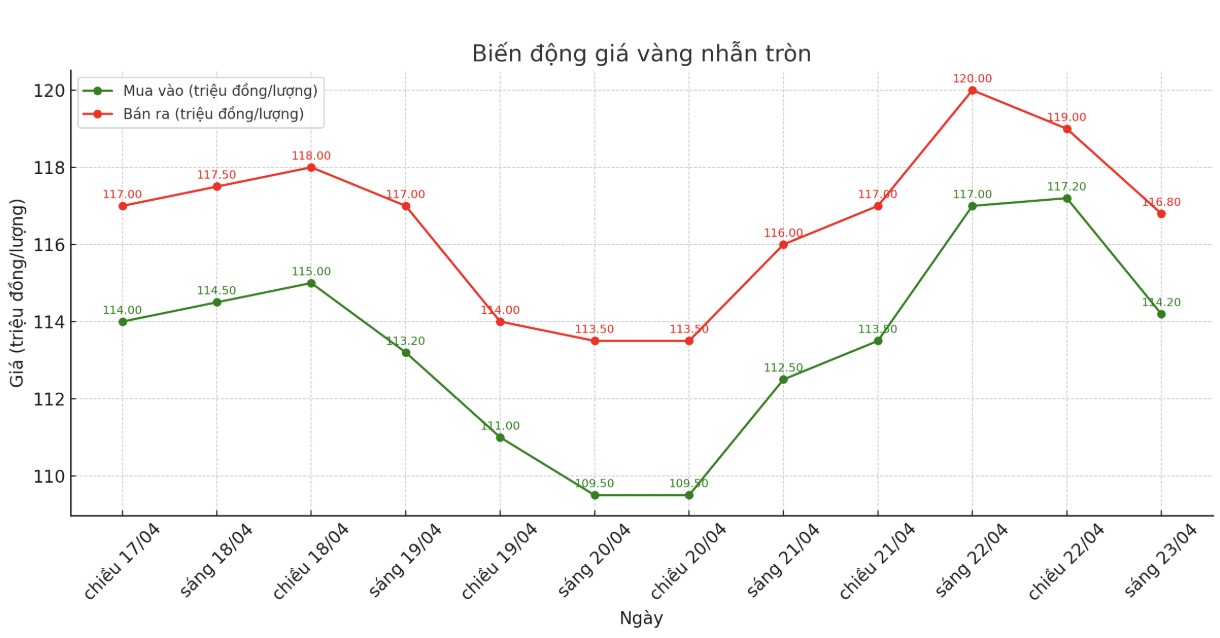

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 114.2-116.8 million VND/tael (buy - sell), down 2.8 million VND/tael for buying and down 3.2 million VND/tael for selling. The difference between buying and selling prices is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell), down 2 million VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed to an excessively high level, causing risks for individual investors to increase. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

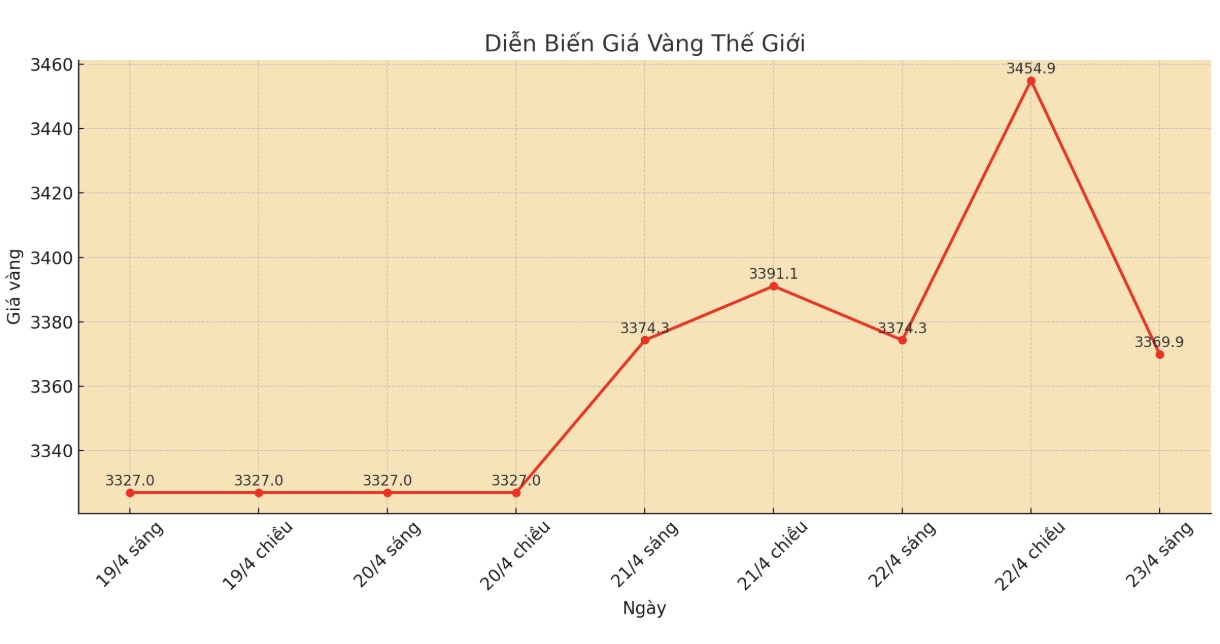

World gold price

At 9:15 a.m., the world gold price listed on Kitco was around 3,369.9 USD/ounce, down 4.4 USD.

Gold price forecast

According to Reuters, world gold prices fell sharply as US-China trade tensions showed signs of cooling down, supply of stocks and the USD increased sharply.

Recently, statements from US Treasury Secretary Scott Bessent suggested that US-China trade tensions could ease, boost stock optimism and strengthen the USD.

"The US Treasury Secretary's speech suggests a chance to ease tensions in the trade war with China, which is when gold prices start to fall," said Bob Haberkorn, senior market strategist at RJO Futures.

Neils Christensen - an analyst at Kitco News - commented that gold is recording a strong profit-taking as soon as the North American stock market opens. Although the International Monetary Fund (IMF) has just sharply lowered its forecast for US GDP growth this year, the demand for gold as a safe-haven asset has not appeared.

According to Jim Wyckoff - senior analyst at Kitco, gold has encountered a wave of profit-taking due to the strong recovery of US stock indexes.

"The recent greater price fluctuations in gold are an early sign that this strong growth cycle may be close to a possible upcoming short-term market peak and peak, from a time perspective rather than from a price perspective.

Technically, June gold investors are having a solid short-term technical advantage, but today's price action shows that they may be exhausted. Gold investors' next target is to close above solid resistance at today's contract high of $3,509.9/ounce.

The long-term downside target of discount investors is to push futures below $3,200/ounce. The first resistance level was $3,550/ounce. The first support level is $3,375/ounce," the expert said.

Economic data to watch

Wednesday: Preliminary manufacturing and services PMI, new home sales in the US.

Thursday: Long-term goods orders, weekly jobless claims, US home sales.

See more news related to gold prices HERE...