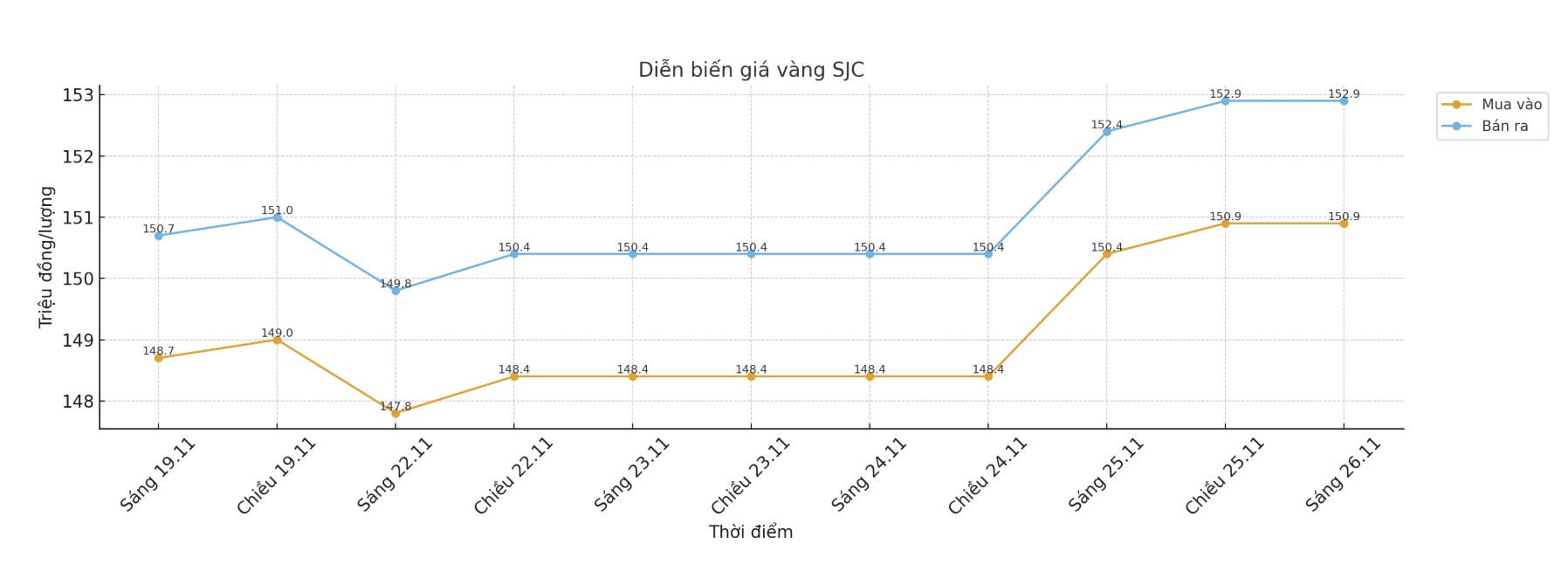

Updated SJC gold price

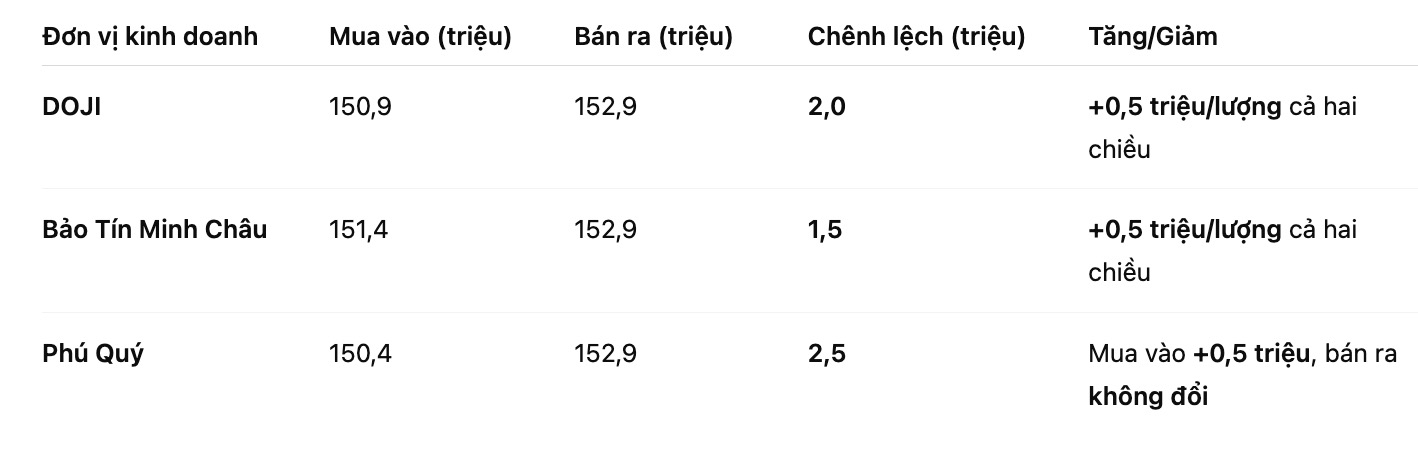

As of 9:25, the price of SJC gold bars was listed by DOJI Group at 150.9-152.9 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 151.4-152.9 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 150.4-152.9 million VND/tael (buy - sell), an increase of 500,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

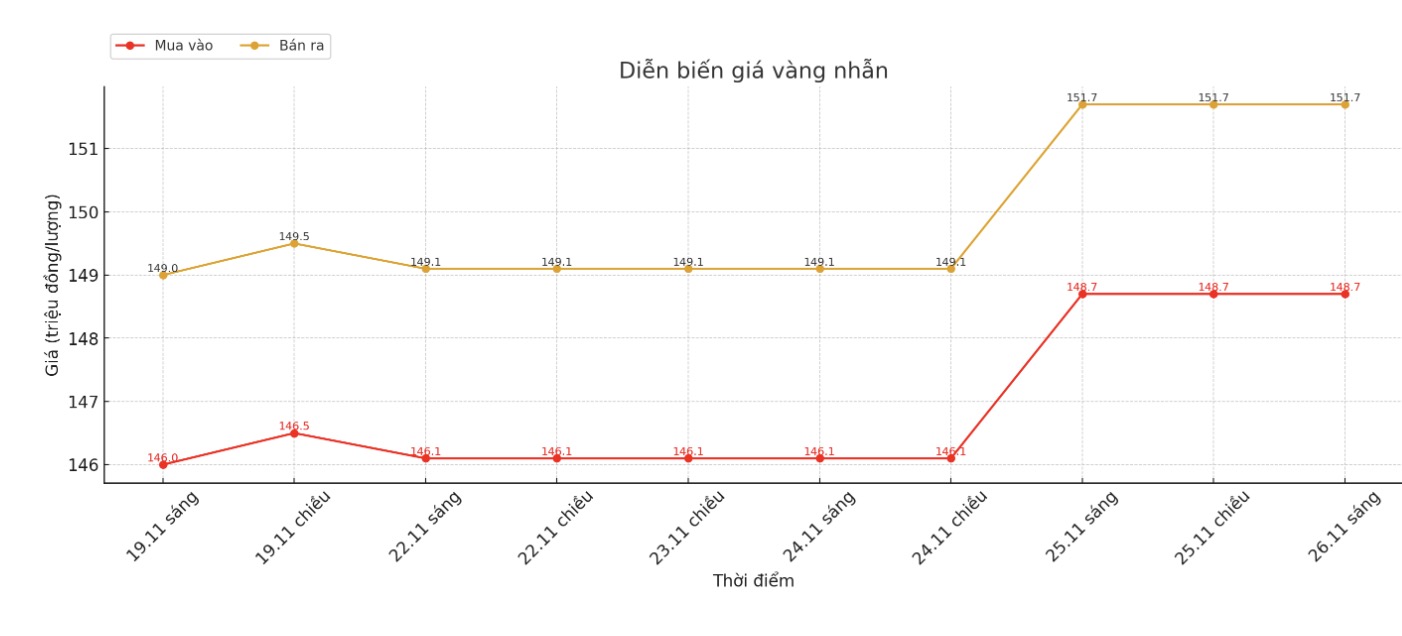

9999 round gold ring price

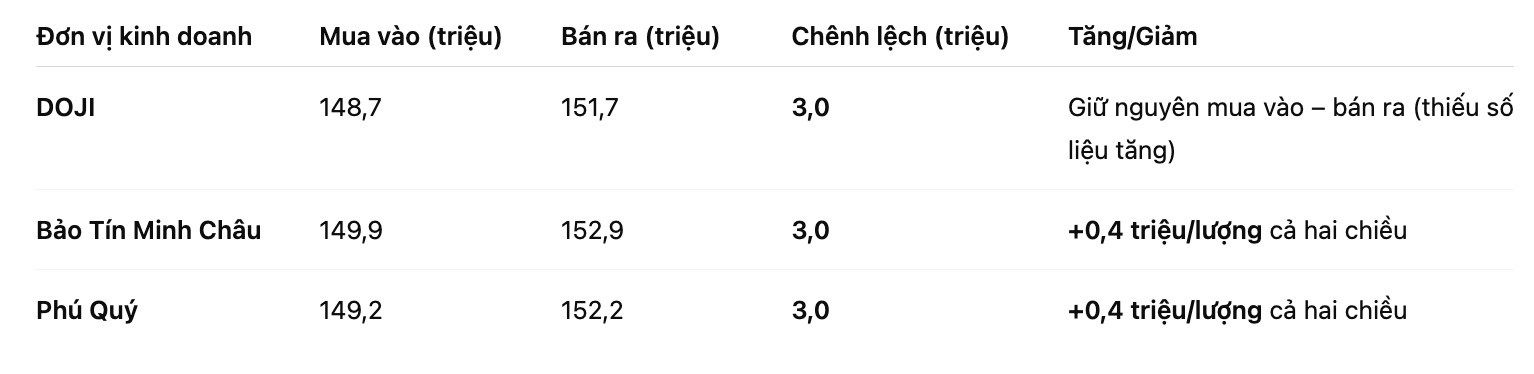

As of 9:25, DOJI Group listed the price of gold rings at 148.7-151.7 million VND/tael (buy in - sell out), unchanged in both buying and increasing directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 149.9-152.9 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 149.2-152.2 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

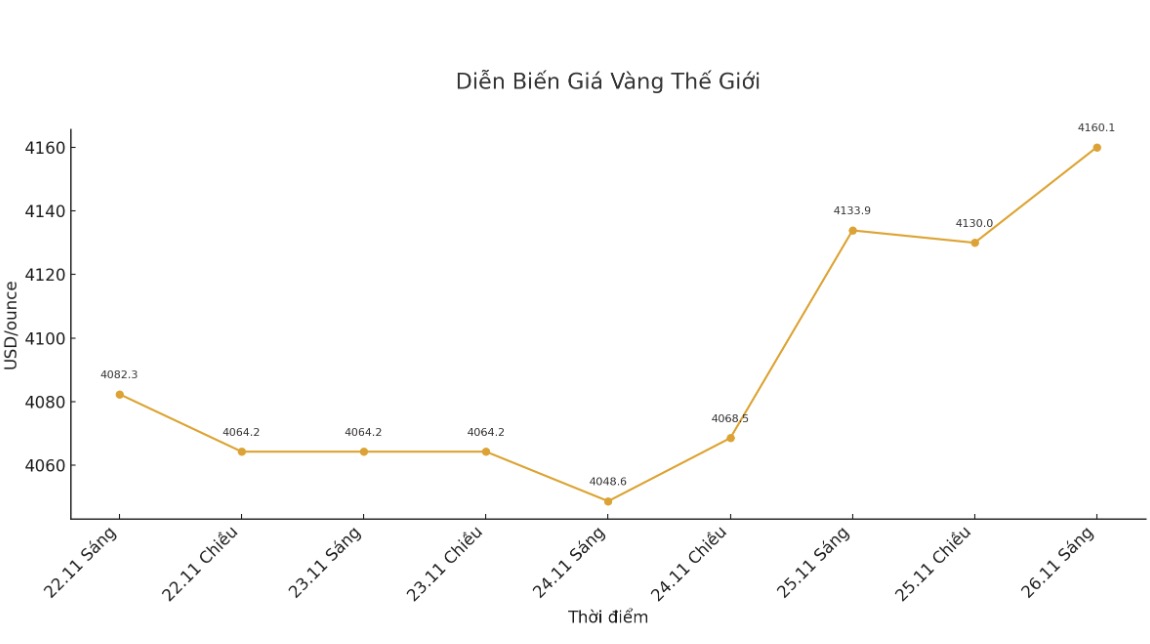

World gold price

At 9:28 a.m., the world gold price was listed around 4,160.1 USD/ounce, up 26.2 USD compared to a day ago.

Gold price forecast

Gold prices increased sharply in the context of newly released economic data from the US showing a mixed picture.

New economic data released from the US shows that consumer spending is weak while manufacturing inflation is still under control. These factors are reinforcing market expectations that the US Federal Reserve (FED) could cut interest rates next month, thereby strongly supporting the precious metal.

According to the US Commerce Department, retail sales rose just 0.2% in September, well below the 0.4% forecast and almost one-third the pace of August. Although the 12-month growth rate still reached 4.3%, higher than the expectation of 3.9%, analysts said that consumer demand is clearly slowing down.

Meanwhile, the September Producer Price Index (PPI) report shows that inflation in the manufacturing stage is still quite "low". The overall PPI rose 0.3% after falling 0.1% last month, in line with forecasts. Core PPI increased by only 0.1%, lower than the expectation of 0.2%.

For the year, manufacturing inflation reached 2.7%, in line with analysts' forecasts. Although the report was delayed due to a 43-day government shutdown, previously collected data still reflected a not-so-hot inflation trend, creating conditions for the Fed to consider policy easing.

Traders are in the midst of a two-day "rain" of US economic data, with reports up to now showing a rather confusing picture.

The market saw a series of important reports: Weekly unemployment claims, long-term orders, second-quarter GDP estimates, preliminary economic index reports, ISM Chicago business survey, personal income and spending (including key inflation measures), new housing figures, DOE energy reserve reports, along with the US Federal Reserve's economic report.

Technically, the next target for December gold futures buyers is to close above the strong resistance level at the November peak of $4,250/ounce. The short-term downside target for the bears is to push prices below a solid support zone at $4,000/ounce.

The first resistance level was at the peak set overnight at $4,152/ounce, followed by $4,200/ounce. First support was $4,100/ounce and then $4,050/ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...