In its annual report Precious Metals Investment Focus, Metals Focus analysis team said that prolonged economic uncertainty will continue to be an important factor supporting gold prices next year.

Following developments in 2025, uncertainty over US trade policy and the impact on the global economy are expected to remain the main psychological driver for gold, the report said.

At the same time, investment demand from retail investors is expected to remain strong, as the US Federal Reserve (FED) continues to ease in the context of high inflation, causing the opportunity cost of gold - non-interest-bearing assets - to decrease.

Trade tensions, inflation risks and fragile confidence will continue to boost safe-haven demand, while fiscal pressures and doubts about the Feds independence reduce the attractiveness of the US dollar.

Even if the rate of interest rate cuts is not as strong as expected, real yields are lower, geopolitical tensions and central bank gold purchases are still enough to put gold prices on a new record" - the expert group commented.

Metals Focus forecasts that the average gold price in 2026 will be around 4,560 USD/ounce, up 40% compared to the average since the beginning of the year.

According to the report, this positive outlook reflects the fact that the proportion of gold allocation in investors' portfolios is still much lower than the period after the 2008 financial crisis, showing that there is still a large room for cash flow into gold - especially in the medium and long term vision.

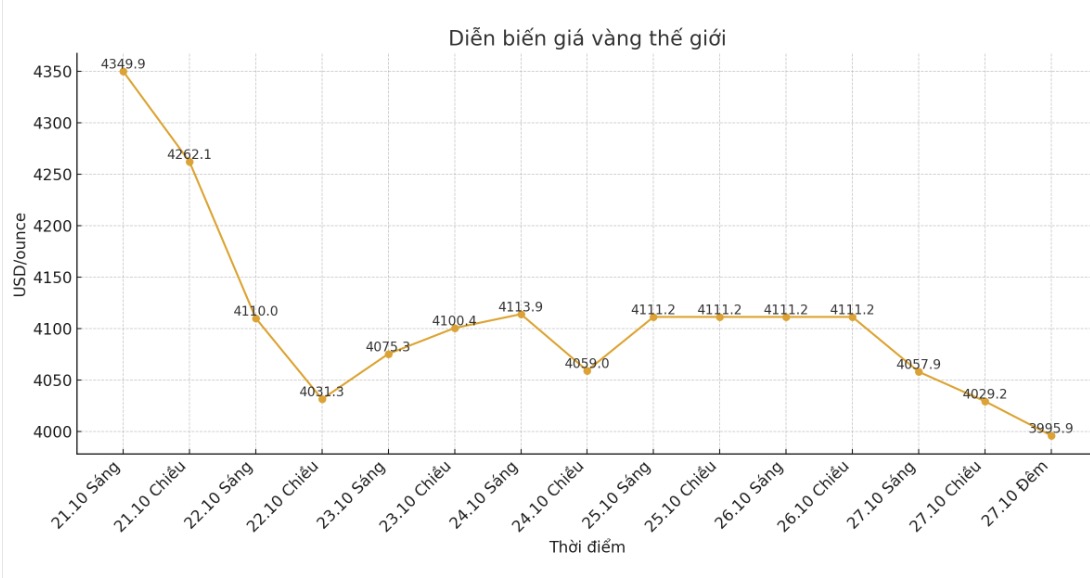

An optimistic forecast was released amid difficulties in gold prices at the start of the week. Spot gold is currently around $3,975/ounce, down more than 3% in the session and extending last week's 3% loss.

Not only gold, Metals Focus also has a positive outlook for silver, saying prices could rise to $60 an ounce next year, with an average price for the whole year estimated at $77/ounce.

At the beginning of the new week, silver continued to plummet: spot prices were at 46.28 USD/ounce, down more than 4% in the session after losing 6% last week.

Although silver has room to increase significantly, experts believe that gold will be superior in 2026, especially in the second half of the year.

We believe that in the early stages of the forecast, silver may continue to outperform gold, causing the gold/esilient ratio to decrease further; however, from mid-2026 onwards, this trend may reverse.

Whether it is due to the stagnating increase in copper, too high a price for silver, causing demand to decrease or inventories from East Asia flocking to London, or the demand for gold in India cooling down - gold will return to lead the market.

Industrial demand is forecast to remain a key role for silver in 2026, although businesses are looking to reduce use and replace it with cheaper materials.

Although efforts have been made to reduce silver consumption due to record high prices, many industries need time to adjust, so demand will not decrease immediately. In addition, the decline from the reduction will be partly offset by the recovery in investment demand, especially in India, said Metals Focus.

According to the report, strong demand for silver continues to put pressure on the global precious metals supply chain.

Last year, US President Donald Trump's tax declarations caused a spike in silver in New York's reserves, leading to a shortage of physical metals in London.

Increased investment demand and record imports into India continue to exhaust inventories in London, causing spot prices to be much higher than CME futures. Meanwhile, silver rental interest rates have hit a record high.

Physical liquidity in the London market is likely to remain tight in the short term, due to strong investment demand and demand from India, structural deficits and policy uncertainty that keep a large amount of silver in the US, the report concluded.

See more news related to gold prices HERE...