According to Kitco, the market witnessed a strong price increase. All assets affected in previous trading sessions increased sharply. This comes after news that US tariffs, apart from China, will be postponed for 90 days.

US President Donald Trump announced on social media at 1:30 p.m. on April 9 (local time) about the decision to postpone the 90-day tax because more than 75 trade partners have not paid and have contacted the US to "discuss" some of the issues he has raised.

I have put a 9-day deadline on those who did not repay, because I told them, If you repay, we will double it, Trump said.

The 30-day tariff extension does not apply to China, which has imposed an 84% retaliatory tax on US goods. Instead, President Trump has raised tariffs on Chinese goods to 125%, effective immediately.

This news sent stock indexes soaring, with the S&P 500 and Dow Jones up 6% in just 15 minutes. Nasdaq which endured a sharp decline last week rose 6.5%. Bitcoin is also one of the assets that benefited greatly from the tariff announcement, with the cryptocurrency increasing by 3.34% over the same period of 15 minutes.

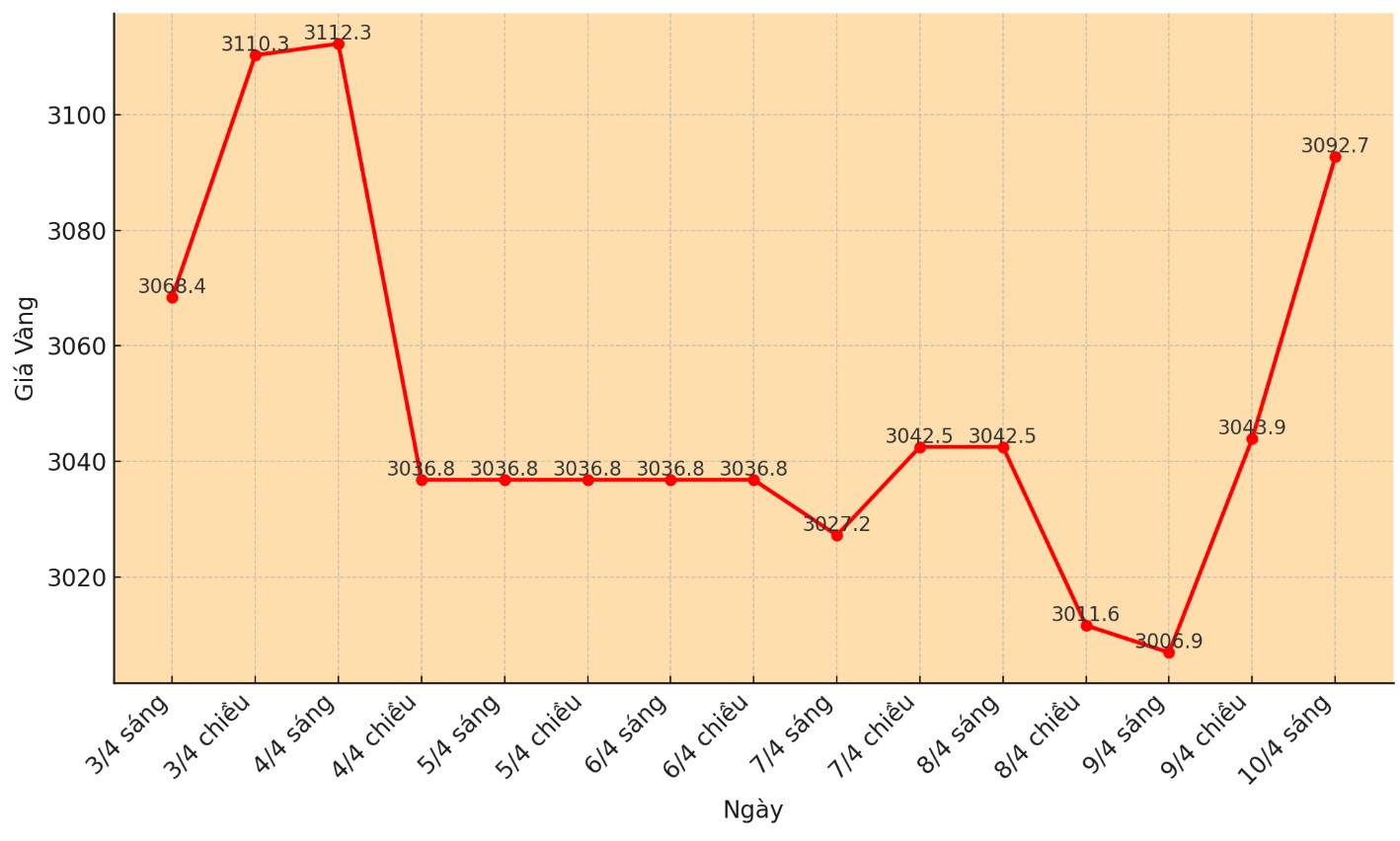

Precious metals prices have increased sharply ahead of Mr. Trump's surprise announcement. Gold prices have risen more than 3% to a record high of $3,099 an ounce just before the news was released.

However, even as seeking shelter eased, gold fell $50 in a matter of minutes. The money flow into the market then quickly brought gold back close to $3,100/ounce at 3:40 p.m. EDT.

Silver doubled its previous gains just minutes after the announcement, surpassing $31 an ounce and recording a gain of more than 4% on the daily chart.

Shortly after Trump announced the tariff postponement, Finance Minister Scott Bessent said it was a strategy for countries to come to negotiations.

We have seen the successful negotiation strategy that President Trump implemented a week ago which has brought more than 75 countries to the table for negotiations. Every country in the world wants to come and negotiate, we are ready to listen. We will reduce the basic tax rate to 10% for them," Bessent told reporters.

We will work with our trade partners to find a solution, he said.

Bessent said China was an exception, with the US tax rate on Chinese goods increasing to 125%.

Bessent said the tariffs on Chinese imports will increase to 125% - as Beijing "deberately escalates" when it announced an 84% increase in tariffs on US goods, a sharp increase compared to 34% previously. This comes after Trump's 104% tariffs on Chinese goods took effect in the early morning of April 9.

Despite the tax delay, the " turn-off" signals in Mr. Trump's tax policy are making it unpredictable for global businesses to predict and delay major investment decisions.

It is definitely an enemy of investment. As you prepare to pour billions of dollars into the US, even if the tariffs are lifted, the worry is still deep in your subconscious: Will this happen again?" - Mr. Scott Lincicome, a trade expert at the Cato Institute, shared with CBS MoneyWatch.