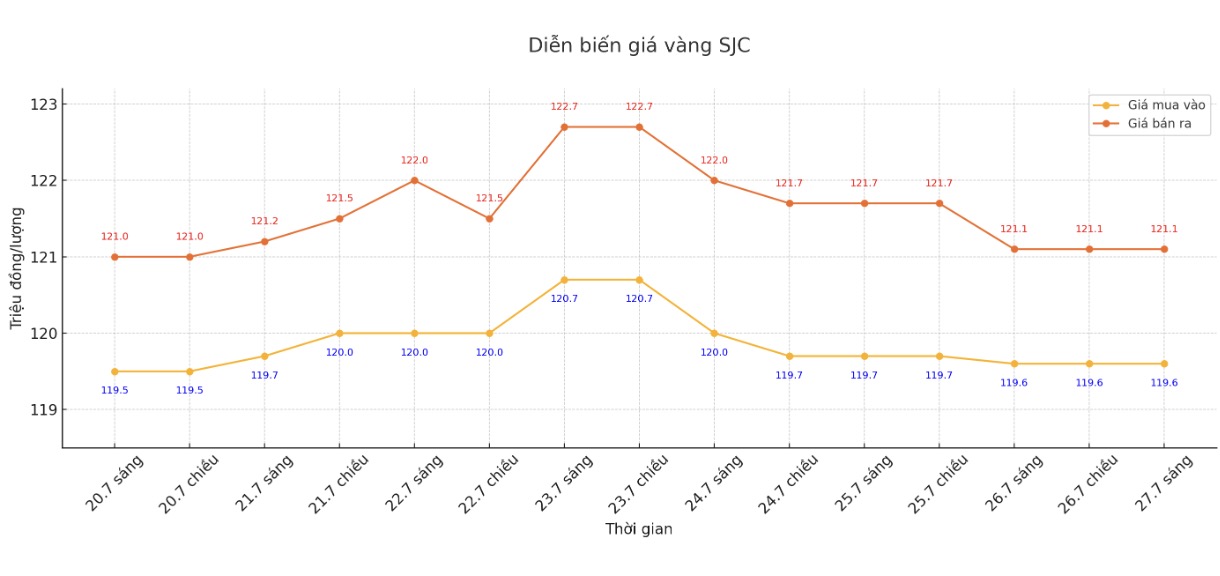

SJC gold bar price

At the end of the trading session of the week, Saigon Jewelry Company SJC listed the price of SJC gold at 119.6-121.1 million VND/tael (buy in - sell out).

Compared to the closing price of the previous trading session (July 20, 2025), the price of SJC gold bars at Saigon Jewelry Company SJC increased by VND100,000/tael in both directions. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.6-121.1 million VND/tael (buy in - sell out).

Compared to a week ago, the price of SJC gold bars was increased by 100,000 VND/tael by Bao Tin Minh Chau in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

If buying SJC gold at Bao Tin Minh Chau and Saigon Jewelry Company SJC in the session of July 20 and selling it in today's session (July 27), buyers will lose 1.4 million VND/tael.

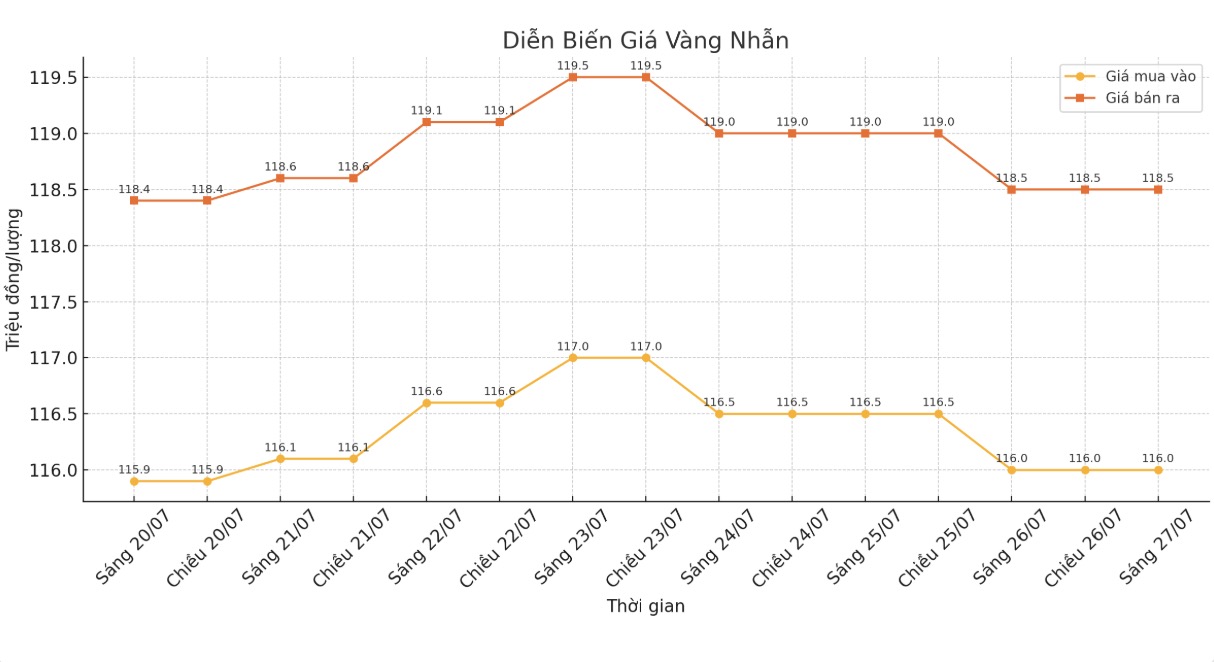

9999 gold ring price

This morning, Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell); an increase of 100,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is at 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.1-118.1 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions compared to a week ago. The difference between buying and selling is 3 million VND/tael.

If buying gold rings in the session of July 20 and selling in today's session (July 27), buyers at Bao Tin Minh Chau will lose 2.9 million VND/tael, while the loss when buying in Phu Quy is 2.7 million VND/tael.

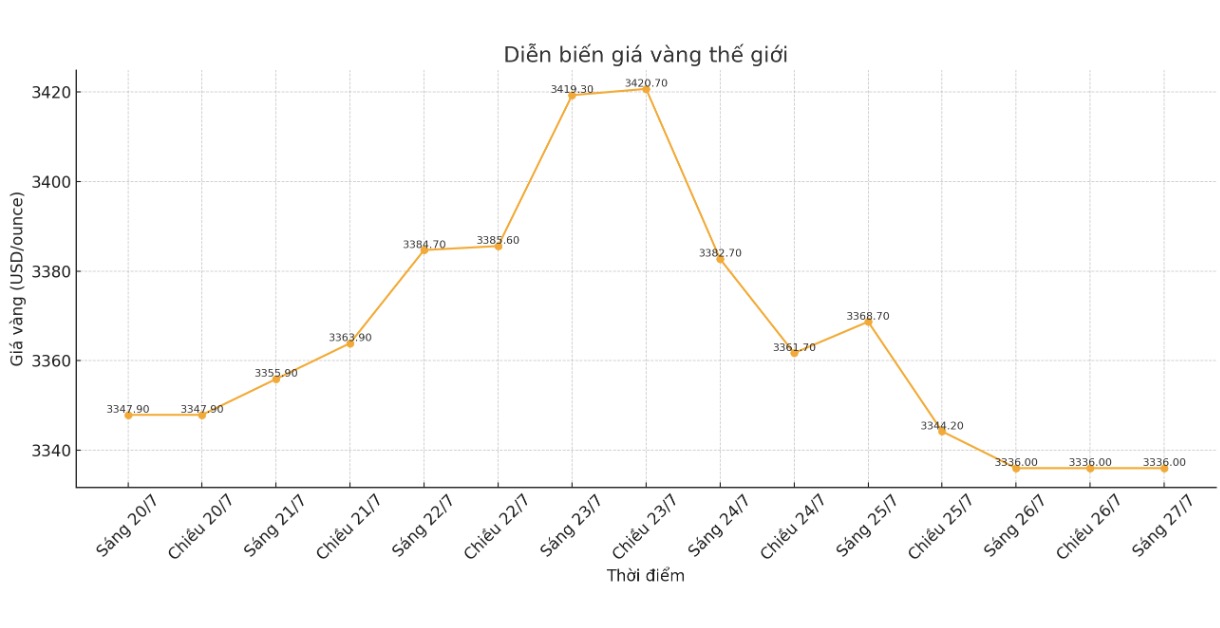

World gold price

At the end of the trading session of the week, the world gold price was listed at 3,336 USD/ounce, down 11.9 USD/ounce compared to the closing price of the previous trading session.

Gold price forecast

The developments in the gold market last week showed the sensitivity of this precious metal in the context of the lack of clear economic data. The surge above $3,400/ounce earlier in the week reflects expectations that a stable economy will create conditions for the US Federal Reserve (FED) to start a rate cut cycle, as worries about recession gradually cool down.

However, after the US and Japan reached a trade deal on Tuesday an event seen by investors as a positive signal for progress in negotiations between the US and other major partners such as the EU the gold market reversed. Optimism has boosted risk appetite, causing cash flow to shift to higher-yielding assets such as stocks.

Ms. Barbara Lambrecht - commodity analyst at Commerzbank said that the investment trend in gold has peaked in the short term, especially when the FED has no plans to cut interest rates at the upcoming meeting.

Mr. Alex Kuptsikevich - chief analyst at FxPro - commented that this is the fourth time gold prices have failed to surpass the 3,400 USD/ounce mark, and technical risks are increasing. Currently, gold prices are trading near the 50-day average.

If prices fall sharply below this average line next week, it will be a signal that the trend has shifted from accumulation to adjustment. In the adjustment scenario, gold prices could fall sharply to the 3,150 or even 3,050 USD/ounce zone. The above target is near the peak before " released" day (a metaphor for April 2, 2025 - when US President Donald Trump announced the "Liberation Day" tariff package), corresponding to a withdrawal of 61.8% since the increase at the end of last year. The target below is a 50% retreat area, near the 200-day average" - he commented.

Meanwhile, Mr. Aakash doshi, head of global gold strategy at State Street Global Advisors, said that gold still has a solid foundation as an important monetary asset. Although risk-off sentiment has caused stocks to hit a new peak, gold prices are still less than 5% below the April peak.

There are many structural reasons why spikes like this are still a buying opportunity, he said.

Economic data to watch next week

Tuesday: New employment numbers (JOLTS), US consumer confidence.

Wednesday: ADP employment data, US preliminary GDP, Bank of Canada monetary policy decision, pending home sales, FED interest rate decision, Bank of Japan decision.

Thursday: US PCE, weekly jobless claims.

Friday: US non-farm payrolls, ISM manufacturing PMI.

See more news related to gold prices HERE...