Matt Simpson, senior expert at City Index, said the ADP's weak employment data has reinforced the possibility of the US Federal Reserve cutting interest rates, while the US government's closure is supporting gold's safe-haven role.

According to CME FedWatch, traders are almost certain that the FED will cut 25 basis points this month.

Meanwhile, Chicago Fed President Austan Goolsbee warned against cautiousness with rate cuts amid concerns about inflation.

However, Goldman Sachs believes that the risk of gold price rising beyond forecasts is increasing, possibly reaching over 4,000 USD/ounce by mid-2026 thanks to ETF capital flow and speculative buying power.

Similarly, commodity analysts at BMO Capital Markets (investment banking and capital market services bank of Montreal - one of the largest financial groups in Canada) have just released a Q4 price forecast, with a strong correction for gold.

The bank expects gold prices to average around $3,900 an ounce in the last three months of 2025, up 8% from its forecast. Gold prices are expected to continue to rise, surpassing $4,000/ounce next year.

BMO raised its forecast for the average gold price in 2026 to $4,400/ounce, up 26% from the previous estimate. In the long term, the bank believes that gold prices will remain around $3,000/ounce, instead of $2,200 as previously forecast.

In another development, the SPDR Gold Trust said its holdings have increased by 0.59% to 1,018.89 tons - the highest since July 2022.

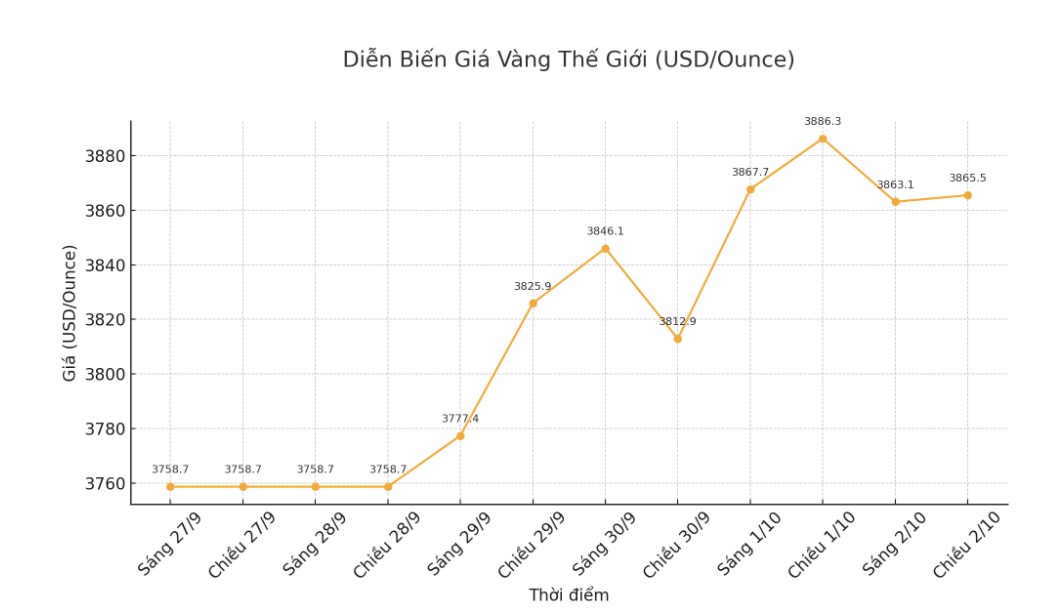

The spot gold price at 15:07 on October 2 (Vietnam time) remained at a high level of 3,865.5 USD/ounce. In the other metals market, silver rose 0.1% to $47.38/ounce, platinum rose 0.7% to $1,567.41/ounce, and palladium rose 2.4% to $1,274.68/ounce.

See more news related to gold prices HERE...