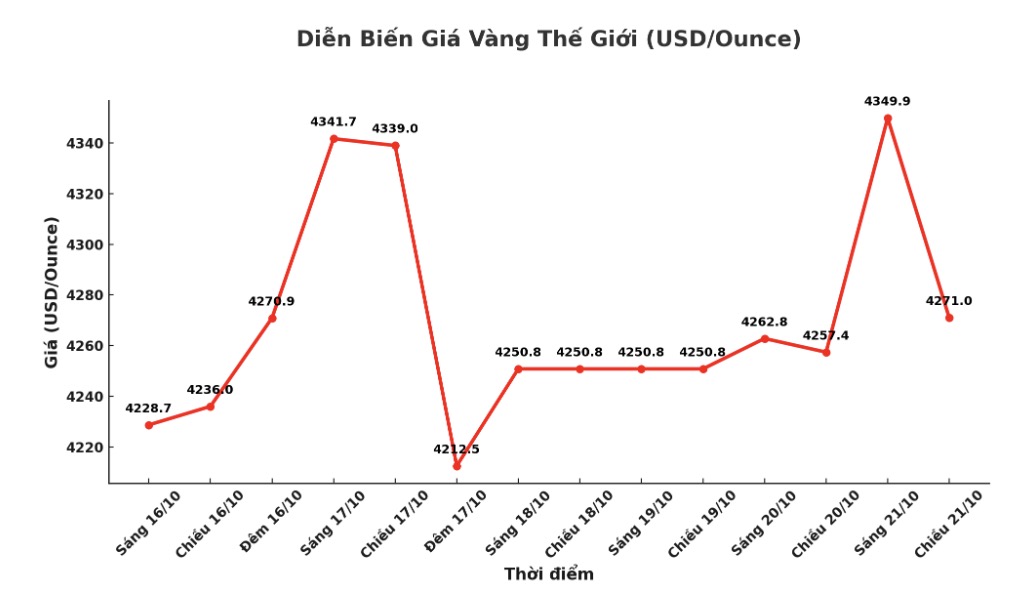

Gold futures set a new record for Monday's trading session, recovering strongly after a drop of more than $75 on Friday - the largest one-day decline since April 4, 2025. The strong fluctuations of this precious metal reflect investors' growing concerns about a series of simultaneous risks that the US economy is facing.

Earlier in the second session, gold futures surpassed a one-day gain that was previously recorded on Thursday. Although prices have adjusted slightly from the end-of-session peak, the precious metal is still trading about 100 USD higher at the end of the session, emphasizing strong demand for safe-haven assets.

Thursday's strong rally coincided with reports of serious loopholes in the banking sector. Two regional financial institutions California Bank & Trust and Western Alliance have revealed their involvement in a large-scale credit fraud case, which has raised new concerns about credit quality and risk management activities in the regional banking system.

According to court records, California Bank & Trust granted two revolving credit limits to investment funds in 2016 and 2017 with a total value of more than $60 million. These credits are designed to finance the buyback of commercial mortgages in difficulty, with contract terms ensuring the number one priority for all mortgaged assets, including each mortgage loan purchased by the borrower's investment funds.

However, the investigation process later discovered many serious violations. The lending party discovered that many debt securities and collateral had been transferred to other legal entities without valid permission. Many of these assets had been processed for debt collection or were in the process of being processed at the time the lawsuit was filed.

Western Alliance also encountered similar problems in its lending portfolio. This bank discovered that mortgaged assets that were said to be secured by top-notch mortgages had not actually held that position. The lawsuit accuses the borrower of forging property ownership insurance contracts by deliberately concealing the existence of higher-level collateral, which will put the bank's collateral behind.

The fraud case does not stop at distorting information about mortgaged property. According to legal documents, the borrower has withdrawn money systematically from accounts designated as additional assets. As of August 18, the borrower's account at Western Alliance only has more than 1,000 USD, completely opposite to the minimum monthly average balance of 2 million USD according to the contract.

These revelations have increased traders' concerns about the stability of the US financial system, especially in the context of memories of the regional banking crisis in 2023 that are still very new. As a result, capital flows strongly to safe-haven assets, thereby pushing demand for gold - a traditional safe-haven asset - to skyrocket.

However, the banking crisis is only part of a broader risk environment that is fueling gold's rally. The US government has yet to approve plans to reopen after 10 consecutive failed votes, raising uncertainty regarding the operations of key agencies and the debt ceiling. At the same time, escalating trade tensions between the US and China continue to put pressure on economic growth prospects and corporate profit expectations.

The combination of factors such as financial risks, political instability and geopolitical tensions has created a particularly favorable environment for gold prices. The precious metal has continuously set new records with unprecedented frequency, and analysts believe that if the above fundamental factors continue, gold prices could reach $4,500/ounce in the short term.

Investors will continue to closely monitor developments in all three risk groups to seek signals of the possibility of resolution or further escalation in the coming time.