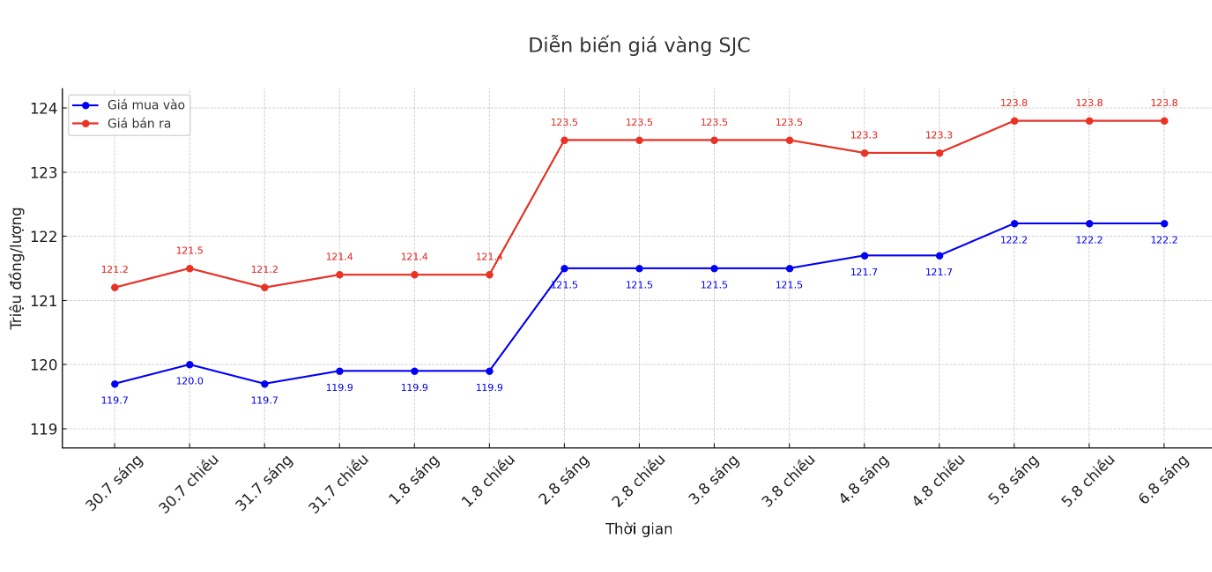

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 122.2-123.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.6 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 122.2-123.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 1.6 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 121.2-123.8 million VND/tael (buy in - sell out), unchanged in both directions. The difference between buying and selling prices is at 2.6 million VND/tael.

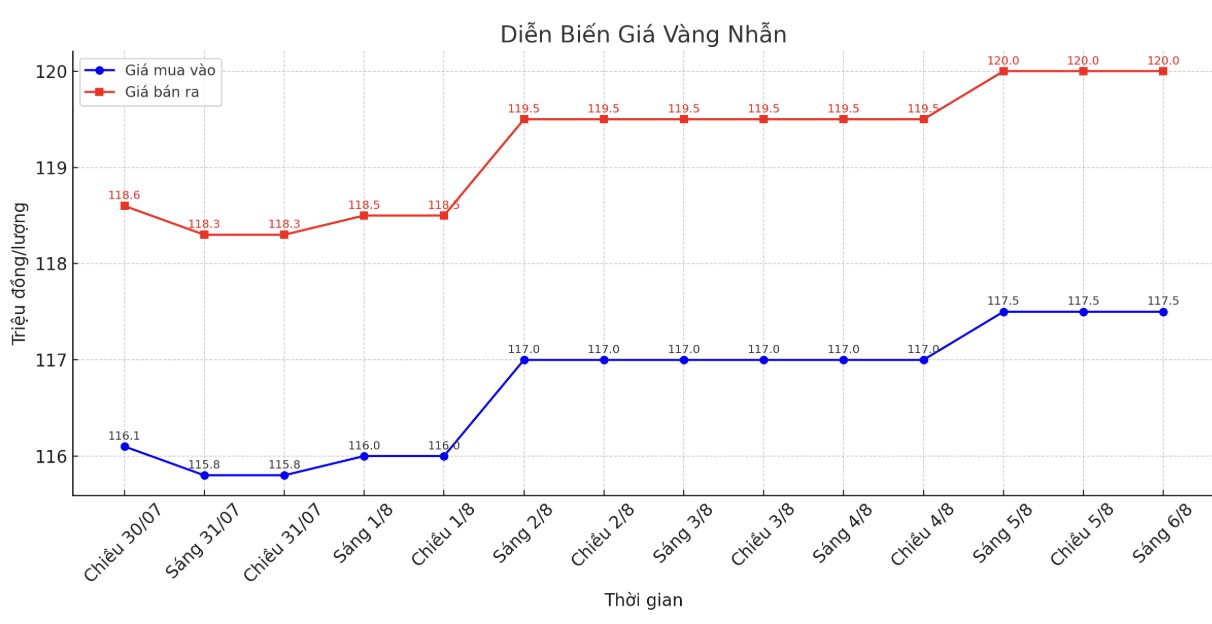

9999 round gold ring price

As of 9:00 a.m., DOJI Group listed the price of gold rings at 117.5-120 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.8-120.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.9-1199.5 million VND/tael (buy in - sell out), an increase of 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

The buying-selling gap is pushed up too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

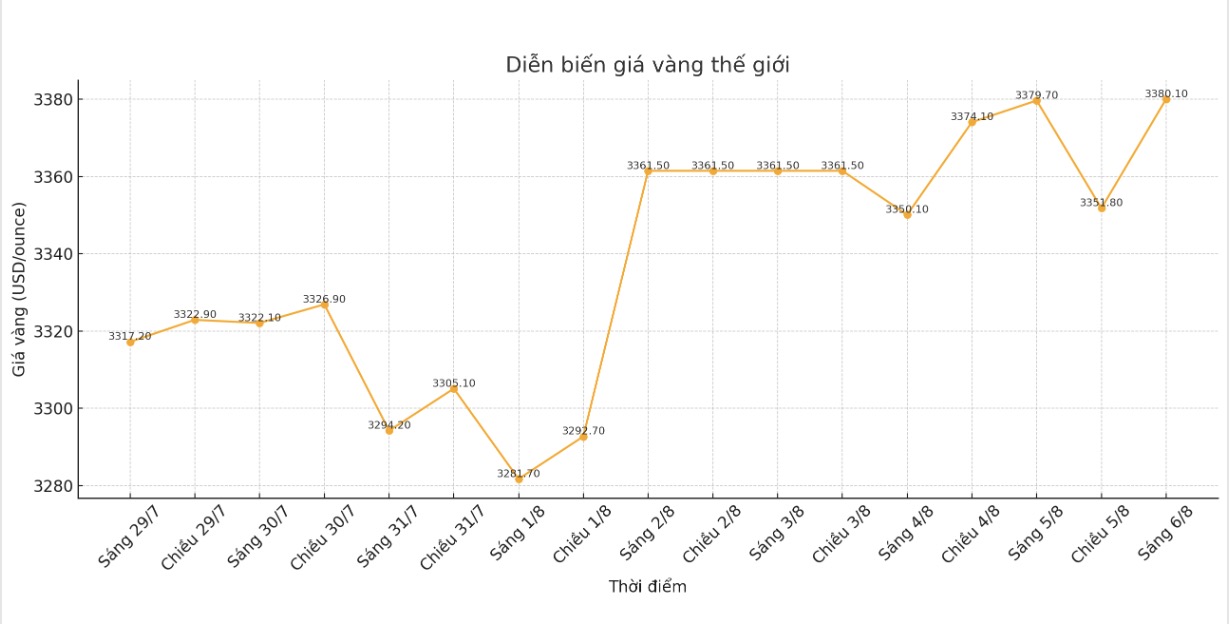

World gold price

At 8:50 a.m., the world gold price was listed around 3,380.1 USD/ounce, not much changed compared to a day ago.

Gold price forecast

Citigroup (a US multinational financial group) has just raised its forecast for world gold prices to $3,500/ounce in the next 3 months, from $3,300/ounce in June 2025, with an adjusted trading floor increasing from $3,100 - $3,500/ounce to $3,300 - $3,600/ounce.

The main reasons include concerns about US economic growth, high inflation due to US President Donald Trump's tariff policies and a weakening USD.

WisdomTree (a US-based ETF issuer and asset management company) believes that there are 5 major economic factors that could continue to push gold prices to record highs.

If the Trump administration is truly pursuing a policy of devaluing the US dollar, then the $5,355/ounce by the end of June 2026 (up to 58.6% compared to the present) will be a rather reserved forecast.

According to the World Gold Council (WGC), central banks net bought 22 tonnes of gold in June, reaching a total of 123 tonnes in the first half of the year.

Demand for gold from countries remained stable in June, ending the first half of the year with a positive performance, according to the latest gold statistics report from the WGC.

Mr. Krishan Gopaul - senior EMEA analyst at WGC said: "Central banks reported net buying 22 tons of gold in June through the IMF and other public data sources. Based on available data, demand has increased slightly monthly for the third consecutive month.

According to Mr. Gopaul, central banks have net bought a total of 123 tons of gold in the first half of 2025, down slightly compared to the same period in 2024.

On Wednesday, the US will auction a 10-year Treasury note an event that could affect bond yields and the US dollar, thereby affecting gold prices.

On Thursday, investors will monitor the Bank of England's monetary policy decision, along with the US weekly jobless claims report - an indicator of labor market health. This information will provide more clues on the interest rate management roadmap of major economies, thereby affecting market sentiment and fluctuations in precious metal prices.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...