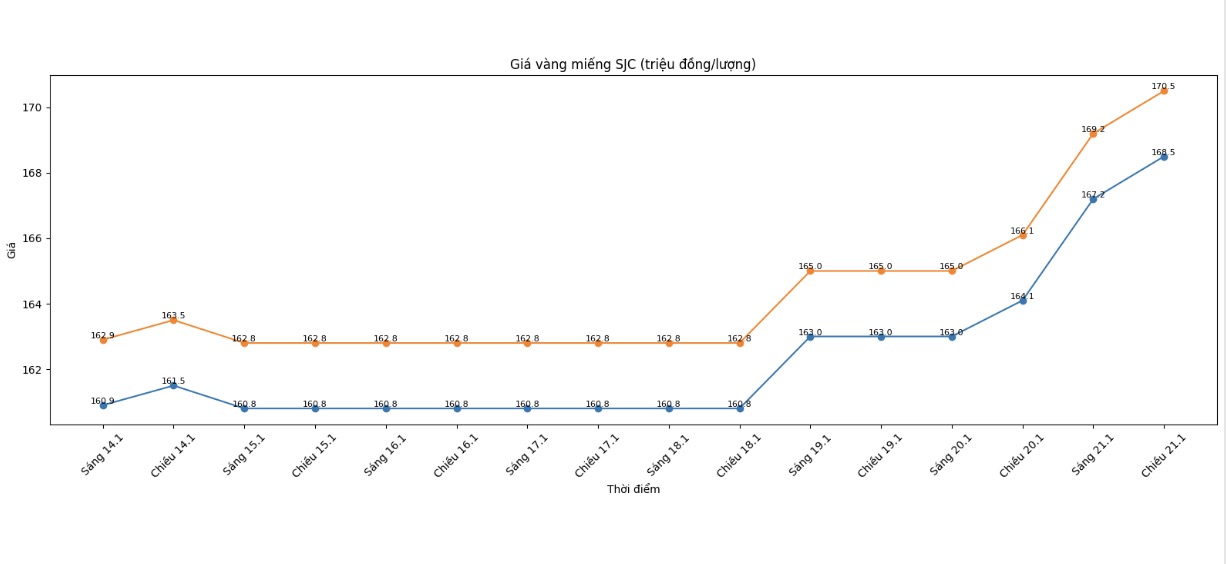

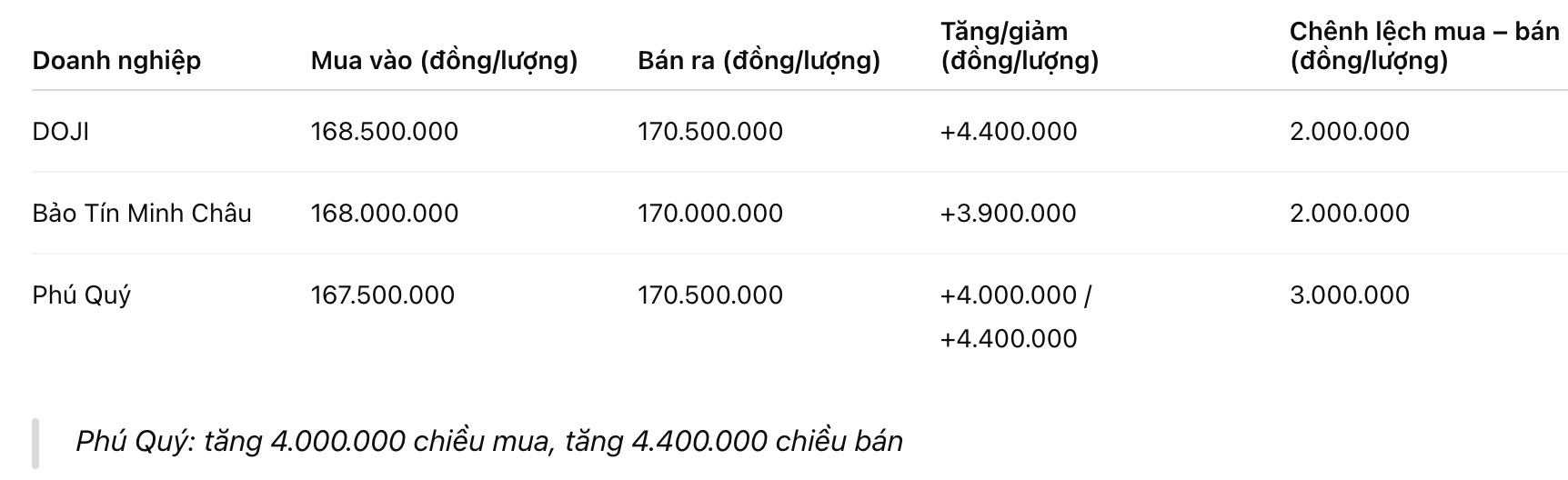

SJC gold bar price

As of 7:15 PM, SJC gold bar prices were listed by DOJI Group at the threshold of 168.5-170.5 million VND/tael (buying - selling), an increase of 4.4 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at the threshold of 168-170 million VND/tael (buying - selling), an increase of 3.9 million VND/tael in both directions. The difference between buying and selling prices is at the threshold of 2 million VND/tael.

Phu Quy Gold, Silver and Gems Group listed SJC gold bar prices at 167.5-170.5 million VND/tael (buying - selling), an increase of 4 million VND/tael on the buying side and an increase of 4.4 million VND/tael on the selling side. The difference between buying and selling prices is at 3 million VND/tael.

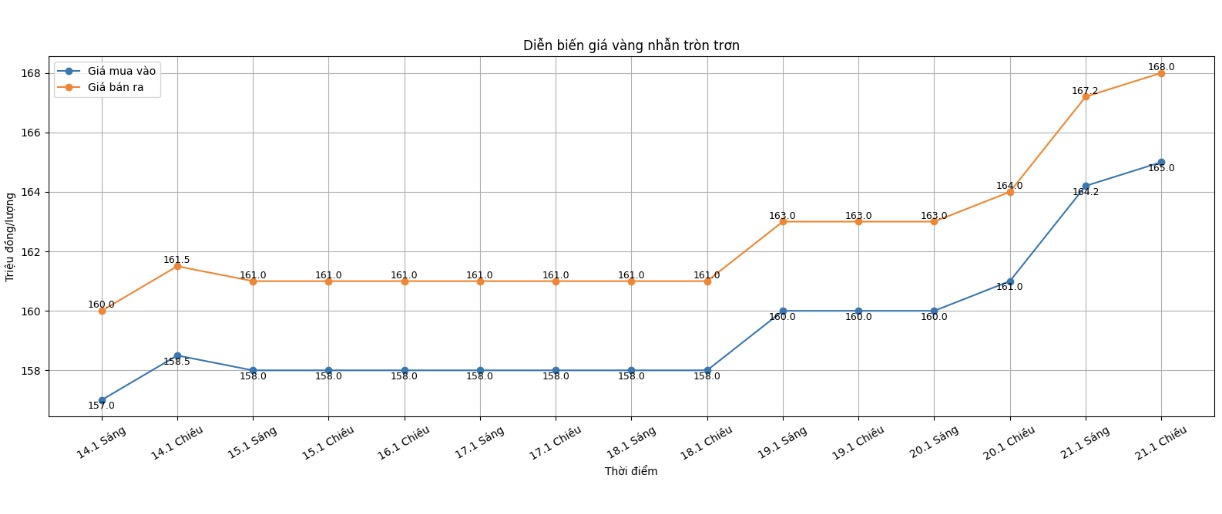

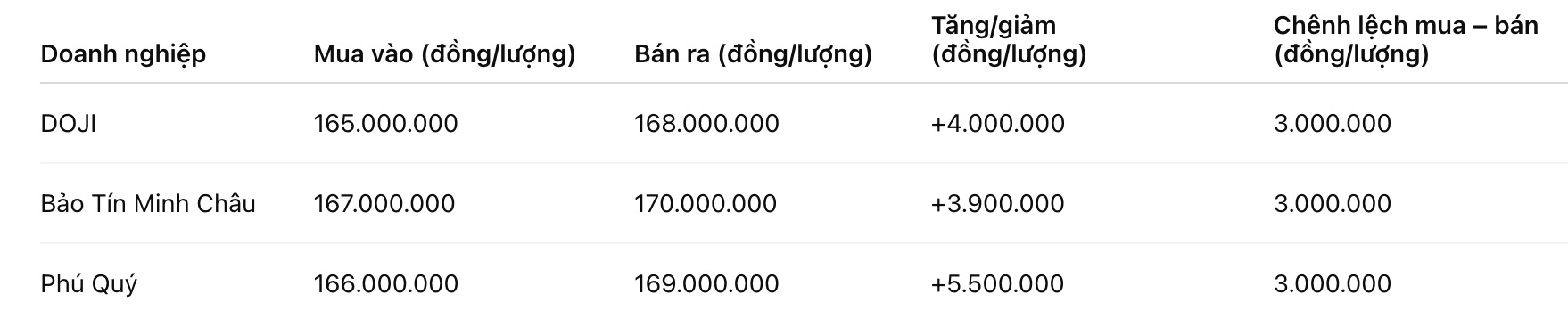

9999 gold ring price

As of 7:15 PM, DOJI Group listed the price of gold rings at 165-168 million VND/tael (buying - selling), an increase of 4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at the threshold of 167-170 million VND/tael (buying - selling), an increase of 3.9 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold, Silver and Gemstone Group listed the price of gold rings at 166-169 million VND/tael (buying - selling), an increase of 5.5 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

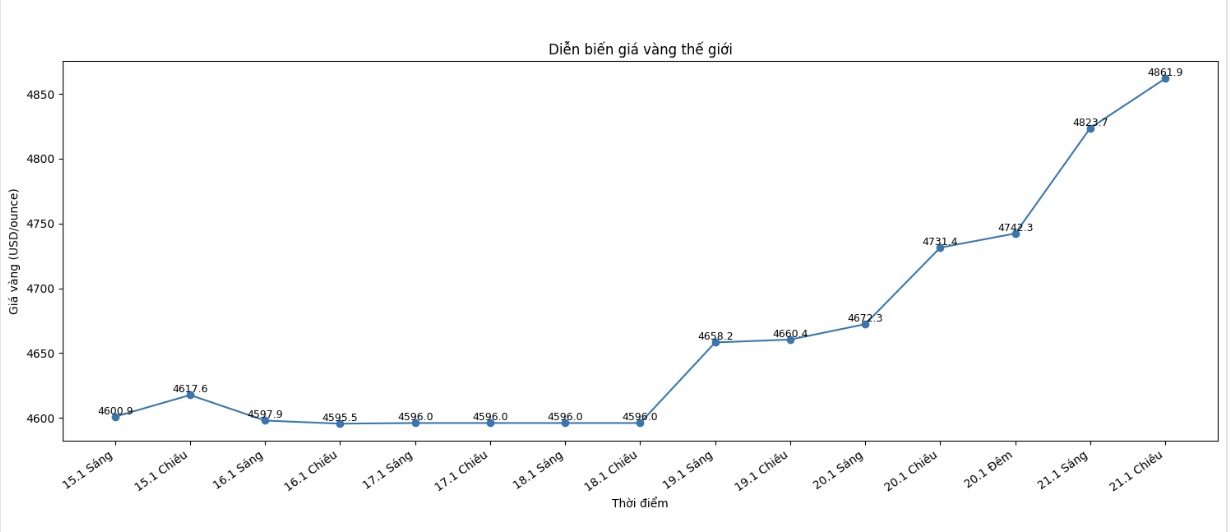

World gold price

At 7:15 PM, world gold prices were listed around the threshold of 4,861.9 USD/ounce, up 130.5 USD compared to the previous day.

Gold price forecast

The strong increase in domestic and world gold prices on January 21 shows that this precious metal is still clearly benefiting from the volatile global economic and financial context. The fact that world gold has surpassed the 4,800 USD/ounce mark, continuously setting new records, is strengthening expectations that the upward trend will not end soon in the short term.

According to experts, risk avoidance in the international financial market is a key factor driving cash flow to gold. New tensions related to tax and trade policies between the US and Europe, along with tough statements surrounding the Greenland issue, have put global stocks under adjustment pressure, while the safe haven role of gold continues to be promoted.

Mr. Kyle Rodda - senior market analyst at Capital.com, said that the strong increase in gold prices reflects a decline in confidence in risky assets, especially USD-denominated assets. "Geopolitical and policy concerns are making investors prioritize holding gold, instead of seeking yields on other channels," he said.

From a longer-term perspective, many international organizations remain optimistic about the prospects of the precious metal. According to a survey by the London Gold Market Association (LBMA), most analysts predict that gold prices may remain above the highs in 2026, thanks to low real interest rates, weakening the USD, and the increasing trend of gold purchases by central banks.

Mr. Nicholas Frappell - Global Organization Market Director of ABC Refinery, said that gold standing firm above the 4,800 USD/ounce mark is an important signal. “When global public debt increases, the USD weakens and geopolitical instability has not cooled down, investors will not rush to take profits on gold before the price approaches the 5,000 USD/ounce mark,” he assessed.

Technically, analysts believe that the upward trend is still dominant, although it is not excluded that gold prices will have short-term corrections due to profit-taking pressure. In the current context, gold is considered an important defensive channel, continuing to attract cash flow as global risks show no signs of cooling down.

Gold price data is compared to the previous day.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.

See more news related to gold prices HERE...