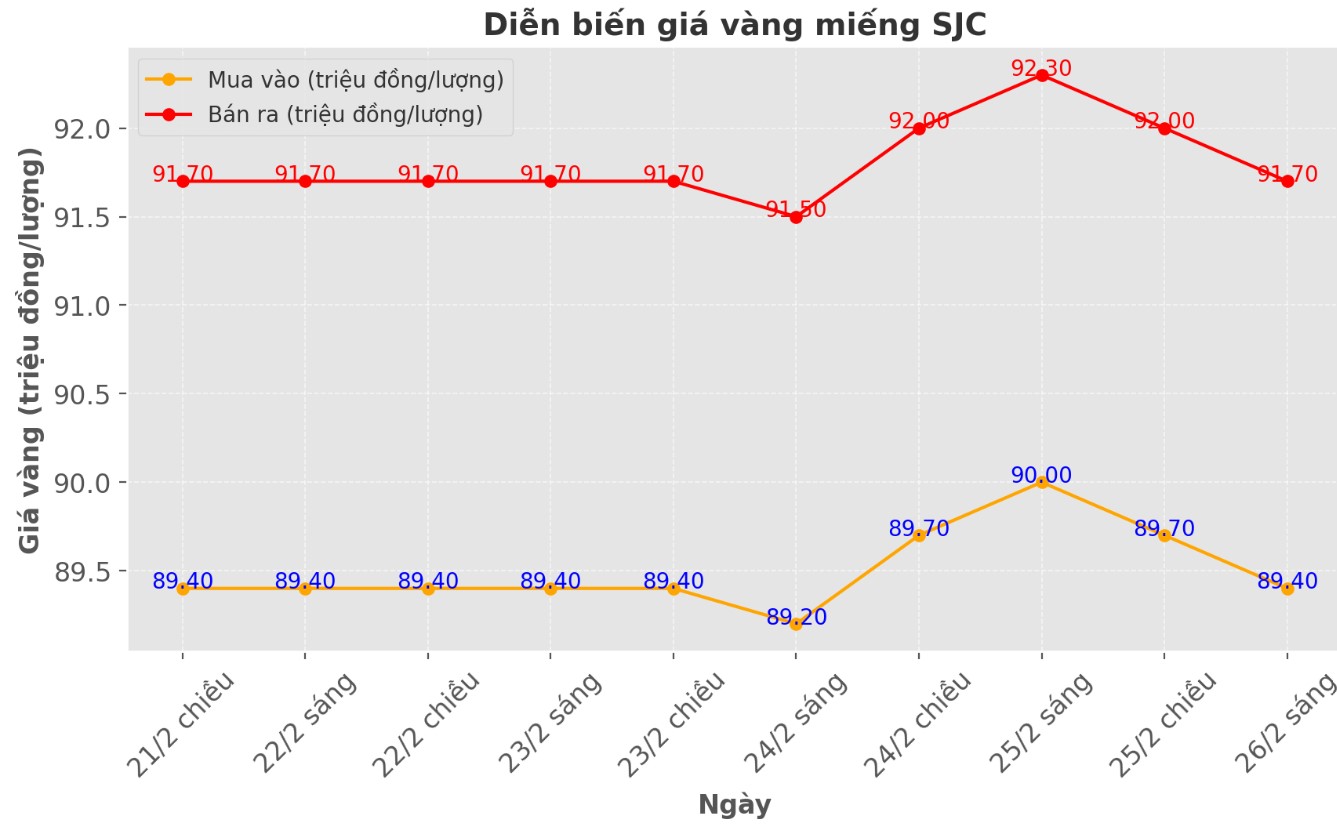

Updated SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND89.2-91.5 million/tael (buy in - sell out), down VND800,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at VND89.4-91.7 million/tael (buy - sell), down VND600,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at VND89.7-91.7 million/tael (buy - sell); down VND300,000/tael for both buying and selling.

The difference between buying and selling SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

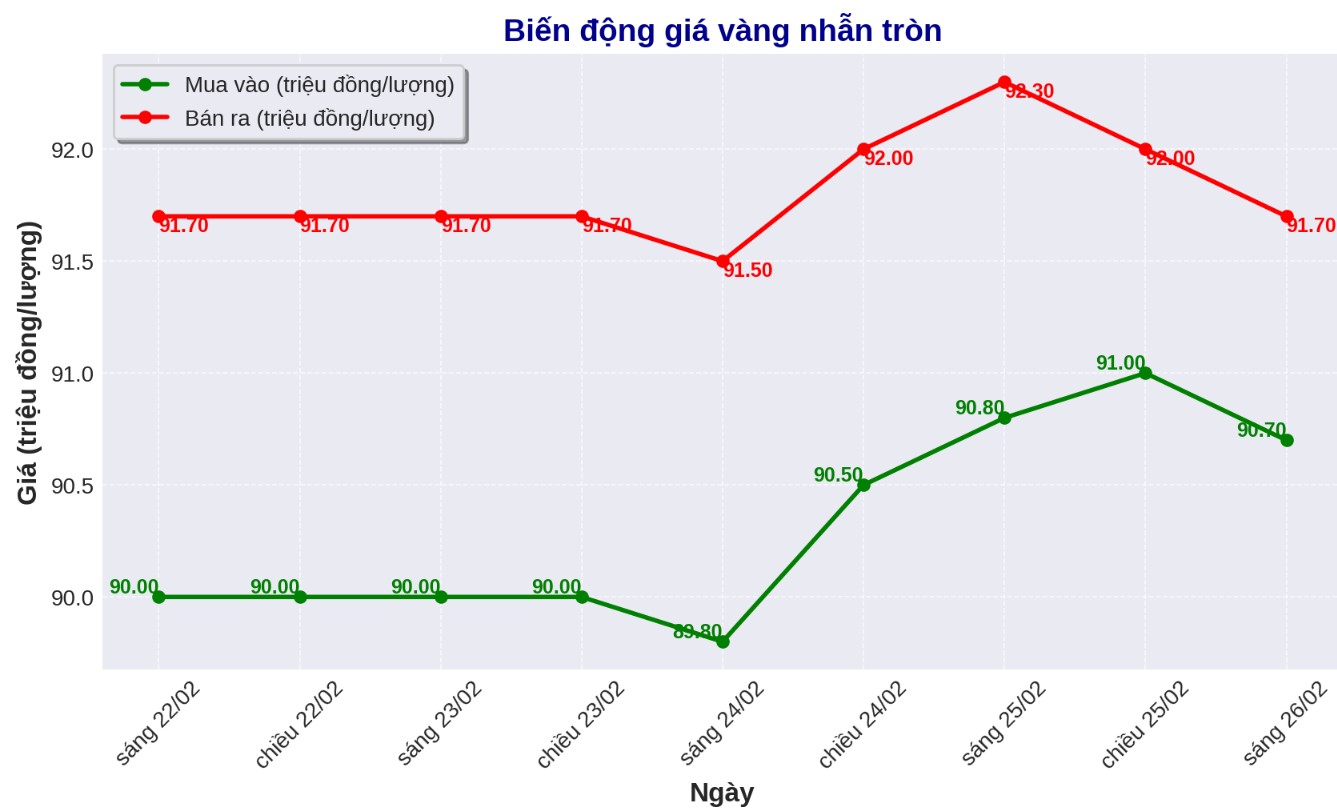

9999 round gold ring price

As of 9:30 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 90.7-91.7 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 600,000 VND/tael for selling compared to early this morning.

The difference between buying and selling is at 1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.3-91.8 million VND/tael (buy - sell), down 300,000 VND/tael for both buying and selling compared to early this morning.

The difference between buying and selling is at 1.5 million VND/tael.

World gold price

As of 9:50 a.m., the world gold price listed on Kitco was at 2,917.3 USD/ounce, down 31.4 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices plummeted in the context of the USD increasing. Recorded at 9:60 a.m. on February 26, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.310 points (up 0.1%).

Just one day after hitting a new record above $2,950 an ounce, gold prices were under strong selling pressure. Jim Wyckoff - senior analyst at Kitco.com described this sell-off as a normal profit-taking move after gold prices increased by more than 12% in the first two months of the year.

He also stressed that the decline has not caused significant technical damage on the gold price chart.

"Once the April gold futures fall below the key support level of $2,845/ounce, the market could suffer near-term technical damage, even showing signs of a peak," Wyckoff said.

Over the past two weeks, the gold market has recorded a slower increase and stronger fluctuations. According to Carsten Fritsch - commodity analyst at Commerzbank (one of Germany's largest banks, based in Frankfurt), this is a sign that the increase has weakened.

Last night, there was a time when gold prices fell below the support level of 2,900 USD/ounce (down nearly 2% on the day). The latest record shows that spot gold was listed on Kitco at 5:30 a.m. on February 26 (Vietnam time) at $2,915 an ounce. Although it has a recovery trend, this precious metal has left the peak of 2,950 USD/ounce very far.

Fritsch also pointed out that investment demand for gold is changing. The recent rally has been driven largely by capital flows into gold ETFs, while data shows some investors taking profits after betting on the precious metal's upside trend.

The "COT Commitment of Traders" report released by the US Securities and Exchange Commission (CSTC) shows that in the week ended February 18, hedge funds reduced the number of gold purchase contracts on the Comex exchange to 222,538 contracts, down 6,533 contracts compared to the previous week. At the same time, the number of sales contracts increased by 2,941 contracts, to 37,209 contracts.

Data shows that investors have continuously cut their buying positions over the past four weeks, causing the total number of net buying contracts to fall to a one-month low of 185,300 contracts.

"With gold prices continuously hitting new peaks, speculative financial investors should have increased their buying position. However, instead, they have reduced their position.

Obviously, these investors think that there is no room for price increases, so they choose to take profits. This shows that the increase in gold prices is currently being supported by fewer and fewer investors" - Fritsch commented.

Notable economic events that may affect gold prices

Wednesday: New home sales in the US.

Thursday: US Q4 preliminary GDP, US long-term goods orders, US weekly jobless claims, US pending home sales.

Friday: US core PCE index, personal income and spending.

See more news related to gold prices HERE...