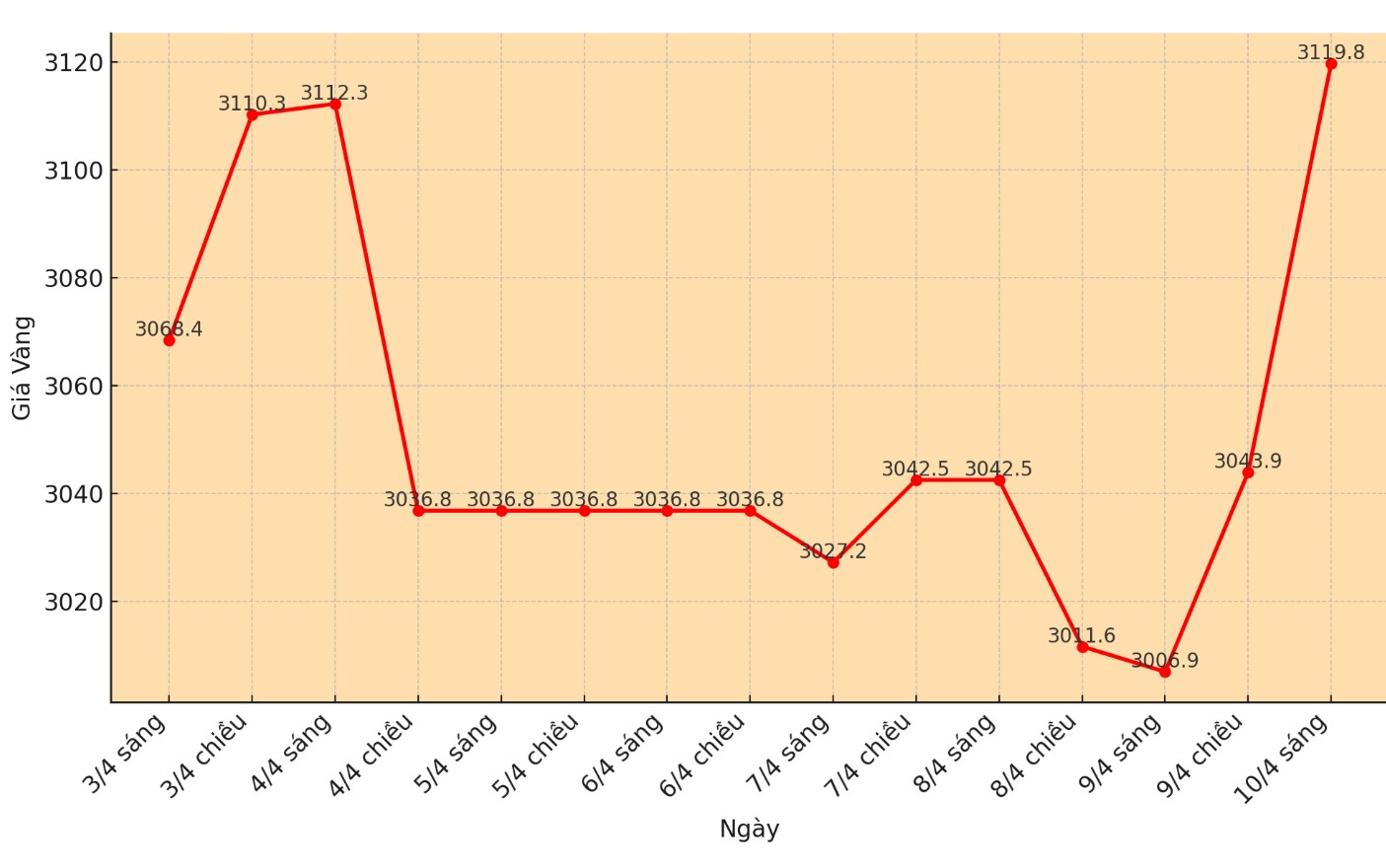

The gold market still maintained a significant increase of over $3,000/ounce, although investor sentiment improved after US President Donald Trump announced a temporary suspension of tariffs on imports for 90 days.

President Trump announced on social media at 1:30 p.m. on April 9 (local time) about the decision to postpone theorous imposition of the tariffs for 90 days because more than 75 trade partners have not paid and have contacted the US to "discuss" some of the issues he has raised.

The 30-day tariff extension does not apply to China, which has imposed an 84% retaliatory tax on US goods. Instead, President Trump has raised tariffs on Chinese goods to 125%, effective immediately.

The last spot gold price traded at 3,082 USD/ounce, up more than 3% on the day. Meanwhile, the S&P 500 closed Wednesday's session with an increase of nearly 10%. Silver also attracted attention when it increased by 4%, testing resistance at nearly 31 USD/ounce.

According to some analysts, gold is still maintaining a strong uptrend and is not expected to face great selling pressure, as some investors still want to keep safe-haven assets, although sentiment has improved.

This is not a clear time, traders will react quickly to news affecting market sentiment. In this context, with concerns about recession in the US and the forecast of the US Federal Reserve (FED) cutting interest rates by 0.25% four times, demand for gold as a safe-haven asset will continue to be high" - Ricardo Evangelista, senior analyst at ActivTrades, said.

Although the Trump administration has suspended global tariffs for 90 days, economists note that the trade war is not over yet. The US government has said it will maintain a basic tariffs of 10% for countries such as Canada, Mexico and the European Union. The US is also intensifying its trade war with China, imposing a 125% tariff on imports.

Some analysts say it will take time to recover for all the damage the tariffs have caused to global markets. Bill Adams, chief economist at Comerica Bank, said in a note that although the S&P 500 has recovered from lows, it has fallen 8% year-on-year.

Enterprises will feel relieved that trade policy may cause fewer disruptions than what happened yesterday. However, major policy uncertainty will impact investment and weak decision-making in the coming months.

In addition, a 125% tariff on imported goods from China will be a big problem for many businesses if they continue to exist. After the April tariff shock, uncertainty over trade policy could be a factor that hampers economic growth in 2025 rather than during the Trump administration's first term," Adams said in a note.

Jeffrey Roach, chief economist at LPL Financial, said he expects the economy to continue to struggle.

marking volatility may remain high, even though the 10-day tariff pause for countries that do not respond is punitive. Actual data from the beginning of the year shows that the economy is slowing down, despite trade policies, he said.