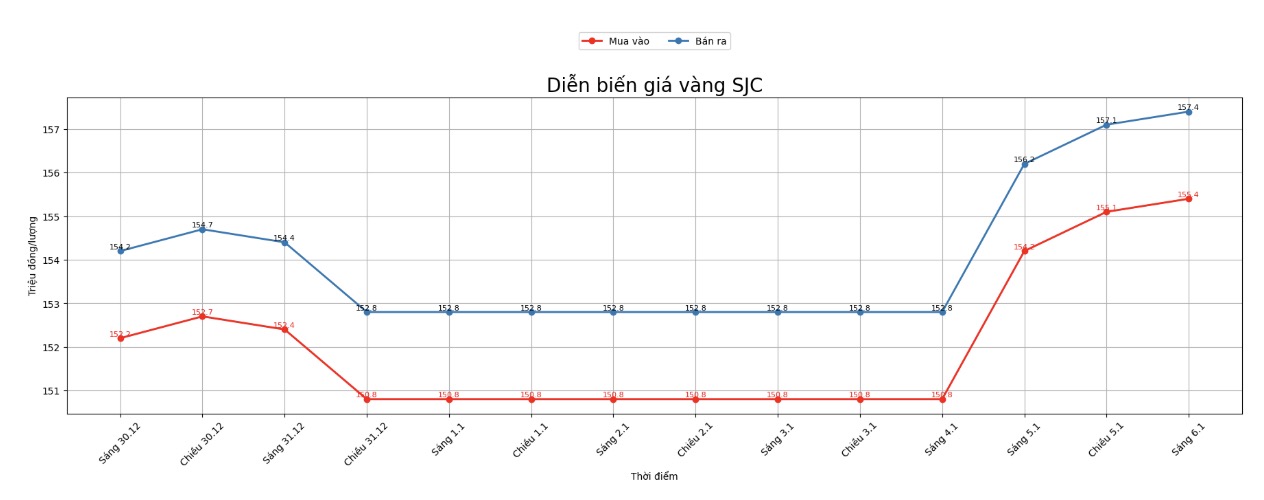

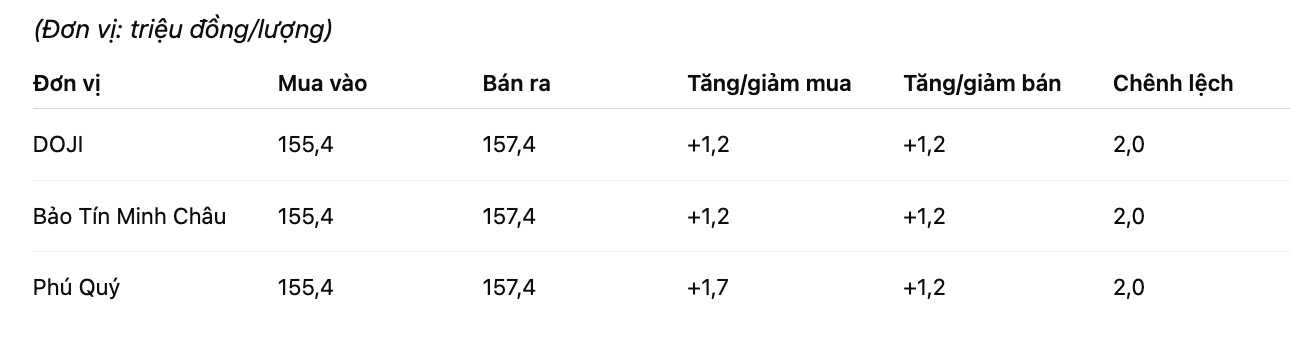

SJC gold bar price

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at the threshold of 155.4-157.4 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 155.4-15.4 million VND/tael (buying - selling), an increase of 1.2 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at the threshold of 155.4-15.4 million VND/tael (buying - selling), an increase of 1.7 million VND/tael on the buying side and an increase of 1.2 million VND/tael on the selling side. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

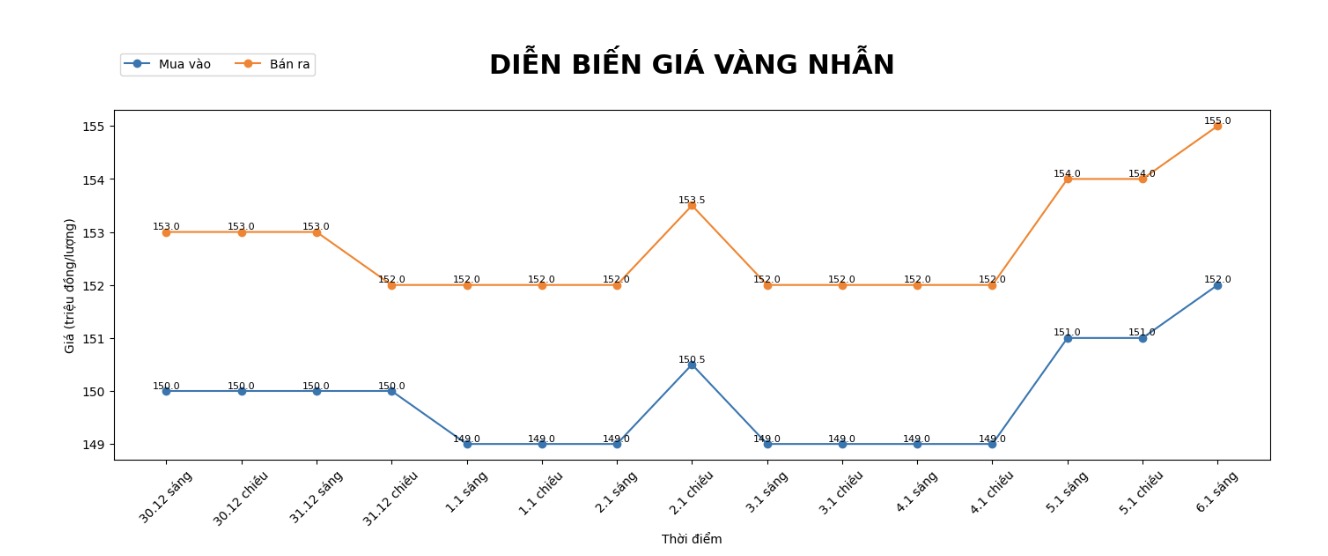

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at the threshold of 152-155 million VND/tael (buying - selling), an increase of 1 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 155-158 million VND/tael (buying - selling), an increase of 1.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 152.5-155.5 million VND/tael (buying - selling), an increase of 1.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

The high buying - selling gap increases the risk for individual investors. Individual investors, especially those with a "surfing" mentality, need to consider carefully before spending money.

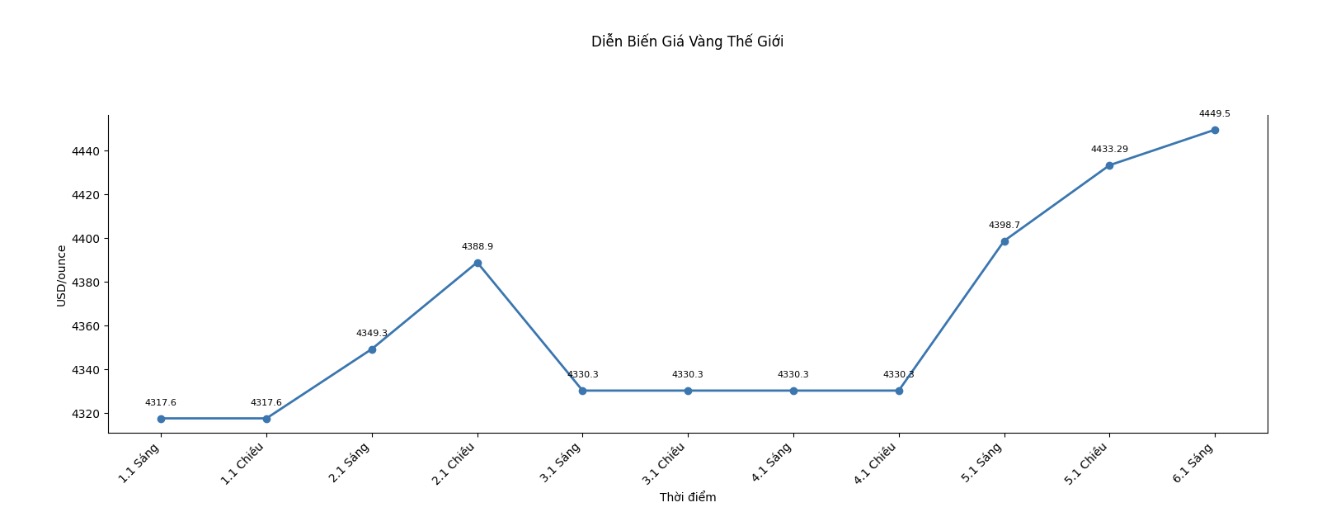

World gold price

At 9:00 AM, world gold prices were listed around the threshold of 4,449.5 USD/ounce, up 50.8 USD compared to the previous day.

Gold price forecast

The strong increase in gold prices in recent times shows that the precious metal is still being supported by many fundamental factors, from geopolitical instability to public debt pressure and global monetary policy. However, according to experts, the hot period may gradually give way to a slower upward trend in the near future.

Mr. Aakash Doshi - Head of Gold Strategy at State Street Investment Management, said that 2025 marked the strongest increase in gold prices since 1979.

However, entering 2026, the basic scenario he put forward is that gold prices will continue to increase but at a more moderate pace, fluctuating in the 4,500-4,600 USD/ounce range.

Notably, Mr. Doshi believes that the long-term trend of gold is still leaning towards positive, with a higher probability of strong increase than the possibility of deep decline, thanks to a fairly solid structural support zone around the 3,600-3,700 USD/ounce mark.

One of the key drivers of the gold market today comes from the expansion of global debt, in the context of persistent inflation and increased fiscal spending.

According to Mr. Doshi, when bond yields increase due to inflationary pressure instead of real economic growth, gold emerges as an effective hedging tool, gradually replacing the traditional role of bonds in the investment portfolio.

From another perspective, Mr. Chris Mancini - co-managing director of Gabelli Gold Fund, believes that high gold prices are not only beneficial for physical gold but also open up opportunities for stocks of mining enterprises. According to him, the gold mining industry is creating a very large free cash flow, while stock valuations still reflect long-standing caution from the past.

If businesses shift their focus to paying stable dividends instead of just buying back shares, gold stocks may become more attractive to investors seeking income in a declining interest rate environment.

Although the outlook is still positive, experts note that short-term risks may come from a stronger USD or weakening physical gold demand in Asia as prices remain high.

In that context, domestic investors need to be cautious, especially when the buying - selling price difference between gold bars and gold rings is still high, increasing the risk for short-term "surfing" decisions.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...