Although the risk of price decrease in the short term is still high, many experts believe that the foundational drivers for the long-term upward trend are still intact.

This positive outlook is given in the context that the precious metal market continues to experience a period of extreme volatility. Gold has just recorded the second largest weekly trading range in history, second only to the historic drop of the previous week.

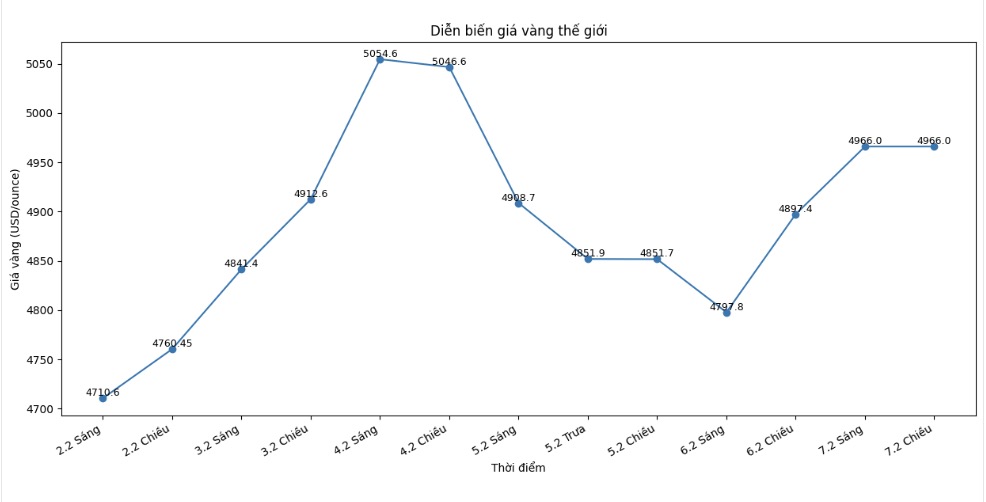

Price movements show one of the most chaotic daily trading periods in many years, when the first session of the week witnessed a continuous selling wave, causing gold prices to plummet by 10.84% during the day, from the session peak to near 4,400 USD/ounce.

Throughout the period of strong fluctuations, gold could not maintain its upward momentum above the 5,000 USD/ounce mark. The nearest spot gold price was at 4,651.1 USD/ounce, up more than 3% in the day. Compared to the end of last week, gold prices are currently about 1% higher.

Meanwhile, silver fluctuates even more violently. On Thursday, this metal recorded a daytime fluctuation range of up to 27.8% - in stark contrast to the fluctuation of just over 2%/day, which has been considered normal for the past 6 years.

Spot silver prices also did not hold the 90 USD/ounce mark. Despite strong selling pressure at the beginning of Friday, silver prices then traded around 77 USD/ounce, up more than 8% during the day. However, for the whole week, silver prices still fell by more than 9%.

Mr. Naeem Aslam - Investment Director at Zaye Capital Markets, believes that gold prices may fall to 3,800 USD/ounce to form a new bottom. However, he still sees buying opportunities even at current prices.

At the current price level, using a portion of the'cash reserve' is reasonable – because the price is much lower than the historical peak, and it is highly likely that the highest peak this year will far exceed the current level," he said.

Although optimistic sentiment still prevails, experts warn investors to prepare mentally for another week of strong fluctuations, as the market closely monitors the jobs and inflation data released late.

These are two key indicators that the US Federal Reserve (Fed) is monitoring in the context of maintaining a neutral monetary policy stance. The Fed remains cautious in reducing interest rates as inflation remains "stubborn" and the labor market remains relatively healthy.

Currently, the market expects the Fed to resume its easing cycle in June. Economic data that may delay this time will be detrimental to gold prices.

In addition to the United States, investors will also closely monitor the upcoming election in Japan. The election results may signal a strong shift to a more loose fiscal policy, including tax cuts and increased public spending, as Japan bears one of the highest public debts in the world.

Experts believe that a broader fiscal stance could put pressure on Japanese government bonds, weaken the yen and make efforts to normalize monetary policy by the Bank of Japan more complex.

According to analysts, gold may witness a new wave of global demand as investors seek shelter from the risk of currency devaluation and growing concerns about the sustainability of public debt.

Ms. Barbara Lambrecht - commodity analyst at Commerzbank - said that investors in the precious metals market are still looking for a clear direction.

Price fluctuations are likely to remain high in the near future. However, in the medium term, we believe that precious metal prices are still supported quite well," she assessed.

Mr. Michael Brown - senior market analyst at Pepperstone - said that the implied monthly volatility of silver is currently even higher than Bitcoin. Although the market is accumulating in a wide range, he still expects the corrections to attract buying power.

The important thing is that the price is still maintained above the 50-day moving average, showing that the current momentum is still slightly leaning towards the buyer. I think the story of price increases in terms of foundation is still very solid, but the market needs a sideways phase to confirm that the recent speculative fever has actually cooled down" - he said.