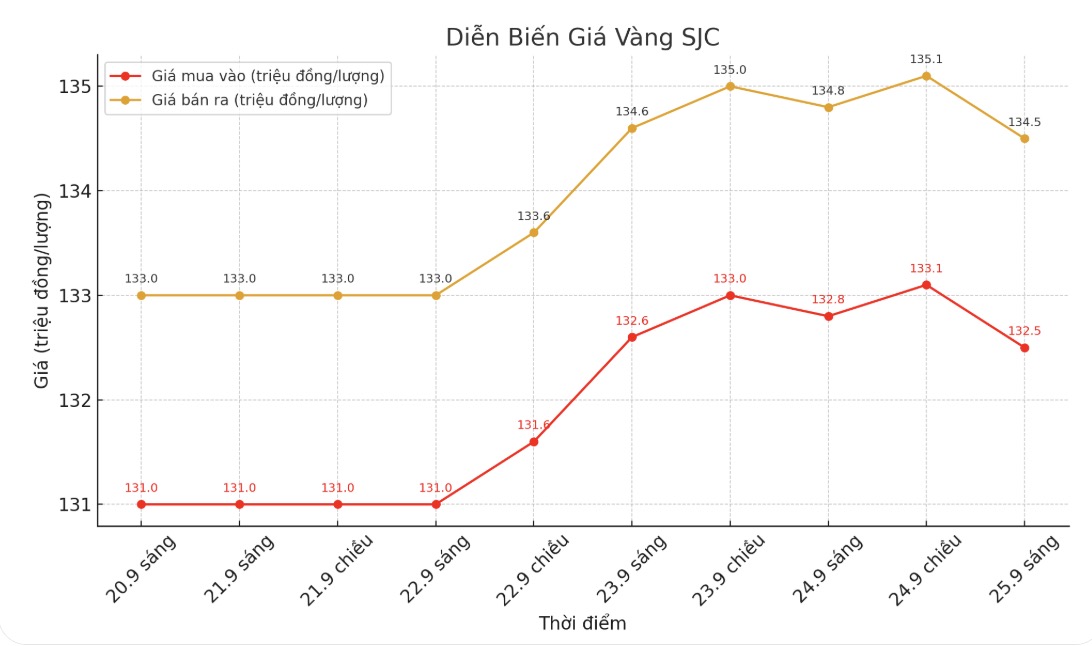

Updated SJC gold price

As of 9:00 a.m., DOJI Group listed the price of SJC gold bars at VND132.5-134.5 million/tael (buy in - sell out), down VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Bao Tin Minh Chau listed the price of SJC gold bars at 132.5-134.5 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at 132-134.5 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

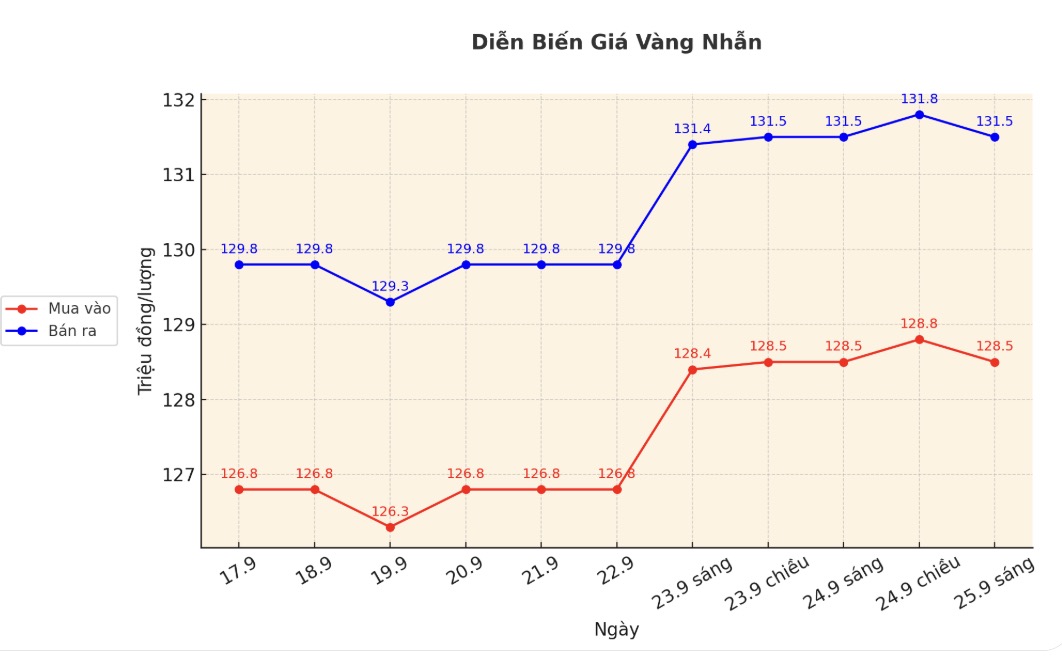

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 128.5-131.5 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 128.9-131.9 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 128.5-131.5 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

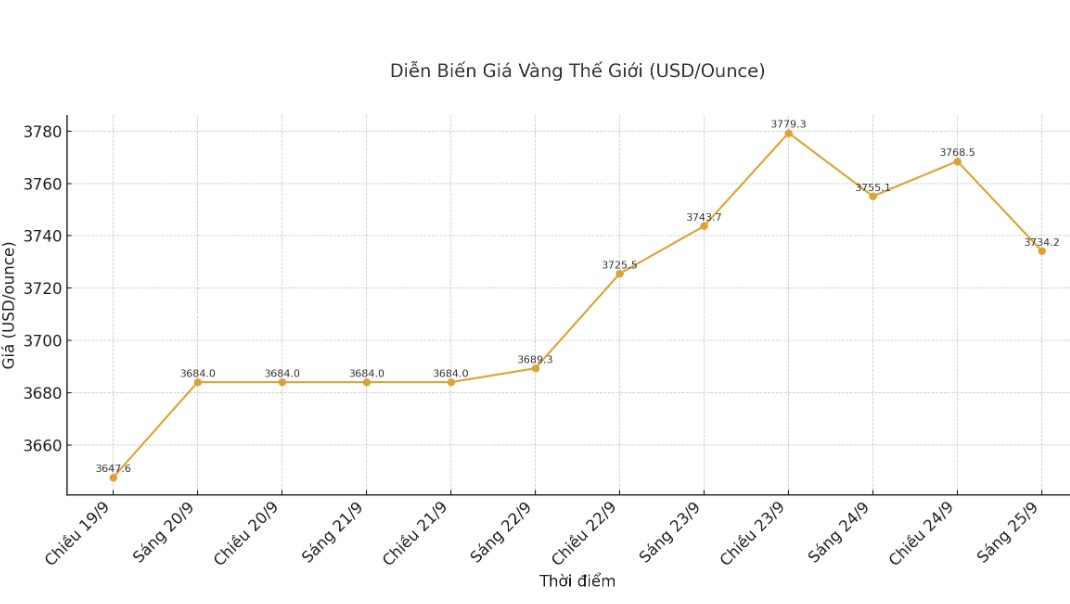

World gold price

At 9:00 a.m., the world gold price was listed around 3,734.2 USD/ounce, down 20.9 USD compared to a day ago.

Gold price forecast

After a sharp increase near $3,800/ounce, world gold prices are facing a profit-taking. Rising US new home sales have put pressure on the precious metal.

According to the report released on Wednesday by the US Bureau of Population and the Department of Housing and Urban Development, new home sales increased by 20.5% last month, reaching an annual adjustment of 800,000 units, compared to the adjustment of 664,000 units in July.

New home sales rose 15.4% year-on-year and are currently at their highest level since February 2022.

Despite the decline, world gold prices still receive positive forecasts from experts. Bart Melek - CEO, Head of Global Commodity Strategy at TD Securities predicted that gold prices could reach $4,000/ounce in the short term as central banks, especially China and many emerging markets, will buy millions ofounces to increase their reserve ratio.

This is a great time for the precious metals industry. I have repeatedly asserted that the possibility of gold reaching $4,000/ounce is completely real.

The main reason is that the US Federal Reserve (FED) continues to loosen monetary policy as it enters 2026. There is a possibility of another rate cut this year, even two, even if the Fed Chairman did not confirm it clearly in his speech on Tuesday, Melek said in an interview on Tuesday.

Meanwhile, Deutsche Bank also maintains its view that gold prices are likely to reach $4,000/ounce next year. Accordingly, the FED's resumption of the easing cycle, while the European Central Bank (ECB) temporarily stops cutting interest rates and the Bank of England (BoE) begins to shift the "hawl" direction, will put pressure on the USD, weakening the advantage of high yields, thereby reducing demand for holding the greenback.

Schedule of announcing economic data affecting gold prices this week

Thursday: Swiss National Bank monetary policy decision, US final Q2 GDP, US long-term orders, US weekly jobless claims, US existing home sales.

Friday: US personal consumption expenditure (PCE) price index, University of Michigan consumer confidence index (adjusted).

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...