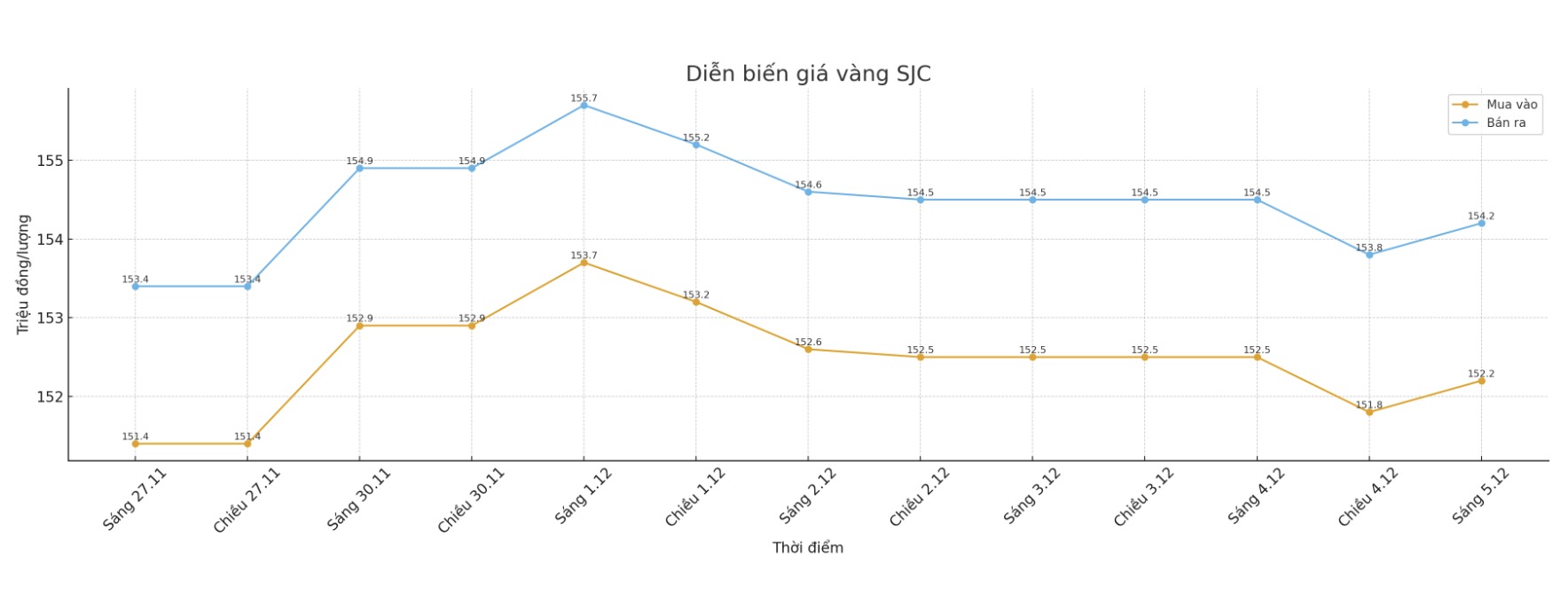

Updated SJC gold price

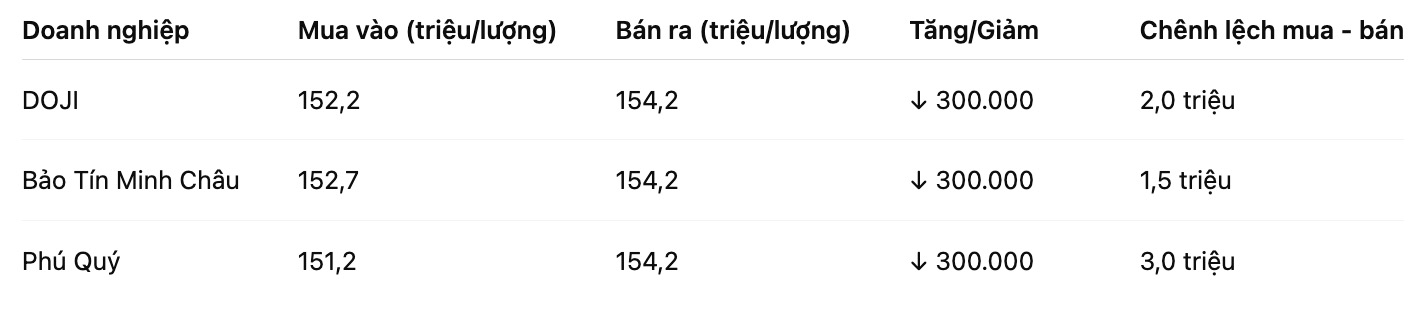

As of 9:10 a.m., DOJI Group listed the price of SJC gold bars at VND152.2-154.2 million/tael (buy in - sell out), down VND300,000/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 152.7-154.2 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 151.2-154.2 million VND/tael (buy in - sell out), down 300,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

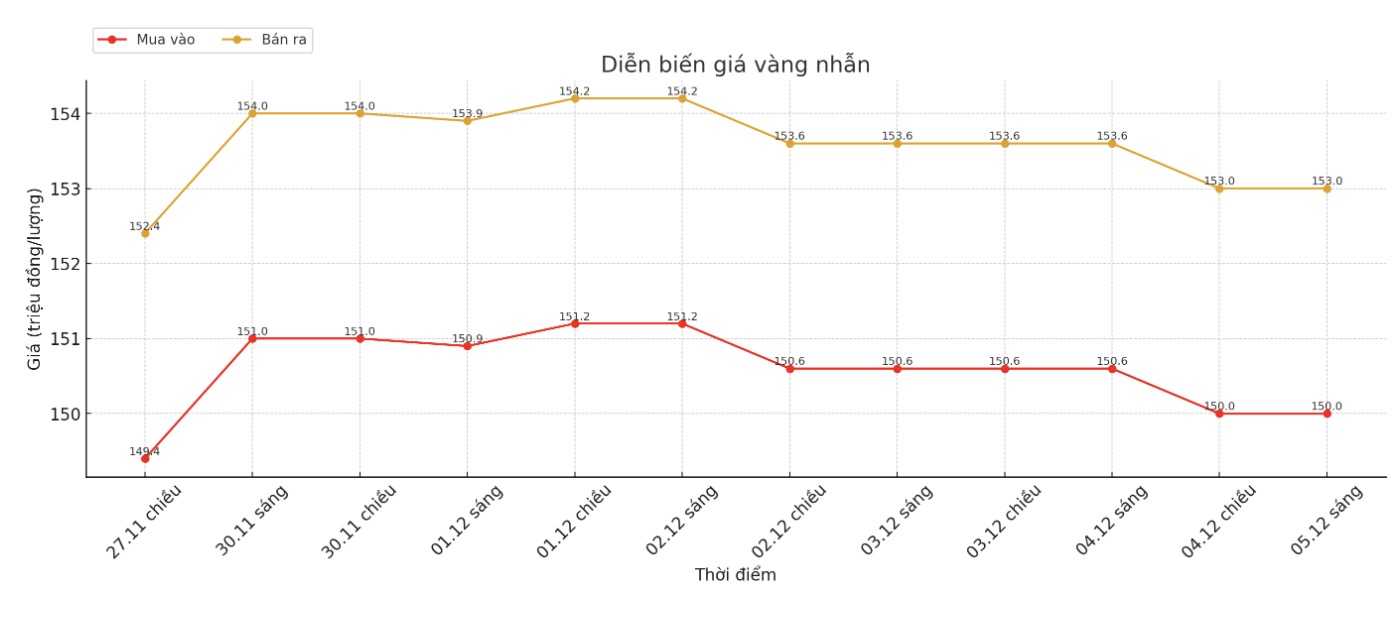

9999 round gold ring price

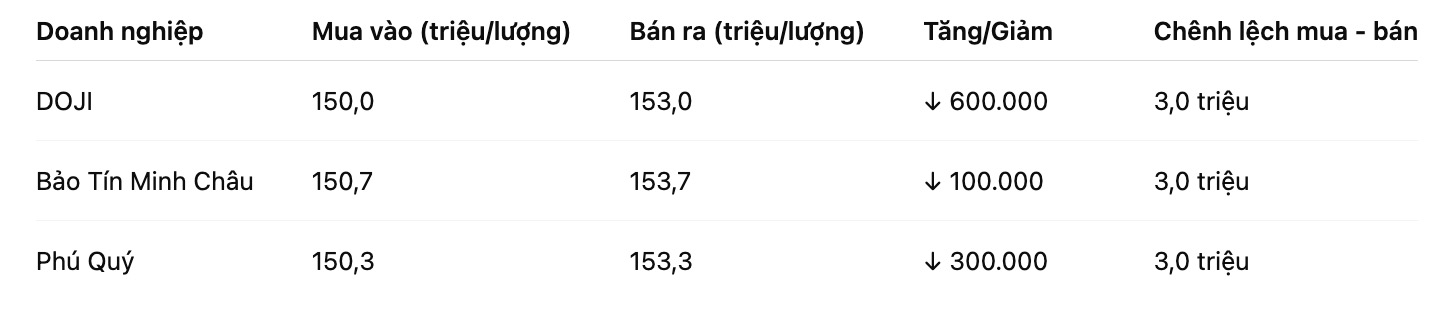

As of 9:10 a.m., DOJI Group listed the price of gold rings at 150-153 million VND/tael (buy - sell), down 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 150.7-153.7 million VND/tael (buy - sell), down 100,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 150.3-153.3 million VND/tael (buy - sell), down 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is at a high level, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

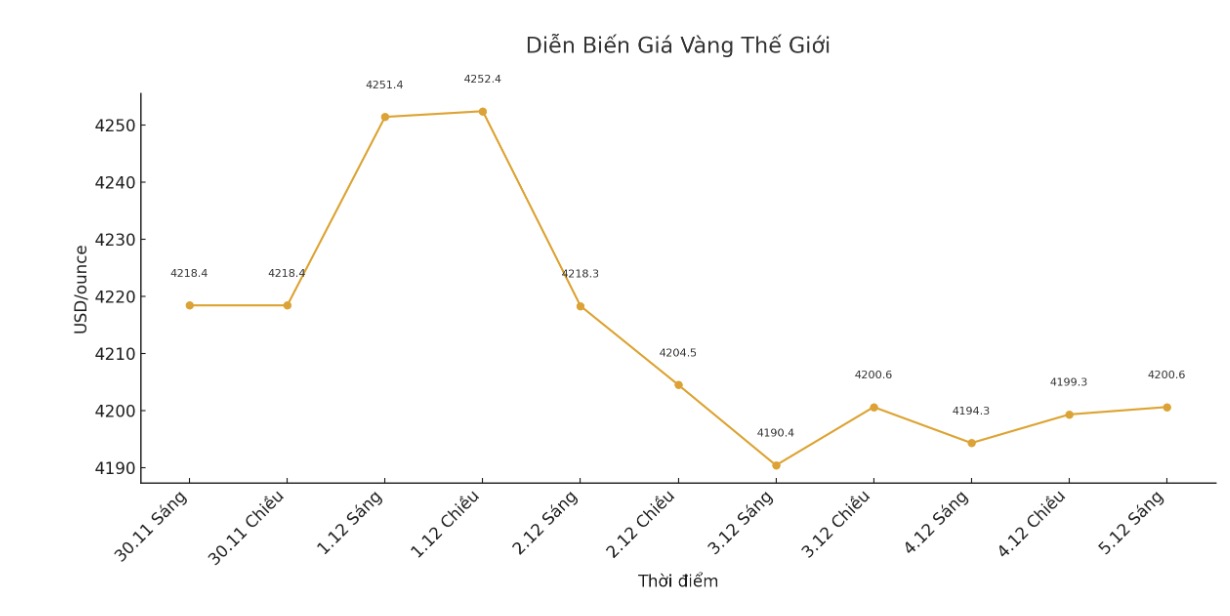

World gold price

At 9:10 a.m., the world gold price was listed around 4,200.000 USD/ounce, up 6.3 USD compared to a day ago.

Gold price forecast

After a short accumulation period, gold prices continued to show stability when forming a support zone around 4,200 USD per ounce.

According to Nitesh Shah - Director of Commodity and Macroeconomic Research at WisdomTree, the current developments of gold are completely consistent with the context of the global economy facing an increasing burden of public debt while the interest rate level tends to decrease.

He said investors expecting deep corrections may have to wait, as the precious metal is likely to continue to be supported by weakening economic prospects. This forces the US Federal Reserve (Fed) to enter a rate cut cycle, which could start from next week and last until 2026, thereby dragging both nominative and real bond yields lower and putting pressure on the USD.

From another perspective, ActivTrades analyst Ricardo Evangelista said that buying pressure in the gold market is still quite cautious as investors wait for PCE inflation data expected to be released on December 5. At the same time, the increasing risk-off sentiment in the stock market is also somewhat holding back the increase in gold prices.

The global stock market recorded a slight increase in the most recent session, thanks to expectations that the Fed's interest rate cut at the upcoming meeting will support the US economy, in the context of new data showing the pace of job growth slowing down.

Investors are now focusing on US weekly jobless claims and the September personal consumption expenditure (PCE) report, which has been postponed, due today. This is considered the last important macro data ahead of the FOMC meeting next week.

Technically, the next upside target for February gold buyers is a solid breakout close at a record high for the contract: $4,433/ounce. The near-term downside target for the bears is to push prices below the strong technical support level at $4,100/ounce.

The first resistance level was an overnight high of $4,246.9/ounce, followed by a high of $4,273.3/ounce on Wednesday. First support was at $4,200 an ounce, followed by a low on Tuesday: $4,194 an ounce.

Note: Gold price data is compared to a day earlier.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are quoted for transactions and spot deliveries.

Second is the futures contract market, which sets prices for future deliveries. Due to year-end book-taking activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...