Gold prices continue to hold support above $3,200/ounce and could see further gains as weaker inflation data creates space for the Fed to cut interest rates to support the weakening US economy.

The consumer price index (CPI) has risen 0.2% over the past month, after falling 0.1% in March, according to the US Bureau of Labor Statistics on Tuesday. Inflation data was lower than expected, with economists expected to increase by 0.3%.

The report said that general inflation has increased by 2.3% over the past 12 months, down slightly from 2.4% in March. Economists expect annual inflation to remain unchanged.

The April increase is the smallest 12-month increase since February 2021, the report said.

The core CPI, which excludes volatile food and energy factors, also rose 0.2% last month, below expectations. Economists expect the core CPI to increase by 0.3%.

For the year, the core CPI remained at a high level of 2.8%, unchanged from the previous month.

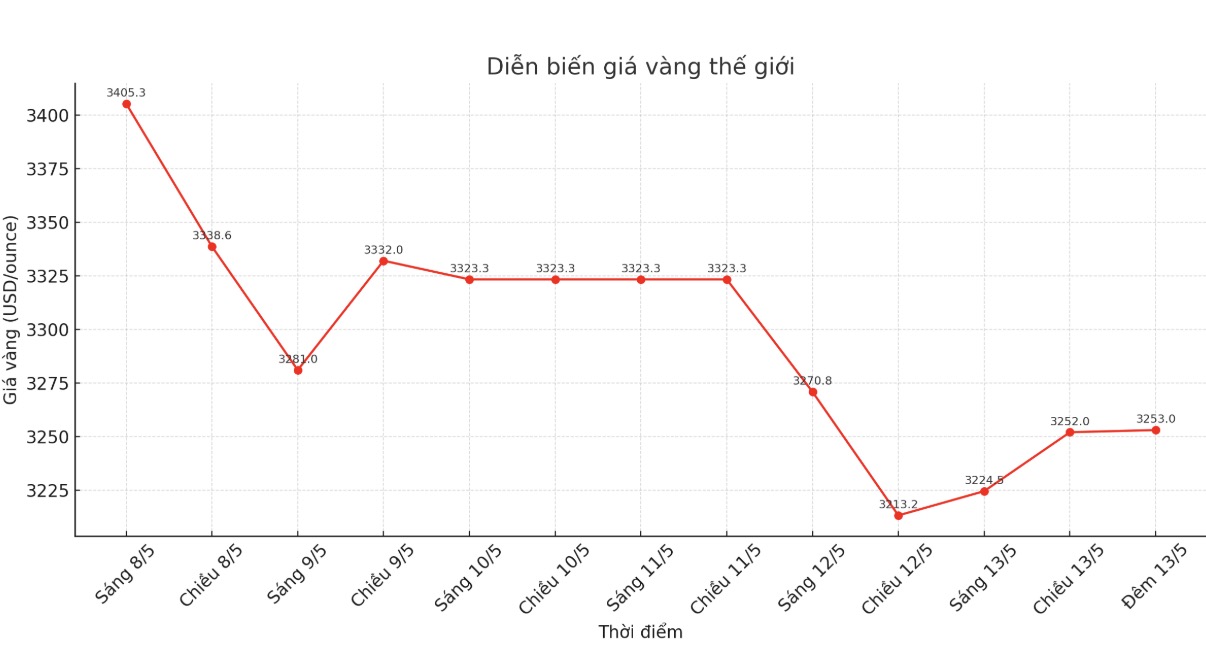

The gold market is seeing a modest buy after releasing inflation data, however, prices are still held back within a narrow range.

Although analysts do not expect the new inflation data to prompt the Fed to change policy, some economists believe that this data gives central banks space to act if economic data continues to be weak.

Some analysts also believe that improved trade negotiations between China and the US, along with a reduction in import tariffs in the next 90 days, will still have a greater impact on market sentiment than economic data.

Regarding the general inflation trend, the report said that housing costs were the main factor increasing consumer prices in the past month. The housing index increased by 0.3%, accounting for more than half of the total increase in the month.

Meanwhile, weak energy prices continue to bring a decrease to consumers. The report said the energy index fell 3.7% in April.

Jeffrey Roach - Chief Economist at LPL Financial commented that, although market sentiment has improved, global financial markets still face many uncertainties.

Improving global trade will provide more clarity on the future inflation path. However, uncertainty over what will happen after the temporary trade deals makes it difficult for the Fed to make decisions, as the risk of economic stagnation still exists.

If the situation is not resolved, the Fed may not be able to adjust policy in June," he said in a note.