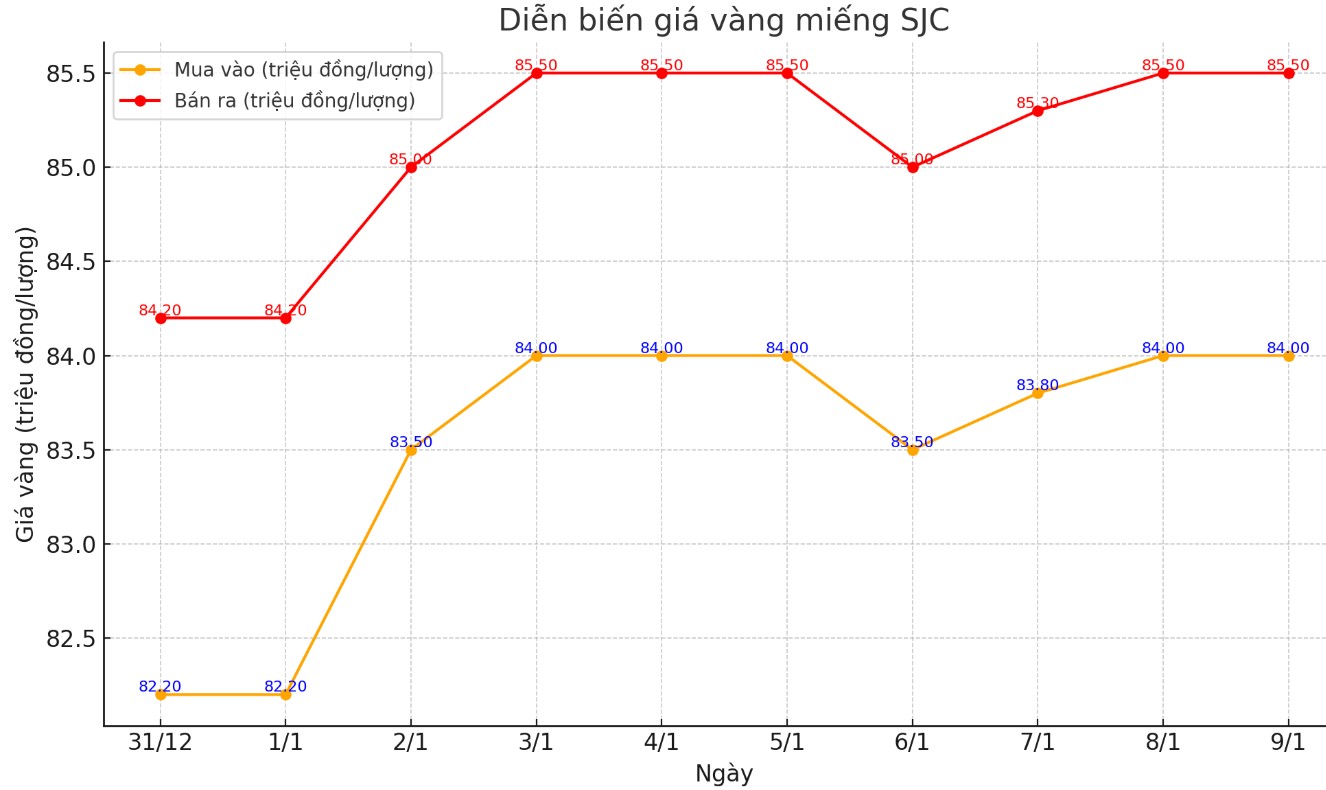

Update SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND84-85.5 million/tael (buy - sell); an increase of VND200,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84-85.5 million VND/tael (buy - sell); an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.2-85.5 million VND/tael (buy - sell); increased 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 1.3 million VND/tael.

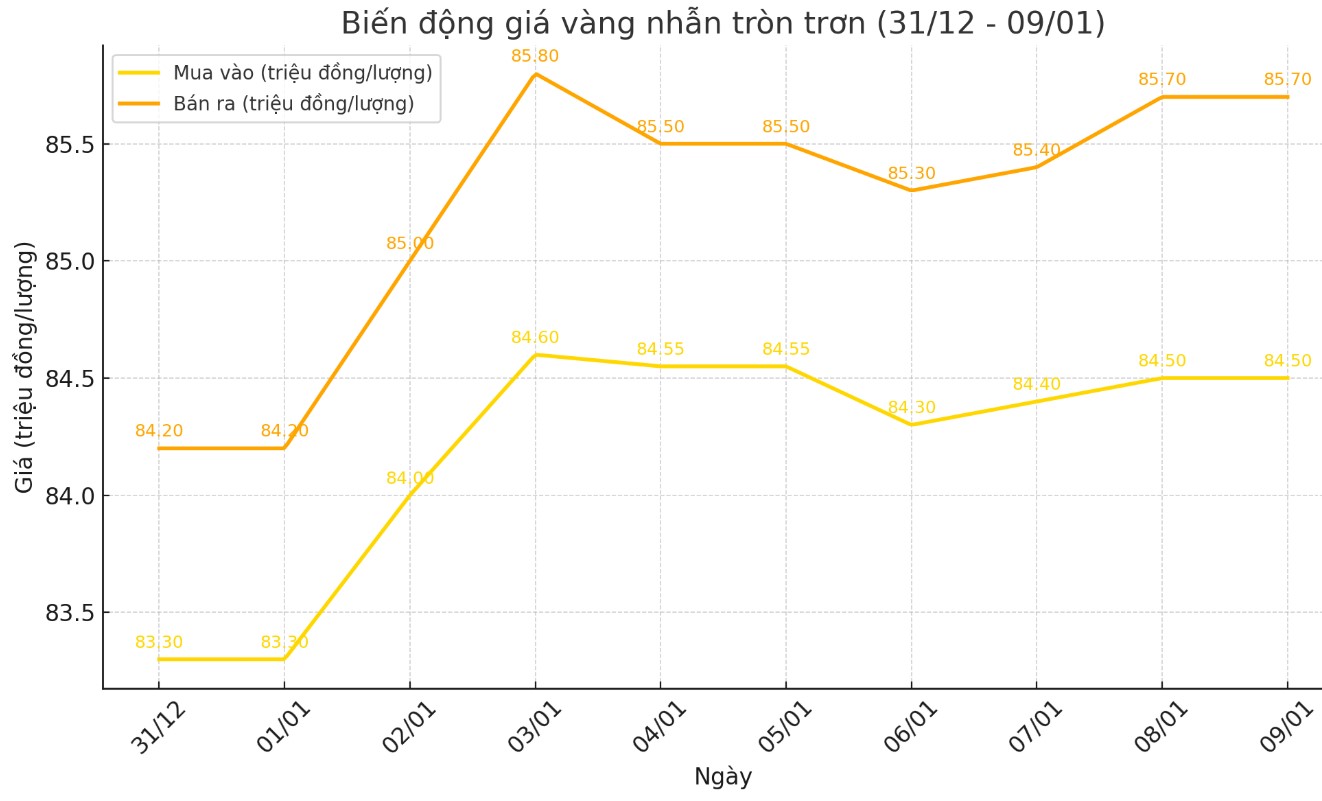

Price of round gold ring 9999

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84.5-85.7 million VND/tael (buy - sell); an increase of 100,000 VND/tael for buying and an increase of 30,000 VND/tael for selling compared to the beginning of the trading session yesterday afternoon.

Bao Tin Minh Chau listed the price of gold rings at 84.7-85.9 million VND/tael (buy - sell), an increase of 300,000 VND/tael for both buying and selling compared to the beginning of the trading session yesterday afternoon.

World gold price

As of 1:00 a.m. on January 9 (Vietnam time), the world gold price listed on Kitco was at 2,657 USD/ounce, up 6.6 USD/ounce compared to the beginning of the trading session yesterday morning.

Gold Price Forecast

World gold prices have increased despite the strong increase in the USD. At 1:00 a.m. on January 9, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, stood at 108,900 points (up 0.48%).

News that the People’s Bank of China resumed buying gold reserves was a factor supporting the precious metal’s price increase. The February gold contract rose $15.1 to $2,680.5 an ounce.

The key data in the US midweek is the minutes of the Federal Open Market Committee (FOMC) meeting. The stock market and the US government will be closed on Thursday to commemorate former President Jimmy Carter.

In overnight news, Bloomberg reported that a growing number of fund managers are warning that the revaluation of the US Treasury bond market may not be over yet, despite the US Federal Reserve's recent interest rate cut.

The market is expecting the yield on the 10-year US Treasury bond to rise to 5%. Meanwhile, the yield on the Chinese 10-year bond is currently 3 percentage points lower than the US 10-year bond.

Chinese investors are turning to the domestic bond market amid concerns about the country’s slowing economy. The yuan continues to fall despite the People’s Bank of China’s intervention to stabilize the currency.

The key US data of the week is the December jobs report due on Friday. The report is expected to show non-farm payrolls rose by 160,000, compared to the 227,000 increase in November's report.

Major outside markets today saw Nymex crude oil futures edge down after hitting a three-month high overnight, currently trading around $73.75 a barrel. The yield on the 10-year US Treasury note continued to rise, currently around 4.68%.

Technically, February gold futures are in the ascending position in the near term. The next upside price objective for bulls is to close above strong resistance at $2,700/oz. The downside price objective for bears is to push futures below strong technical support at the November low at $2,565/oz.

See more news related to gold prices HERE...