According to Reuters, gold prices rose sharply by more than 2% and reached their highest level in a week on Monday, as geopolitical tensions escalated after the US arrest of Venezuelan President Nicolas Maduro, causing investors to flock to safe assets.

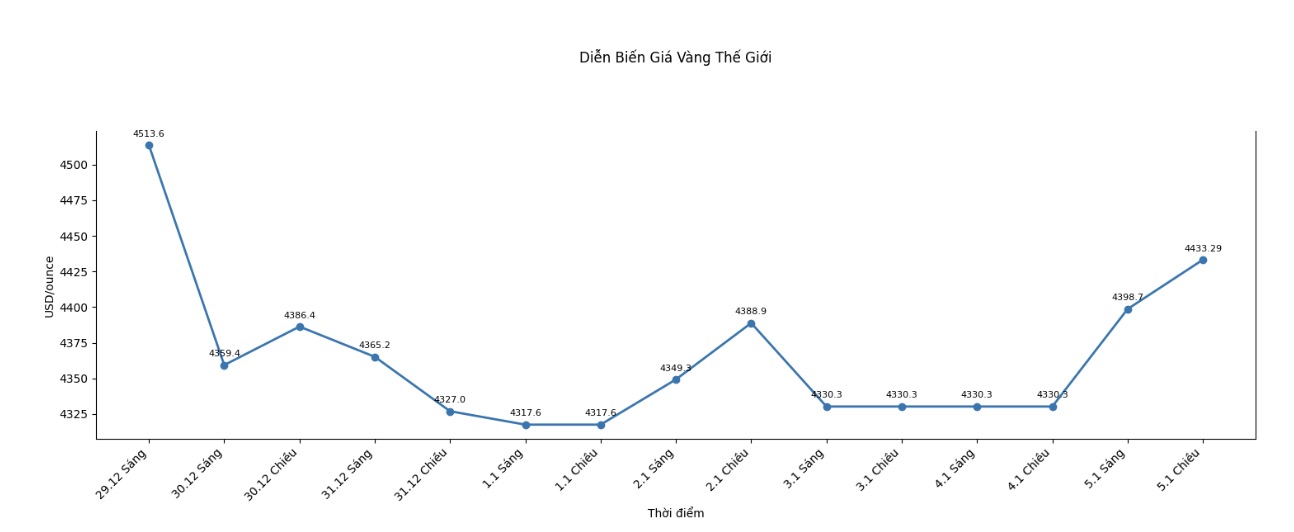

Spot gold prices rose 2.4% to $4,433.29/ounce at 9:42 GMT (I.E., 4:42 PM Vietnam time), the highest level since December 29, after hitting a record of $4,549.71/ounce on December 26.

Gold is benefiting from the escalation of tensions between the US and Venezuela in the last days of the week. This development has increased demand for safe-haven precious metals, as it adds to the uncertainties that the market has faced," said Zain Vawda, an analyst at MarketPulse at OANDA.

Reuters reported that US President Donald Trump said on Sunday that he could order another attack if Venezuela does not cooperate with US efforts to open up the oil industry and prevent drug trafficking. He also hinted that Colombia and Mexico could face military action if they do not reduce the flow of illegal drugs.

The Trump administration's immediate statements about Mexico after the campaign in Venezuela have made the market question the possibility of further campaigns in Latin America. This is likely to keep demand for gold high in the short term," Vawda added.

Last year, gold prices rose by about 64%, recording the strongest annual increase since 1979. The upward momentum was driven by the US Federal Reserve (FED) interest rate cuts, geopolitical tensions, strong buying activity from central banks and increased holdings in portfolio exchange funds (ETFs).

The market is waiting for more signals about central bank monetary policy this year through the US non-farm employment report released on Friday. Currently, investors expect the US to have at least two interest rate cuts this year.

In other precious metals, spot silver prices soared 4.9% to 76.18 USD/ounce, after hitting a record 83.62 USD/ounce on December 29. Silver increased by 147% last year, thanks to being ranked by the US as a strategic mineral, prolonged supply shortages, and increased investment and industrial demand.

Spot platinum prices rose 3.5% to $2,218.50/ounce, after reaching a record high of $2,478.50/ounce on Monday last week. Meanwhile, palladium rose 2.1% to $1,672.93/ounce.

On the futures market, US gold futures for February delivery increased by 2.6% to 4,443.7 USD/ounce.

The world gold market operates through two main valuation mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

Second is the futures contract market, where prices are set for futures delivery. Due to year-end book closing activities, December gold contracts are currently the most actively traded on CME.